Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*Use .(dot) for decimals. Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due

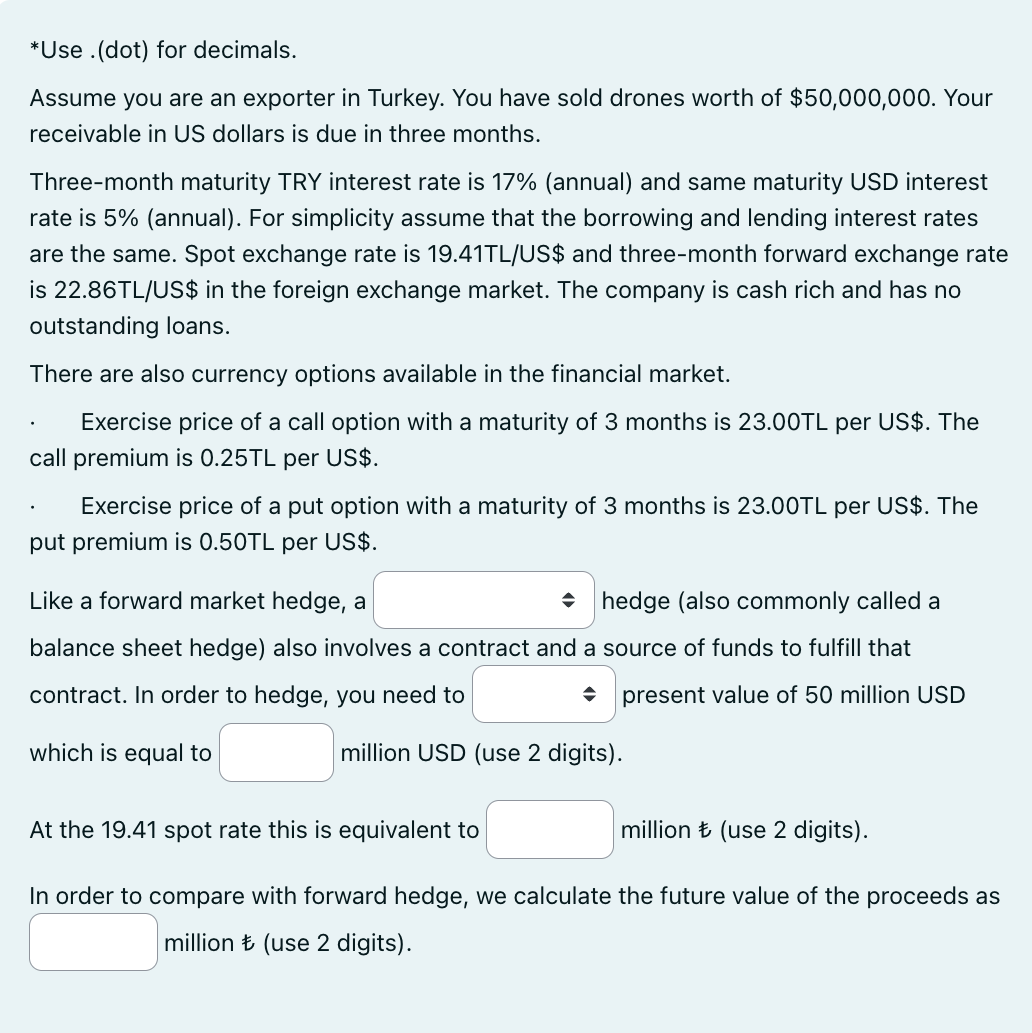

*Use .(dot) for decimals. Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US\$ and three-month forward exchange rat is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US $. Exercise price of a put option with a maturity of 3 months is 23.00TL per US\$. The put premium is 0.50 TL per US $. Like a forward market hedge, a hedge (also commonly called a balance sheet hedge) also involves a contract and a source of funds to fulfill that contract. In order to hedge, you need to present value of 50 million USD which is equal to million USD (use 2 digits). \begin{tabular}{l|l} At the 19.41 spot rate this is equivalent to & million (use 2 digits). \end{tabular} In order to compare with forward hedge, we calculate the future value of the proceeds as million (use 2 digits). *Use .(dot) for decimals. Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US\$ and three-month forward exchange rat is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US $. Exercise price of a put option with a maturity of 3 months is 23.00TL per US\$. The put premium is 0.50 TL per US $. Like a forward market hedge, a hedge (also commonly called a balance sheet hedge) also involves a contract and a source of funds to fulfill that contract. In order to hedge, you need to present value of 50 million USD which is equal to million USD (use 2 digits). \begin{tabular}{l|l} At the 19.41 spot rate this is equivalent to & million (use 2 digits). \end{tabular} In order to compare with forward hedge, we calculate the future value of the proceeds as million (use 2 digits)

*Use .(dot) for decimals. Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US\$ and three-month forward exchange rat is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US $. Exercise price of a put option with a maturity of 3 months is 23.00TL per US\$. The put premium is 0.50 TL per US $. Like a forward market hedge, a hedge (also commonly called a balance sheet hedge) also involves a contract and a source of funds to fulfill that contract. In order to hedge, you need to present value of 50 million USD which is equal to million USD (use 2 digits). \begin{tabular}{l|l} At the 19.41 spot rate this is equivalent to & million (use 2 digits). \end{tabular} In order to compare with forward hedge, we calculate the future value of the proceeds as million (use 2 digits). *Use .(dot) for decimals. Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US\$ and three-month forward exchange rat is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US $. Exercise price of a put option with a maturity of 3 months is 23.00TL per US\$. The put premium is 0.50 TL per US $. Like a forward market hedge, a hedge (also commonly called a balance sheet hedge) also involves a contract and a source of funds to fulfill that contract. In order to hedge, you need to present value of 50 million USD which is equal to million USD (use 2 digits). \begin{tabular}{l|l} At the 19.41 spot rate this is equivalent to & million (use 2 digits). \end{tabular} In order to compare with forward hedge, we calculate the future value of the proceeds as million (use 2 digits) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started