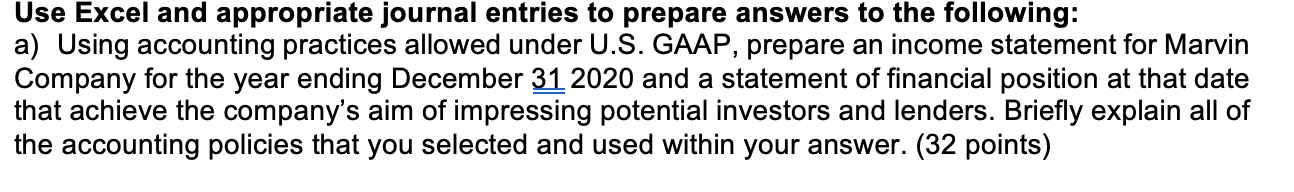

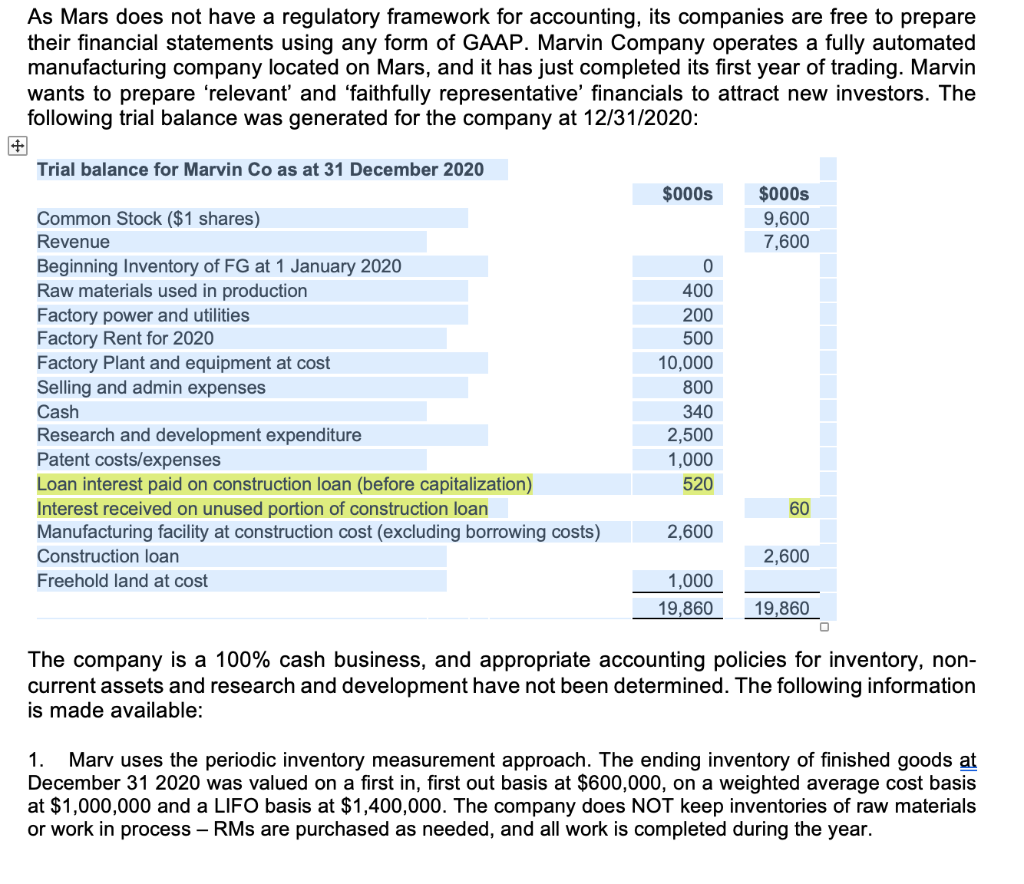

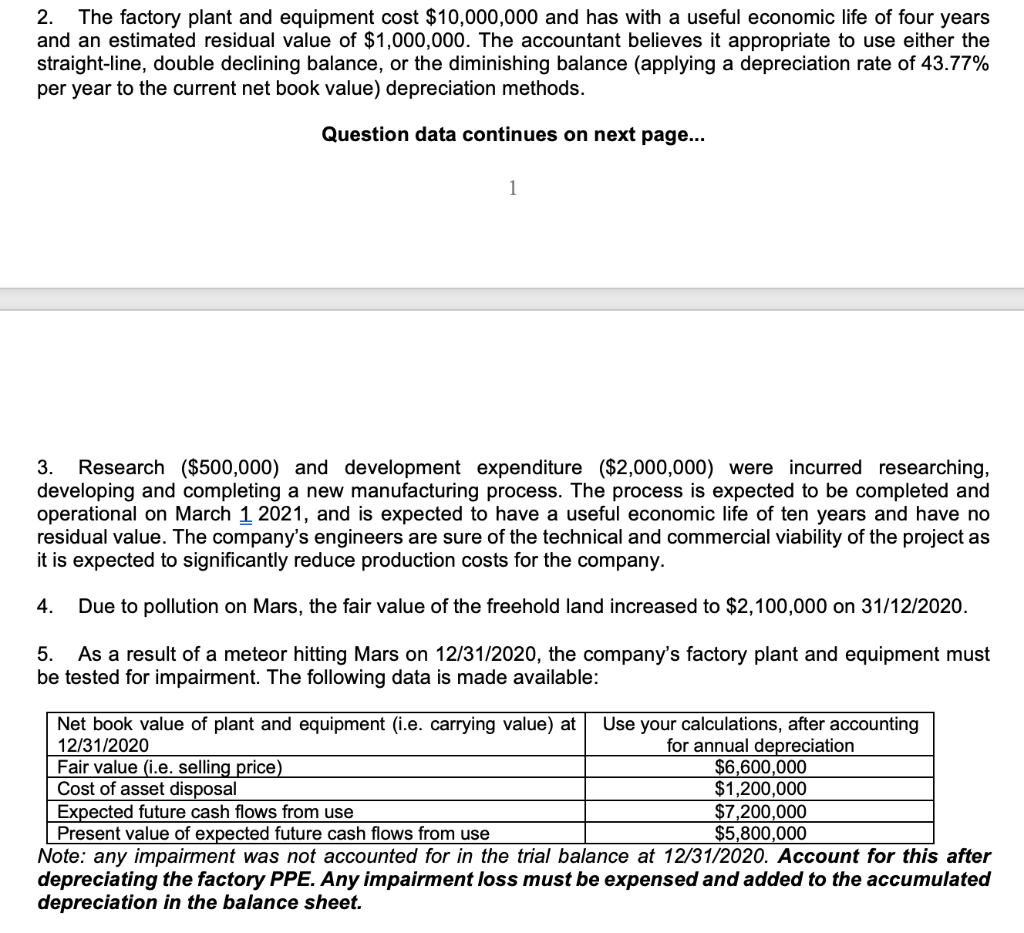

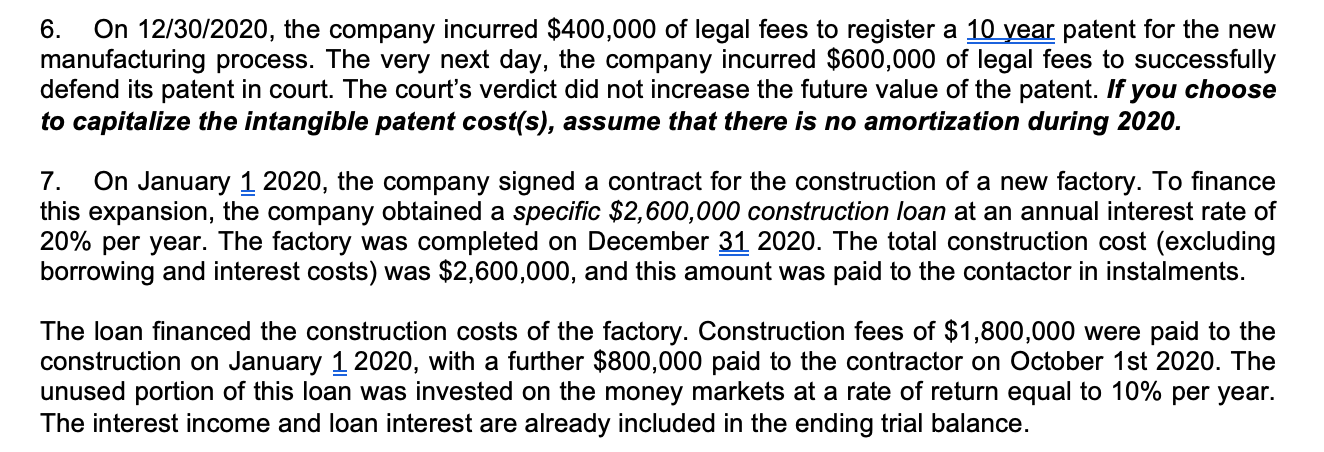

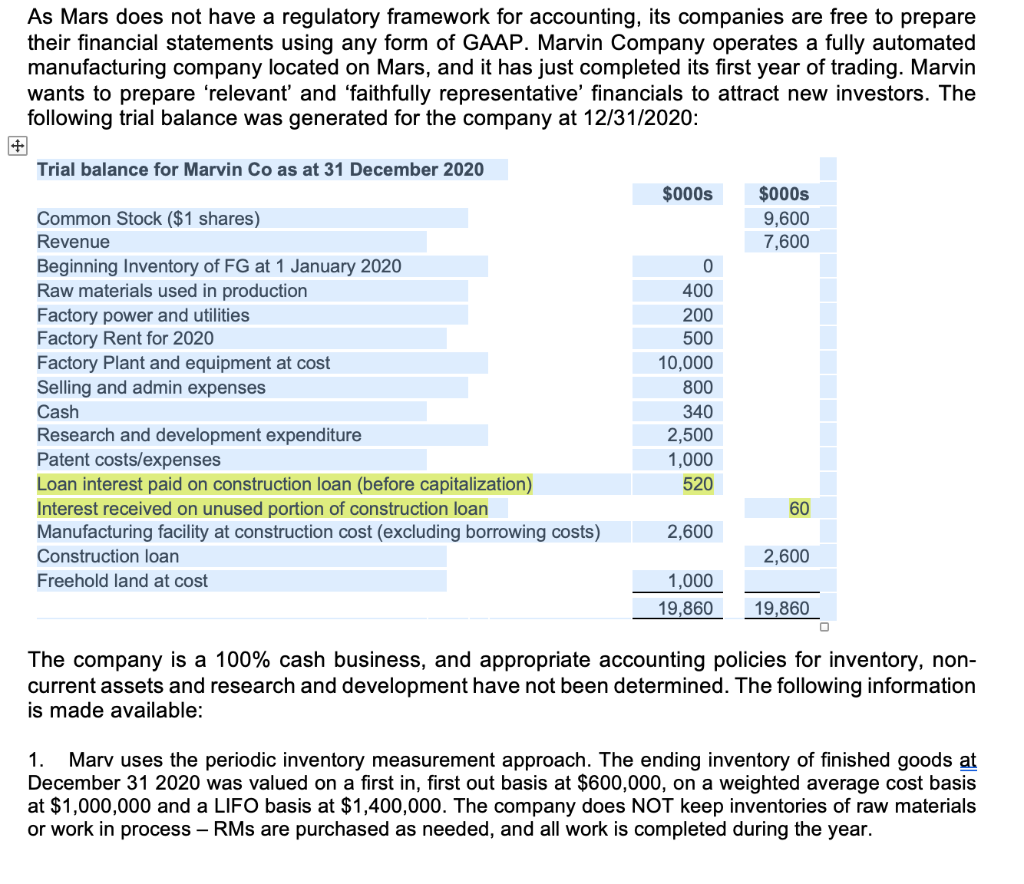

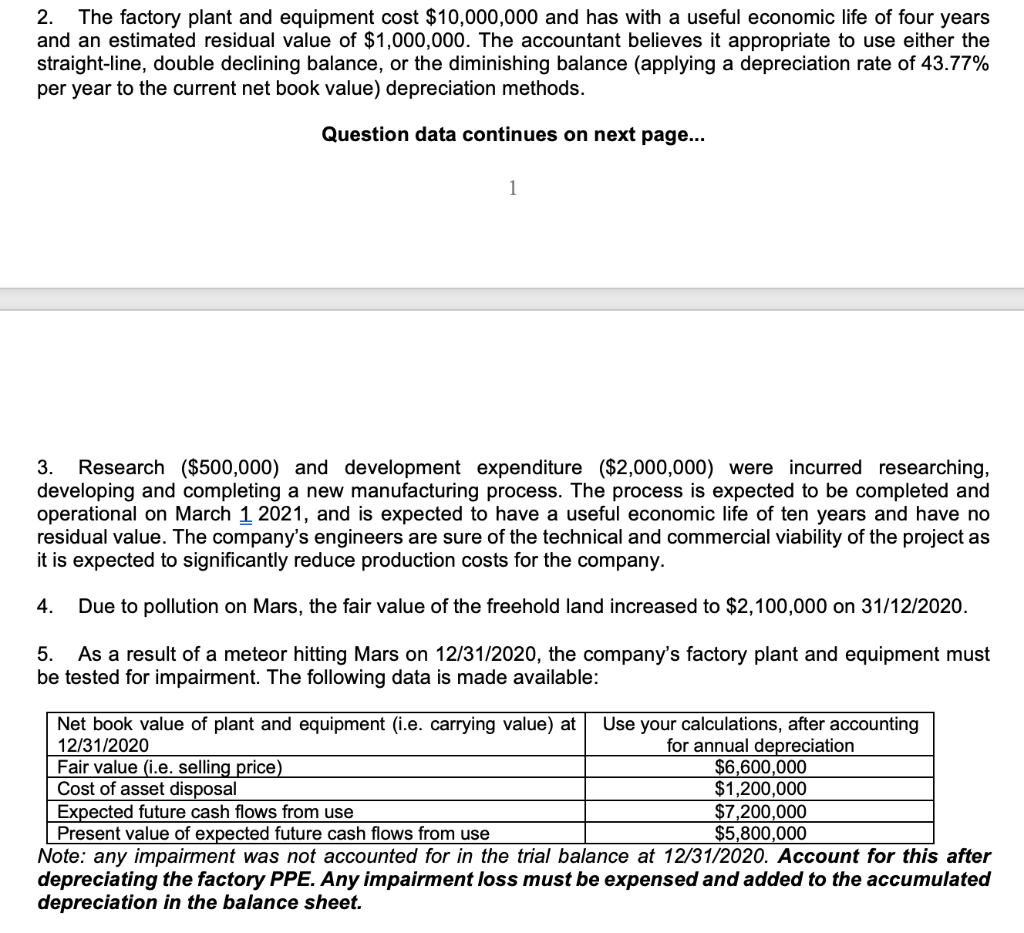

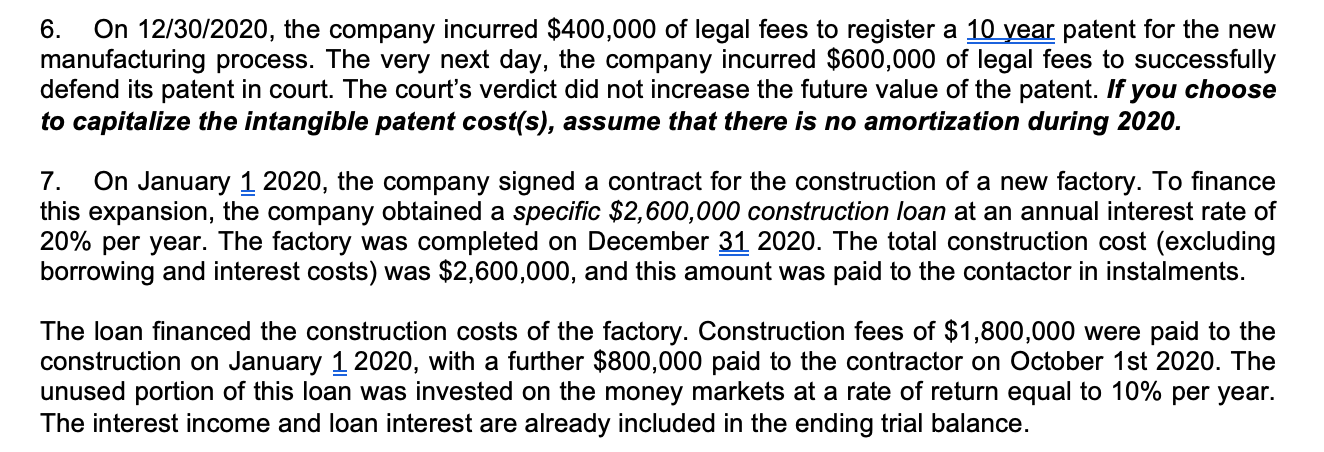

Use Excel and appropriate journal entries to prepare answers to the following: a) Using accounting practices allowed under U.S. GAAP, prepare an income statement for Marvin Company for the year ending December 31 2020 and a statement of financial position at that date that achieve the company's aim of impressing potential investors and lenders. Briefly explain all of the accounting policies that you selected and used within your answer. (32 points) As Mars does not have a regulatory framework for accounting, its companies are free to prepare their financial statements using any form of GAAP. Marvin Company operates a fully automated manufacturing company located on Mars, and it has just completed its first year of trading. Marvin wants to prepare 'relevant' and 'faithfully representative' financials to attract new investors. The following trial balance was generated for the company at 12/31/2020: Trial balance for Marvin Co as at 31 December 2020 $000s $000s 9,600 7,600 Common Stock ($1 shares) Revenue Beginning Inventory of FG at 1 January 2020 Raw materials used in production Factory power and utilities Factory Rent for 2020 Factory Plant and equipment at cost Selling and admin expenses Cash Research and development expenditure Patent costs/expenses Loan interest paid on construction loan (before capitalization) Interest received on unused portion of construction loan Manufacturing facility at construction cost (excluding borrowing costs) Construction loan Freehold land at cost 0 400 200 500 10,000 800 340 2,500 1,000 520 60 2,600 2,600 1,000 19,860 19,860 The company is a 100% cash business, and appropriate accounting policies for inventory, non- current assets and research and development have not been determined. The following information is made available: 1. Marv uses the periodic inventory measurement approach. The ending inventory of finished goods at December 31 2020 was valued on a first in, first out basis at $600,000, on a weighted average cost basis at $1,000,000 and a LIFO basis at $1,400,000. The company does NOT keep inventories of raw materials or work in process - RMs are purchased as needed, and all work is completed during the year. 6. On 12/30/2020, the company incurred $400,000 of legal fees to register a 10 year patent for the new manufacturing process. The very next day, the company incurred $600,000 of legal fees to successfully defend its patent in court. The court's verdict did not increase the future value of the patent. If you choose to capitalize the intangible patent cost(s), assume that there is no amortization during 2020. 7. On January 1 2020, the company signed a contract for the construction of a new factory. To finance this expansion, the company obtained a specific $2,600,000 construction loan at an annual interest rate of 20% per year. The factory was completed on December 31 2020. The total construction cost (excluding borrowing and interest costs) was $2,600,000, and this amount was paid to the contactor in instalments. The loan financed the construction costs of the factory. Construction fees of $1,800,000 were paid to the construction on January 1 2020, with a further $800,000 paid to the contractor on October 1st 2020. The unused portion of this loan was invested on the money markets at a rate of return equal to 10% per year. The interest income and loan interest are already included in the ending trial balance. Use Excel and appropriate journal entries to prepare answers to the following: a) Using accounting practices allowed under U.S. GAAP, prepare an income statement for Marvin Company for the year ending December 31 2020 and a statement of financial position at that date that achieve the company's aim of impressing potential investors and lenders. Briefly explain all of the accounting policies that you selected and used within your answer. (32 points) As Mars does not have a regulatory framework for accounting, its companies are free to prepare their financial statements using any form of GAAP. Marvin Company operates a fully automated manufacturing company located on Mars, and it has just completed its first year of trading. Marvin wants to prepare 'relevant' and 'faithfully representative' financials to attract new investors. The following trial balance was generated for the company at 12/31/2020: Trial balance for Marvin Co as at 31 December 2020 $000s $000s 9,600 7,600 Common Stock ($1 shares) Revenue Beginning Inventory of FG at 1 January 2020 Raw materials used in production Factory power and utilities Factory Rent for 2020 Factory Plant and equipment at cost Selling and admin expenses Cash Research and development expenditure Patent costs/expenses Loan interest paid on construction loan (before capitalization) Interest received on unused portion of construction loan Manufacturing facility at construction cost (excluding borrowing costs) Construction loan Freehold land at cost 0 400 200 500 10,000 800 340 2,500 1,000 520 60 2,600 2,600 1,000 19,860 19,860 The company is a 100% cash business, and appropriate accounting policies for inventory, non- current assets and research and development have not been determined. The following information is made available: 1. Marv uses the periodic inventory measurement approach. The ending inventory of finished goods at December 31 2020 was valued on a first in, first out basis at $600,000, on a weighted average cost basis at $1,000,000 and a LIFO basis at $1,400,000. The company does NOT keep inventories of raw materials or work in process - RMs are purchased as needed, and all work is completed during the year. 6. On 12/30/2020, the company incurred $400,000 of legal fees to register a 10 year patent for the new manufacturing process. The very next day, the company incurred $600,000 of legal fees to successfully defend its patent in court. The court's verdict did not increase the future value of the patent. If you choose to capitalize the intangible patent cost(s), assume that there is no amortization during 2020. 7. On January 1 2020, the company signed a contract for the construction of a new factory. To finance this expansion, the company obtained a specific $2,600,000 construction loan at an annual interest rate of 20% per year. The factory was completed on December 31 2020. The total construction cost (excluding borrowing and interest costs) was $2,600,000, and this amount was paid to the contactor in instalments. The loan financed the construction costs of the factory. Construction fees of $1,800,000 were paid to the construction on January 1 2020, with a further $800,000 paid to the contractor on October 1st 2020. The unused portion of this loan was invested on the money markets at a rate of return equal to 10% per year. The interest income and loan interest are already included in the ending trial balance