Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use Excel to draw a decision tree. Knoop Inc. has completed the first year of operations and they did end up selling 50,000 bikes in

Use Excel to draw a decision tree.

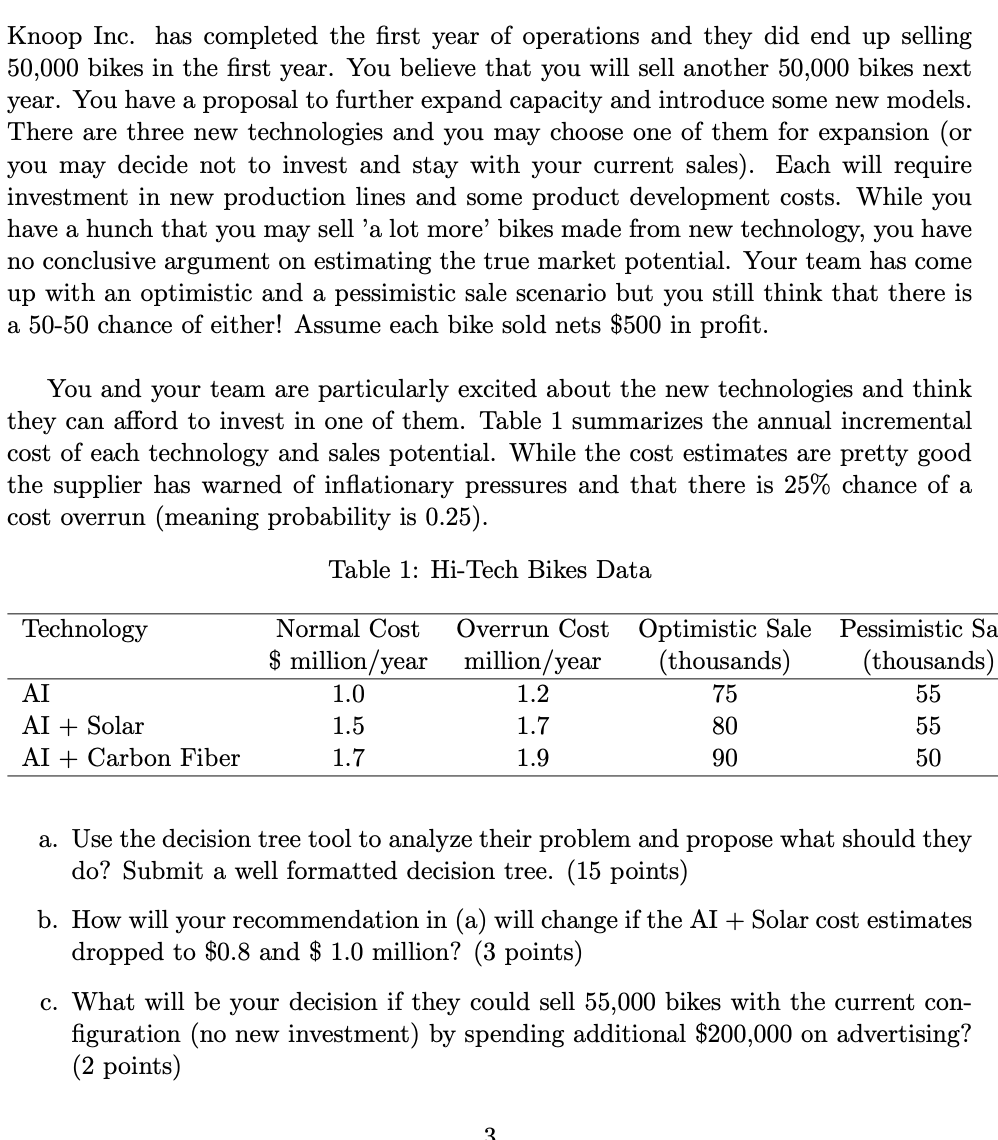

Knoop Inc. has completed the first year of operations and they did end up selling 50,000 bikes in the first year. You believe that you will sell another 50,000 bikes next year. You have a proposal to further expand capacity and introduce some new models. There are three new technologies and you may choose one of them for expansion (or you may decide not to invest and stay with your current sales). Each will require investment in new production lines and some product development costs. While you have a hunch that you may sell 'a lot more' bikes made from new technology, you have no conclusive argument on estimating the true market potential. Your team has come up with an optimistic and a pessimistic sale scenario but you still think that there is a 50-50 chance of either! Assume each bike sold nets $500 in profit. You and your team are particularly excited about the new technologies and think they can afford to invest in one of them. Table 1 summarizes the annual incremental cost of each technology and sales potential. While the cost estimates are pretty good the supplier has warned of inflationary pressures and that there is 25% chance of a cost overrun (meaning probability is 0.25). Table 1: Hi-Tech Bikes Data Technology AI AI + Solar AI Carbon Fiber Normal Cost $ million/year 1.0 1.5 1.7 Overrun Cost million/year 1.2 1.7 1.9 Optimistic Sale Pessimistic Sa (thousands) (thousands) 75 55 80 55 90 50 a. Use the decision tree tool to analyze their problem and propose what should they do? Submit a well formatted decision tree. (15 points) b. How will your recommendation in (a) will change if the AI + Solar cost estimates dropped to $0.8 and $ 1.0 million? (3 points) c. What will be your decision if they could sell 55,000 bikes with the current con- figuration (no new investment) by spending additional $200,000 on advertising? (2 points) 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the decision tree analysis for Knoop Incs expansion options using Excel a A decisi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started