Answered step by step

Verified Expert Solution

Question

1 Approved Answer

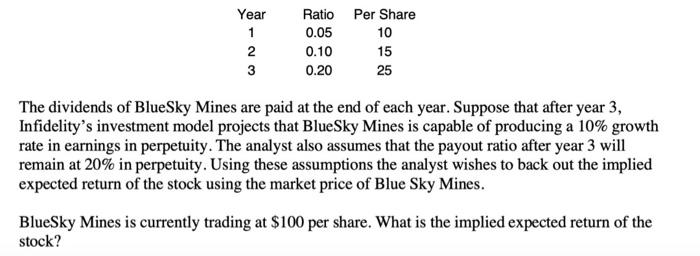

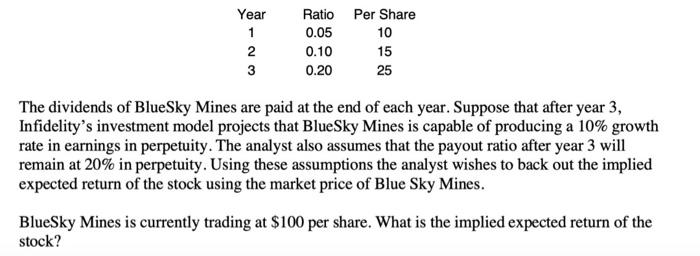

use exel as a setup Year 1 2 3 Ratio Per Share 0.05 10 0.10 15 0.20 25 The dividends of BlueSky Mines are paid

use exel as a setup

Year 1 2 3 Ratio Per Share 0.05 10 0.10 15 0.20 25 The dividends of BlueSky Mines are paid at the end of each year. Suppose that after year 3, Infidelity's investment model projects that BlueSky Mines is capable of producing a 10% growth rate in earnings in perpetuity. The analyst also assumes that the payout ratio after year 3 will remain at 20% in perpetuity. Using these assumptions the analyst wishes to back out the implied expected return of the stock using the market price of Blue Sky Mines. BlueSky Mines is currently trading at $100 per share. What is the implied expected return of the stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started