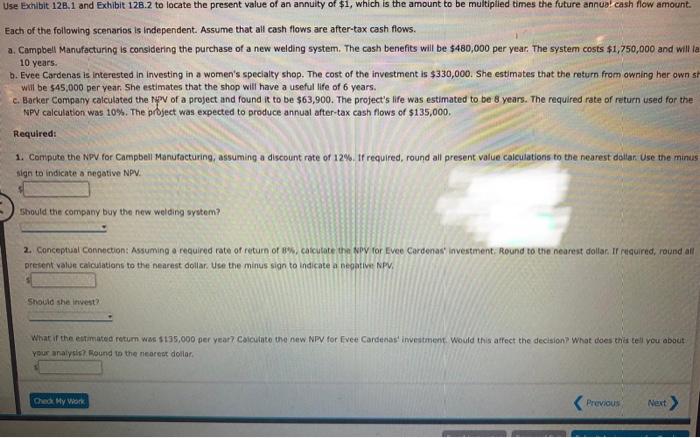

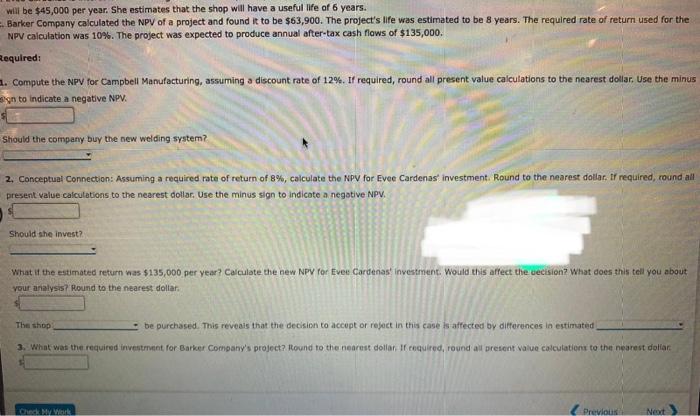

Use Exhibit 128.1 and Exhibit 128.2 to locate the present value of an annuity of $1, which is the amount to be multiplied times the future annual cash flow amount 10 years Each of the following scenarios is Independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $1,750,000 and will la b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $330,000. She estimates that the return from owning her own s will be $45,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the tou of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Computo the NPV for Campbell Manufacturing, assuming a discount rate of 12% If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a negative NPV. should the company buy the new welding system? 2. Conceptual Connection: Assuming a required rate of return of 8%, calculate the NPV for Evee Cardenas Investment: Round to the nearest dollar. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a negative NPV. Should she invest What if the estimated return $135,000 per year Calculate the new NPV for Evee Cardenas investment would this affect the decision? What does the tell you about your analysis. Round to the nearest dollar Ched My Work Previous Next > will be $45,000 per year. She estimates that the shop will have a useful life of 6 years. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar. Use the minus son to indicate a negative NPV. Should the company buy the new welding system? 2. Conceptual Connection: Assuming a required rate of return of 8%, calculate the NPV for Evec Cardenas investment. Round to the nearest dollar. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a negative NPV. a Should she invest? What it the estimated return was $135,000 per year? Calculate the new NPV for Evet Cardenast investment. Would this affect the decision? What does this tell you about your analysis? Round to the nearest dollar The shop be purchased. This reveals that the decision to accept or reject in this case is affected by differences in estimated 3. What was the required investment for Barker Company's project found to the nearest dotlar required, round all present value calculation to the nearest dollar Check My Wik Previous Next