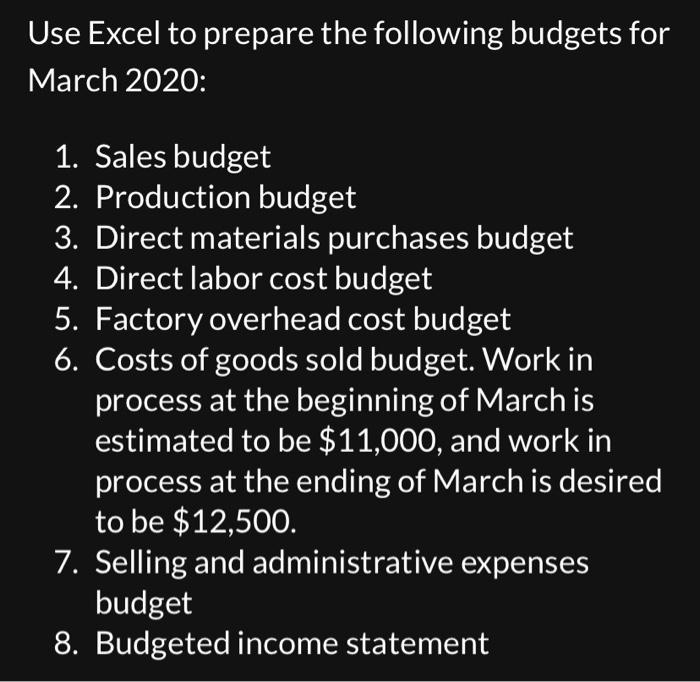

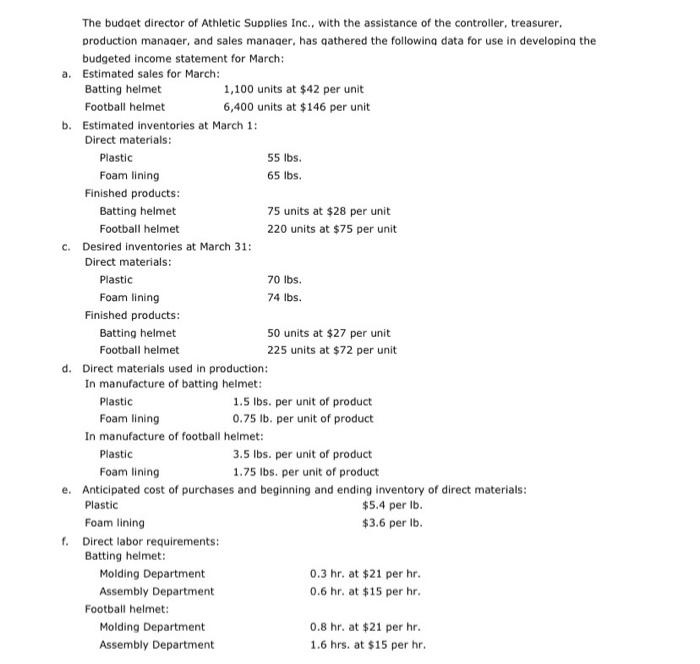

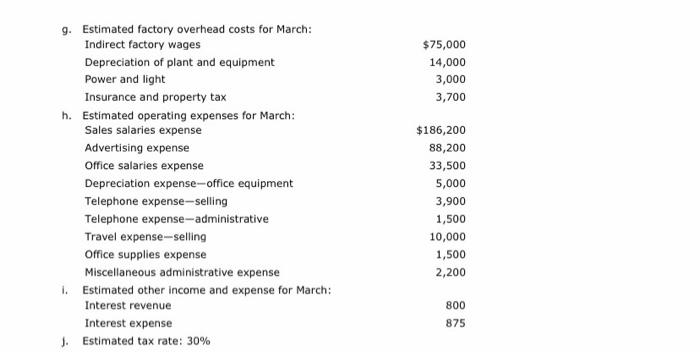

Use Excel to prepare the following budgets fo March 2020: 1. Sales budget 2. Production budget 3. Direct materials purchases budget 4. Direct labor cost budget 5. Factory overhead cost budget 6. Costs of goods sold budget. Work in process at the beginning of March is estimated to be $11,000, and work in process at the ending of March is desirec to be $12,500. 7. Selling and administrative expenses budget 8. Budgeted income statement The budaet director of Athletic Supplies Inc., with the assistance of the controller, treasurer. production manager, and sales manaqer, has qathered the following data for use in developina the budgeted income statement for March: a. Estimated sales for March: Batting helmet 1,100 units at $42 per unit Football helmet 6,400 units at $146 per unit b. Estimated inventories at March 1: Direct materials: Plastic 55lbs. Foam lining 65lbs. Finished products: Batting helmet 75 units at $28 per unit Football helmet 220 units at $75 per unit c. Desired inventories at March 31: Direct materials: Plastic 70lbs. Foam lining 74lbs. Finished products: Batting helmet 50 units at $27 per unit Football helmet 225 units at $72 per unit d. Direct materials used in production: In manufacture of batting heimet: Plastic 1.5lbs. per unit of product Foam lining 0.75lb. per unit of product In manufacture of football heimet: Plastic 3.5lbs. per unit of product Foam lining 1.75lbs. per unit of product e. Anticipated cost of purchases and beginning and ending inventory of direct materials: Plastic $5.4 per lb. Foam lining $3.6 per Ib. g. Estimated factory overhead costs for March: IndirectfactorywagesDepreciationofplantandequipmentPowerandlightInsuranceandpropertytax$75,00014,0003,0003,700 h. Estimated operating expenses for March: SalessalariesexpenseAdvertisingexpenseOfficesalariesexpenseDepreciationexpense-officeequipmentTelephoneexpense-sellingTelephoneexpense-administrativeTravelexpense-sellingOfficesuppliesexpenseMiscellaneousadministrativeexpense$186,20088,20033,5005,0003,9001,50010,0001,5002,200 i. Estimated other income and expense for March: Interestrevenue800 \begin{tabular}{lr} Interest expense & 800 \\ \hline Sstimated tax rate: 30% & 875 \end{tabular} j. Estimated tax rate: 30%