Question

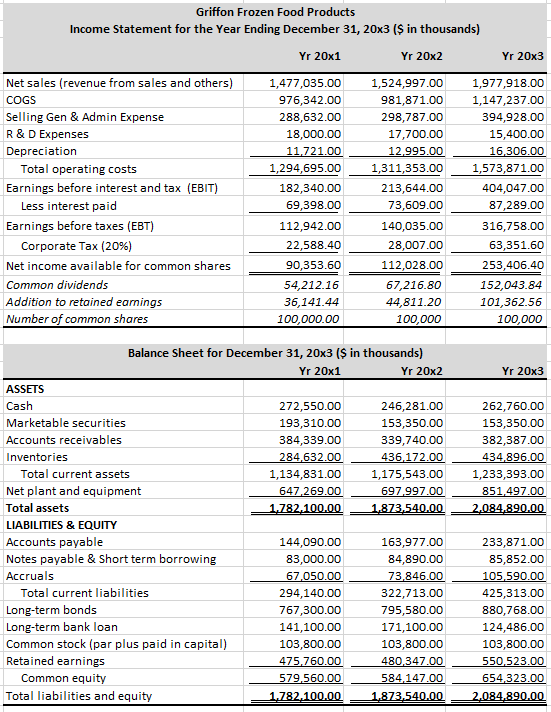

Use financial statements of Griffon Frozen Food Products (GFF), to calculate ratios and provide analyses. Assume that company operates 365 days in one year. The

Use financial statements of Griffon Frozen Food Products (GFF), to calculate ratios and provide analyses. Assume that company operates 365 days in one year. The average interest rate on all debt (short-term and long-term) is 7%. The company has 100,000 common shares.

| Ratios (Trend & Industry Analysis) | Yr 20x1 | Yr 20x2 | Yr 20x3 | Trend analysis | Industry (Given) | Industry analysis | unit |

| 1. Current ratio | Answer | Answer | Answer | AnswerImproveSameWorse | 1.40 | AnswerBetterSameWorse | times |

| 2. Quick ratio | Answer | Answer | Answer |

AnswerImproveSameWorse

| 1.00 |

AnswerBetterSameWorse

| times |

| 3. DSO | Answer |

Answer

|

Answer

|

AnswerImproveSameWorse

|

87.00

|

AnswerBetterSameWorse

| days |

| 4. Inventory conversion period |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 120.00 |

AnswerBetterSameWorse

| days |

| 5. A/P deferral period |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 65.00 | AnswerBetterSameWorse | days |

| 6. CCC = cash conversion cycle |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

|

142.00

|

AnswerBetterSameWorse

| days |

| 7. Inventory turnover = (COGS/Inventories) |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 1.60 |

AnswerBetterSameWorse

| times |

| 8. Net fixed asset turnover |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 1.80 |

AnswerBetterSameWorse

| times |

| 9. Total asset turnover |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 1.15 |

AnswerBetterSameWorse

| times |

| 10. Debt-to-Equity |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 0.67 |

AnswerBetterSameWorse

| times |

| 11. Debt-to-Assets |

Answer%

|

Answer%

|

Answer%

|

AnswerImproveSameWorse

| 40.00 % |

AnswerBetterSameWorse

| % |

| 12. Liabilities-to-Assets |

Answer%

|

Answer%

|

Answer%

|

AnswerImproveSameWorse

|

50.00 %

|

AnswerBetterSameWorse

| % |

| 13. Equity multiplier |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 2.00 |

AnswerBetterSameWorse

| times |

| 14. TIE (Interest coverage) |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| 2.15 |

AnswerBetterSameWorse

| times |

| 15. OPM (Operating profit margin) |

Answer%

|

Answer%

|

Answer%

|

AnswerImproveSameWorse

|

28.00 %

|

AnswerBetterSameWorse

| % |

| 16. NPM (Net profit margin) |

Answer%

|

Answer%

|

Answer%

|

AnswerImproveSameWorse

|

18.00 %

|

AnswerBetterSameWorse

| % |

| 17. BEP |

Answer%

|

Answer%

|

Answer%

|

AnswerImproveSameWorse

|

28.50 %

|

AnswerBetterSameWorse

| % |

| 18. ROA |

Answer%

|

Answer%

|

Answer%

|

AnswerImproveSameWorse

|

20.70 %

|

AnswerBetterSameWorse

| % |

| 19. ROE |

Answer%

|

Answer%

|

Answer%

|

AnswerImproveSameWorse

|

41.40 %

|

AnswerBetterSameWorse

| % |

| 20. EPS |

Answer

|

Answer

|

Answer

|

AnswerImproveSameWorse

| N/A | N/A | $/share |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started