Answered step by step

Verified Expert Solution

Question

1 Approved Answer

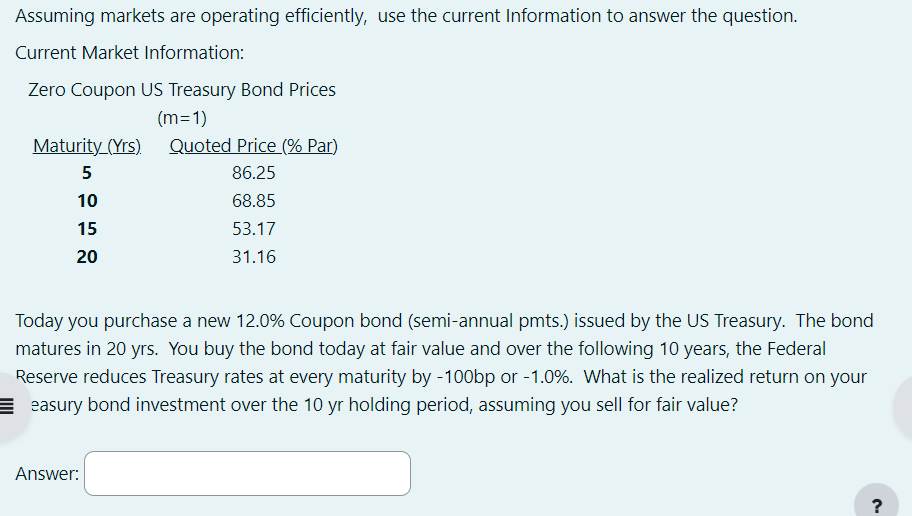

use excel to explainAssuming markets are operating efficiently, use the current Information to answer the question. Current Market Information: Zero Coupon US Treasury Bond Prices

use excel to explainAssuming markets are operating efficiently, use the current Information to answer the question. Current Market Information: Zero Coupon US Treasury Bond Prices Today you purchase a new Coupon bond semiannual pmts issued by the US Treasury. The bond matures in yrs You buy the bond today at fair value and over the following years, the Federal Reserve reduces Treasury rates at every maturity by or What is the realized return on your easury bond investment over the holding period, assuming you sell for fair value? Answer:

use excel to explainAssuming markets are operating efficiently, use the current Information to answer the question.

Current Market Information:

Zero Coupon US Treasury Bond Prices

Today you purchase a new Coupon bond semiannual pmts issued by the US Treasury. The bond

matures in yrs You buy the bond today at fair value and over the following years, the Federal

Reserve reduces Treasury rates at every maturity by or What is the realized return on your

easury bond investment over the holding period, assuming you sell for fair value?

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started