Answered step by step

Verified Expert Solution

Question

1 Approved Answer

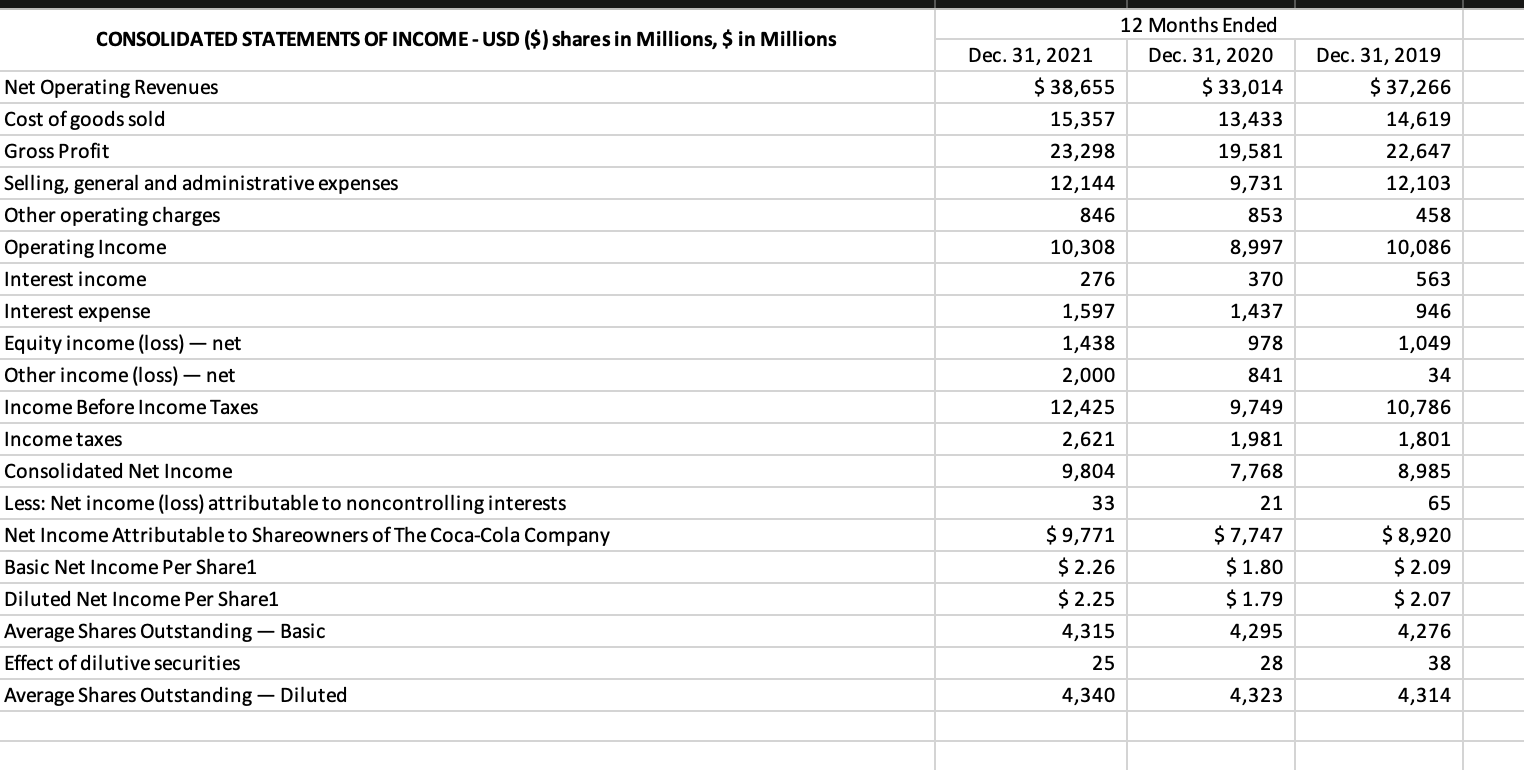

Use equations to calculate the following subtotals or totals: - Gross profit - Earnings before interest and taxes (a.k.a. Operating income) - Earnings before taxes

Use equations to calculate the following subtotals or totals:

- Gross profit

- Earnings before interest and taxes (a.k.a. Operating income)

- Earnings before taxes

- Net income (a.k.a. After-tax income)

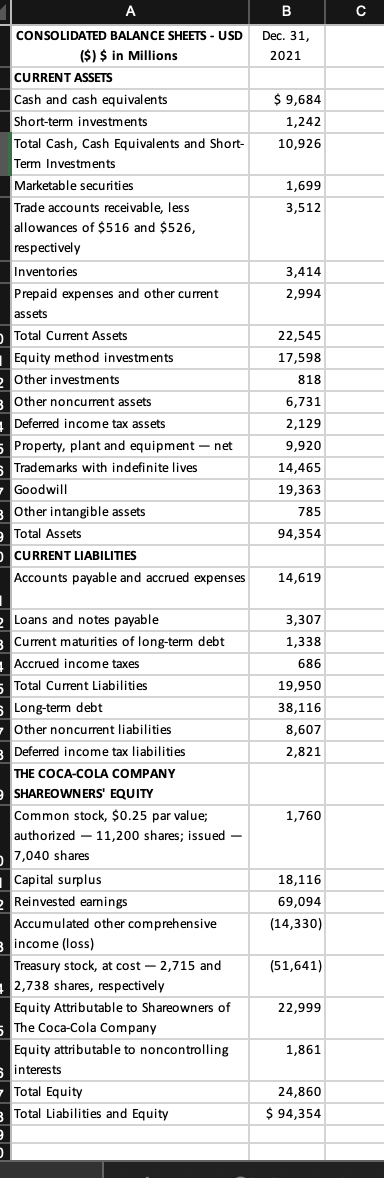

- Total current assets

- Net fixed assets

- Total assets

- Total current liabilities

- Total liabilities

- Total stockholders' equity

- Total liabilities and shareholders equity

FOR THE YEAR 2021 ONLY

CONSOLIDATED STATEMENTS OF INCOME- USD ($) shares in Millions, $ in Millions Dec. 31, 2019 $ 37,266 14,619 22,647 12,103 458 10,086 563 946 12 Months Ended Dec. 31, 2021 Dec. 31, 2020 $ 38,655 $ 33,014 15,357 13,433 23,298 19,581 12,144 9,731 846 853 10,308 8,997 276 370 1,597 1,437 1,438 978 2,000 841 12,425 9,749 2,621 1,981 9,804 7,768 33 21 $9,771 $ 7,747 $ 2.26 $ 1.80 $ 2.25 $ 1.79 4,315 4,295 25 28 4,340 4,323 Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) - net Other income (loss) net Income Before Income Taxes Income taxes Consolidated Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share1 Diluted Net Income Per Share1 Average Shares Outstanding - Basic Effect of dilutive securities Average Shares Outstanding - Diluted 1,049 34 10,786 1,801 8,985 65 $ 8,920 $ 2.09 $2.07 4,276 38 4,314 B Dec. 31, 2021 $ 9,684 1,242 10,926 1,699 3,512 A A CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions CURRENT ASSETS Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short- Term Investments Marketable securities Trade accounts receivable, less allowances of $516 and $526, respectively Inventories Prepaid expenses and other current assets Total Current Assets Equity method investments 2 Other investments Other noncurrent assets Deferred income tax assets Property, plant and equipment - net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets CURRENT LIABILITIES Accounts payable and accrued expenses 3,414 2,994 22,545 17,598 818 6,731 2,129 9,920 14,465 19,363 785 94,354 14,619 3,307 1,338 686 19,950 38,116 8,607 2,821 1,760 Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt - Other noncurrent liabilities Deferred income tax liabilities THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; authorized 11,200 shares; issued 7,040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost - 2,715 and 2,738 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling s interests Total Equity 3 Total Liabilities and Equity 18,116 69,094 (14,330) (51,641) 22,999 1,861 24,860 $ 94,354Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started