Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE EXCEL AND PROVIDE A FORMULA FOR THE GIVEN ANSWERS ABOVE. SHOW YOUR CALCULATIONS. THANK YOU. WE'LL GIVE A THUMBS UP WHEN THERE IS A

USE EXCEL AND PROVIDE A FORMULA FOR THE GIVEN ANSWERS ABOVE. SHOW YOUR CALCULATIONS. THANK YOU. WE'LL GIVE A THUMBS UP WHEN THERE IS A FORMULA AND SOLUTION.

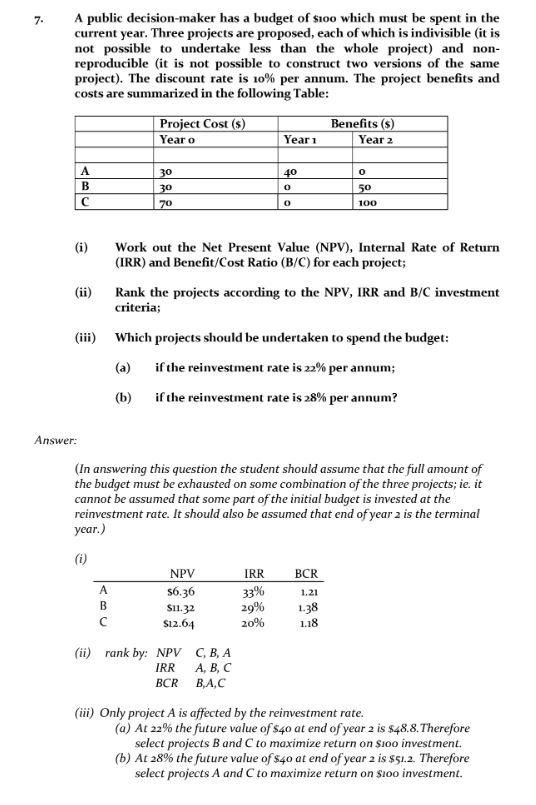

7. A public decision-maker has a budget of $100 which must be spent in the current year. Three projects are proposed, each of which is indivisible (it is not possible to undertake less than the whole project) and non- reproducible (it is not possible to construct two versions of the same project). The discount rate is 10% per annum. The project benefits and costs are summarized in the following Table: Project Cost (s) Year o Benefits (s) Year 2 Year 1 30 40 0 30 0 50 70 0 100 Work out the Net Present Value (NPV), Internal Rate of Return (IRR) and Benefit/Cost Ratio (B/C) for each project; Rank the projects according to the NPV, IRR and B/C investment criteria; ABC (i) (ii) (iii) Which projects should be undertaken to spend the budget: (a) if the reinvestment rate is 22% per annum; (b) if the reinvestment rate is 28% per annum? (In answering this question the student should assume that the full amount of the budget must be exhausted on some combination of the three projects; ie. it cannot be assumed that some part of the initial budget is invested at the reinvestment rate. It should also be assumed that end of year 2 is the terminal year.) (i) NPV IRR BCR A $6.36 1.21 B $11.32 1.38 $12.64 1.18 (ii) rank by: NPV C, B, A IRR A, B, C BCR B,A,C (iii) Only project A is affected by the reinvestment rate. (a) At 22% the future value of $40 at end of year 2 is $48.8. Therefore select projects B and C to maximize return on $100 investment. (b) At 28% the future value of $40 at end of year 2 is $51.2. Therefore select projects A and C to maximize return on $100 investment. Answer: 33% 29% 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started