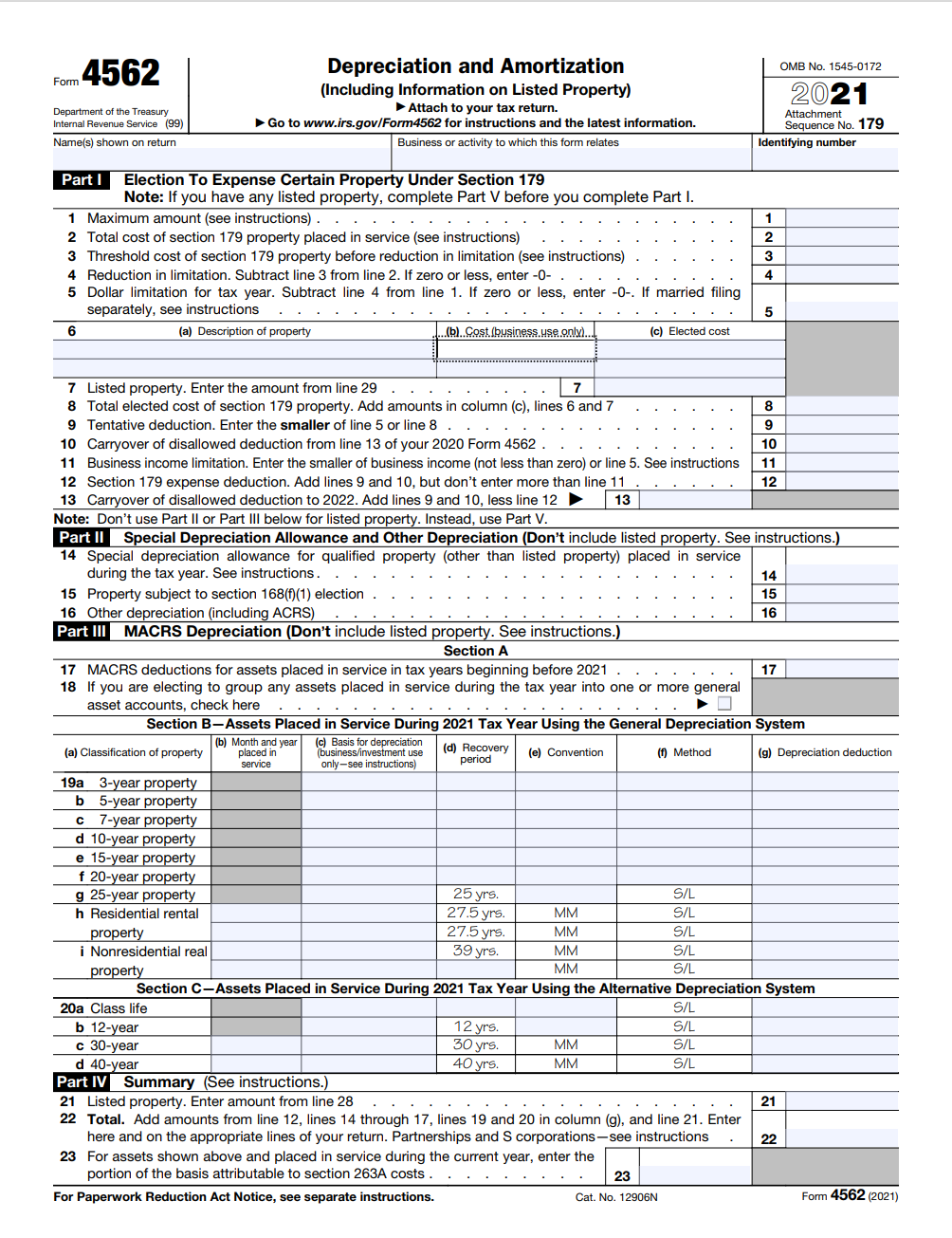

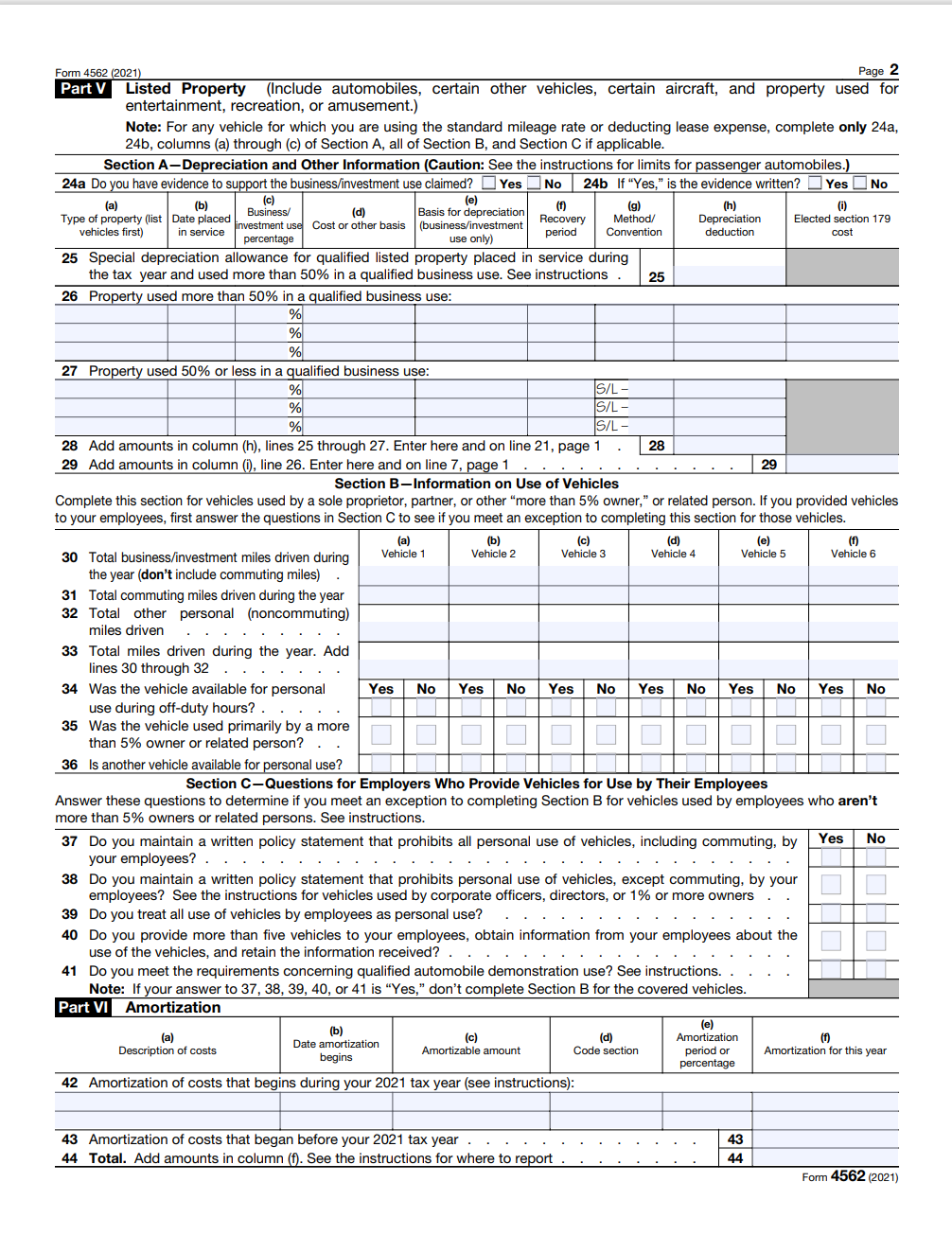

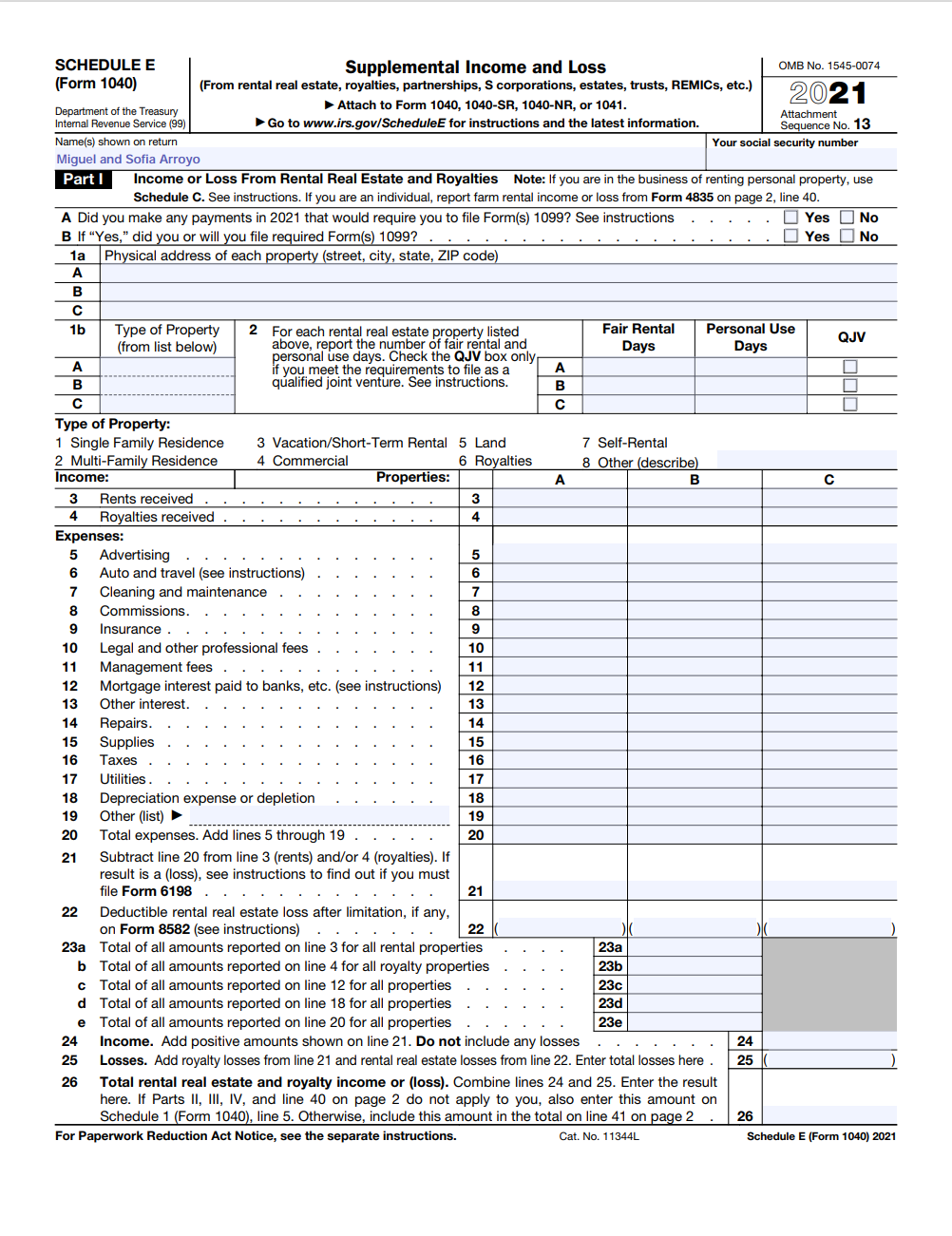

USE FORM 4562 AND SCHEDULE E

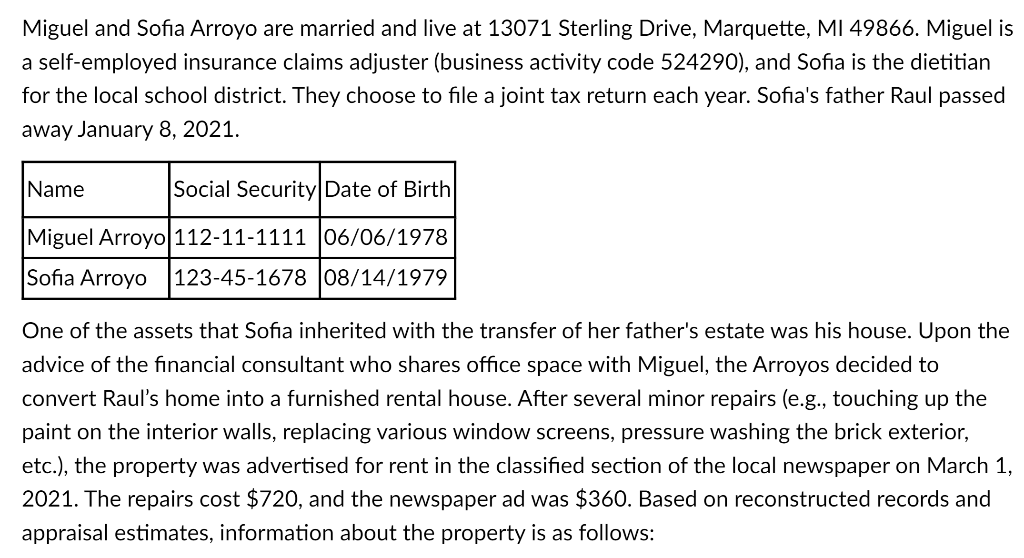

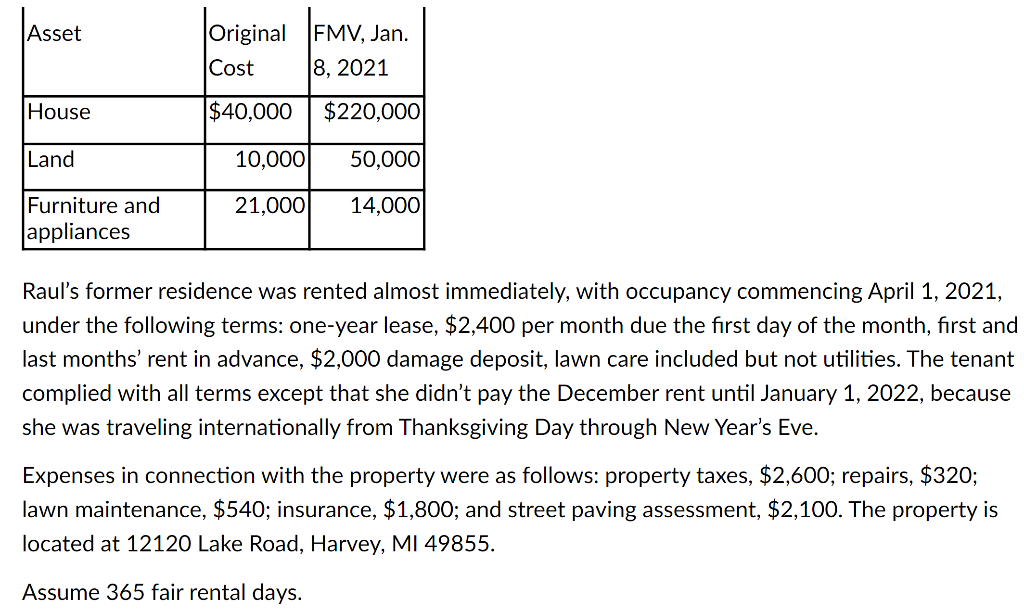

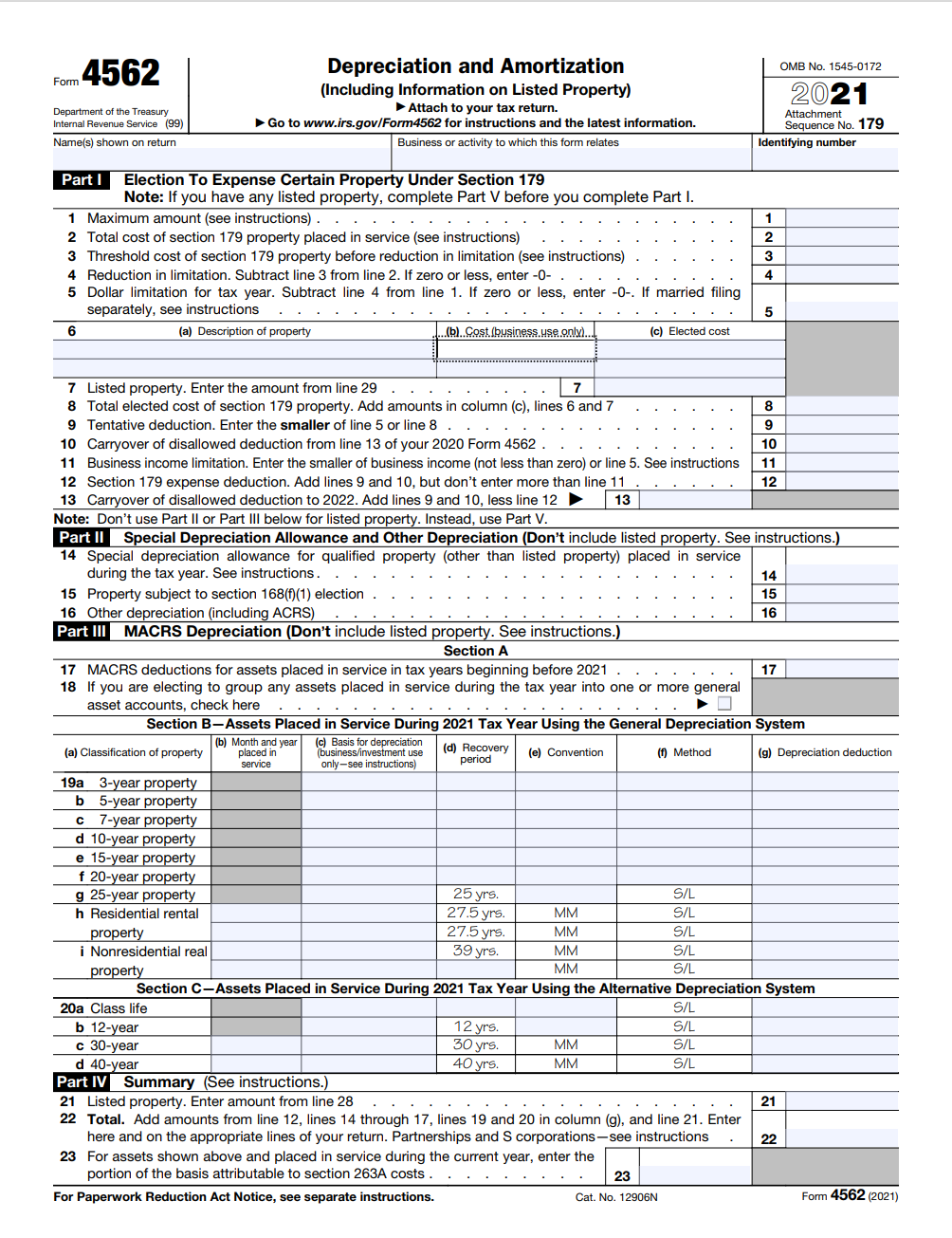

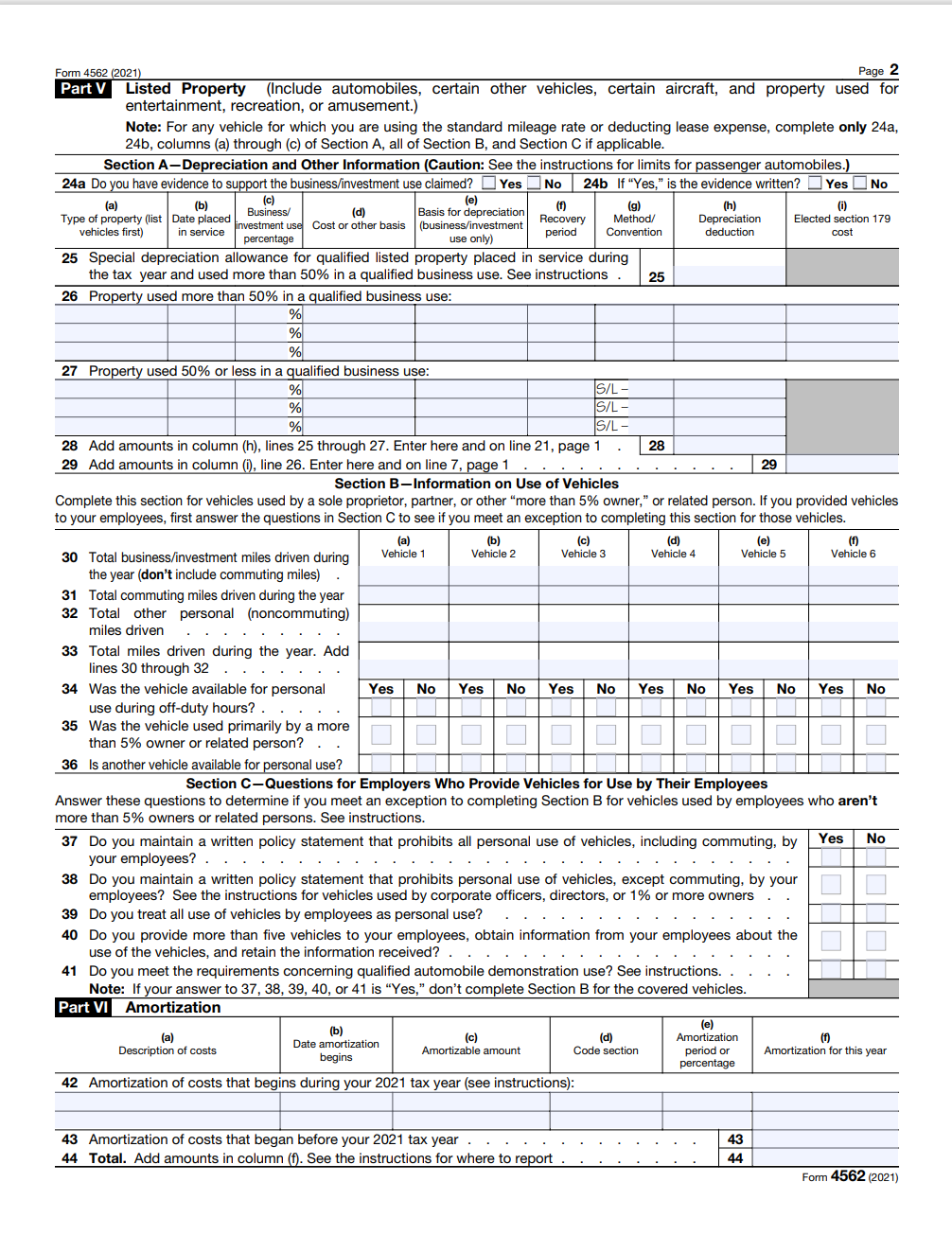

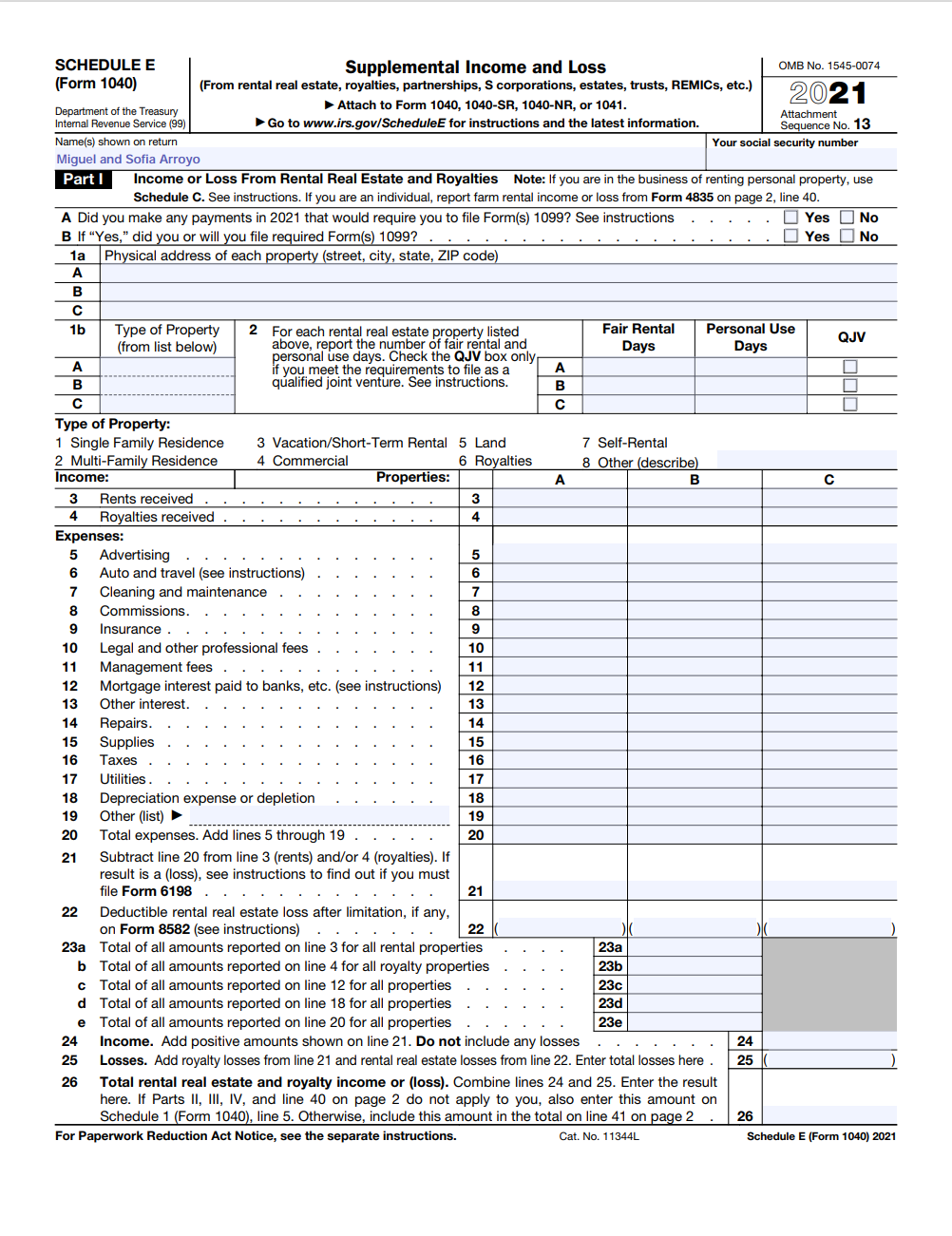

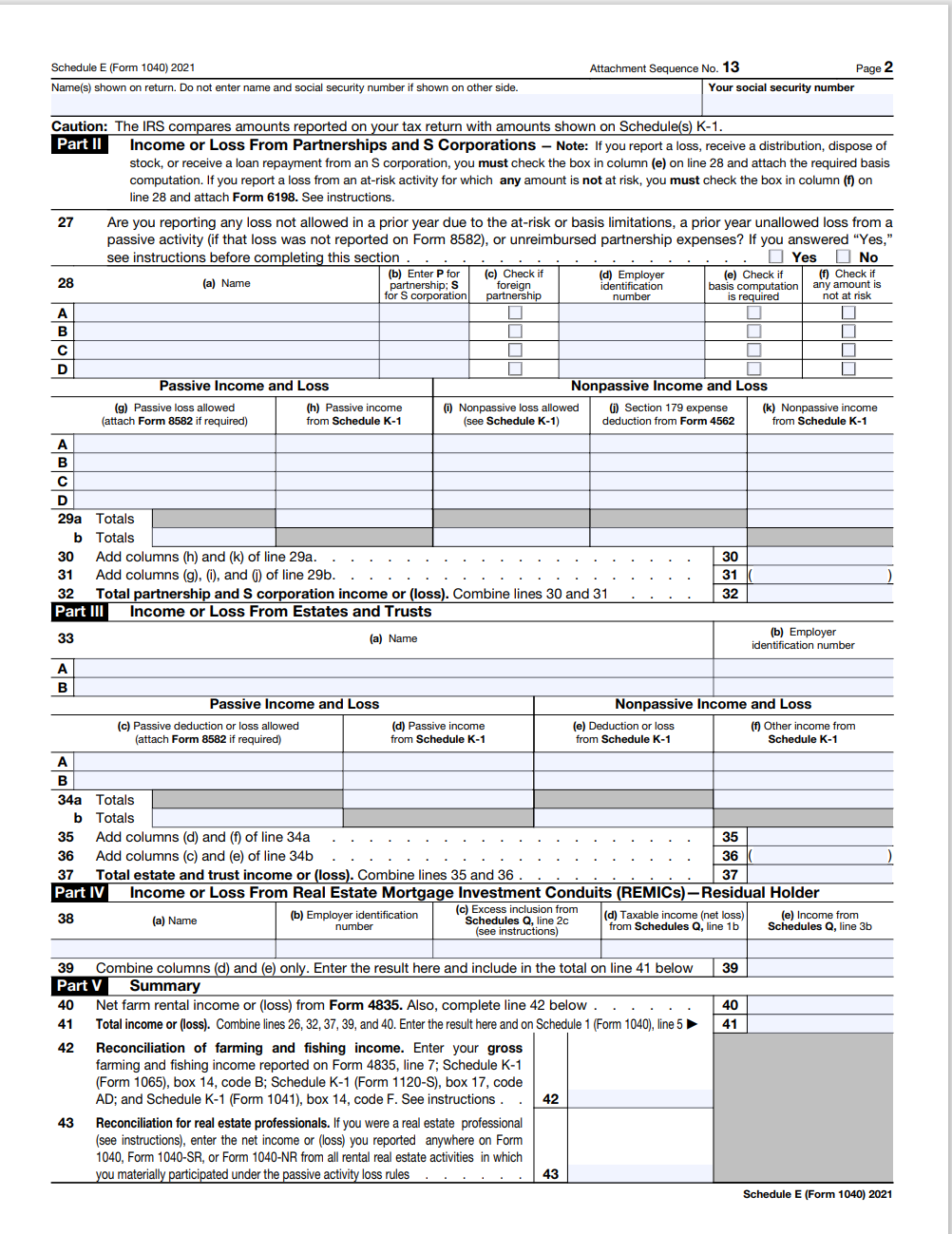

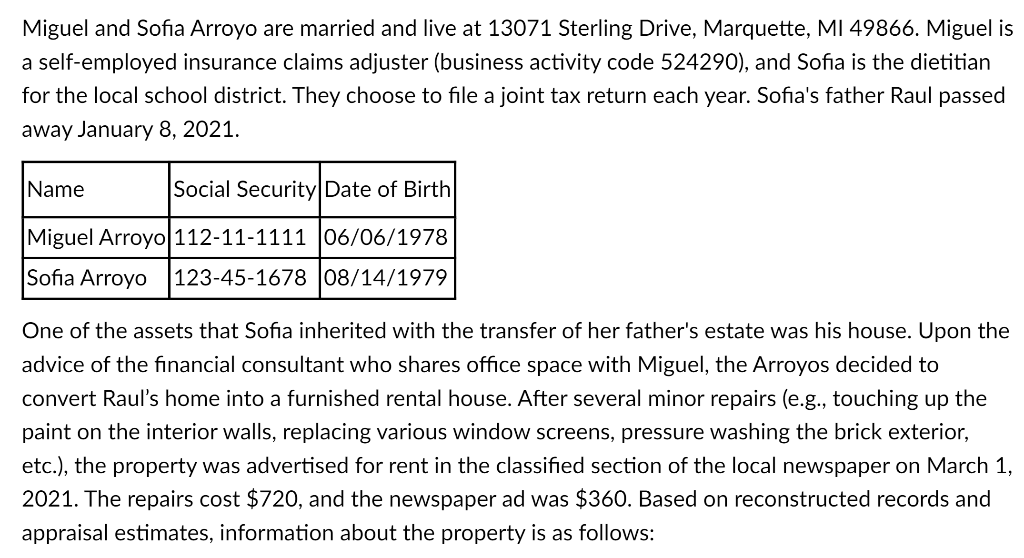

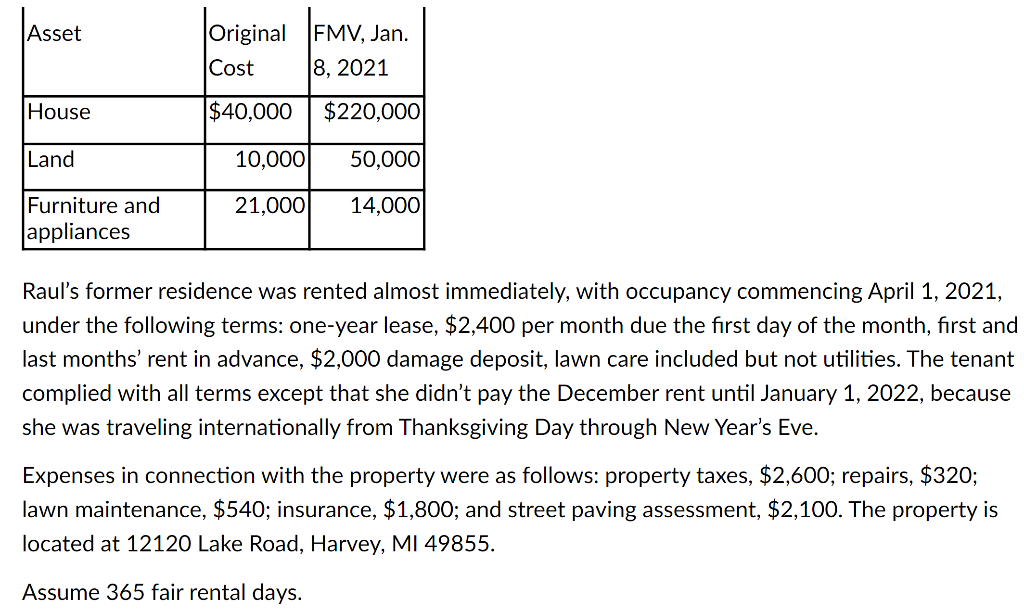

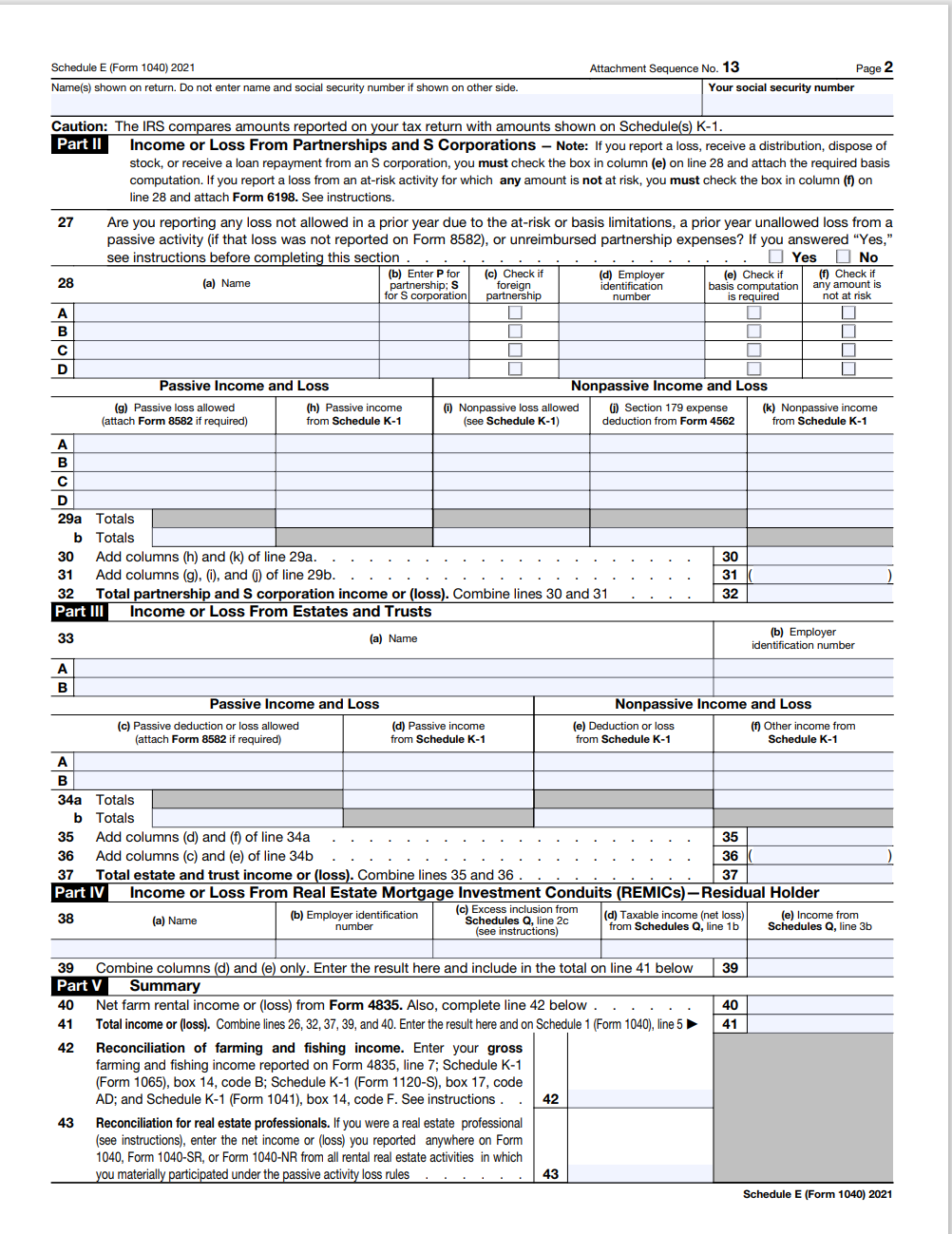

Miguel and Sofia Arroyo are married and live at 13071 Sterling Drive, Marquette, MI 49866. Miguel is a self-employed insurance claims adjuster (business activity code 524290), and Sofia is the dietitian for the local school district. They choose to file a joint tax return each year. Sofia's father Raul passed away January 8, 2021. One of the assets that Sofia inherited with the transfer of her father's estate was his house. Upon the advice of the financial consultant who shares office space with Miguel, the Arroyos decided to convert Raul's home into a furnished rental house. After several minor repairs (e.g., touching up the paint on the interior walls, replacing various window screens, pressure washing the brick exterior, etc.), the property was advertised for rent in the classified section of the local newspaper on March 1 , 2021. The repairs cost $720, and the newspaper ad was $360. Based on reconstructed records and appraisal estimates, information about the property is as follows: Raul's former residence was rented almost immediately, with occupancy commencing April 1, 2021, under the following terms: one-year lease, $2,400 per month due the first day of the month, first and last months' rent in advance, $2,000 damage deposit, lawn care included but not utilities. The tenant complied with all terms except that she didn't pay the December rent until January 1, 2022, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2, 600; repairs, $320; lawn maintenance, $540; insurance, $1,800; and street paving assessment, $2,100. The property is located at 12120 Lake Road, Harvey, MI 49855. Assume 365 fair rental days. Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. Note: Don't use Part II or Part III below for listed property. Instead, use Part V. \begin{tabular}{|l|l|l|l|l|l|} Part II & Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) \end{tabular} 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions. 15 Property subject to section 168(f)(1) election. 16 Other depreciation (including ACRS) Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2021 . . . . . . . . . . 17 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Section C-Assets Placed in Service During 2021 Tax Year Using the Alternative Depreciation System Form 4562 (2021) Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24 a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. Part I Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or loss from Form 4835 on page 2 , line 40. Type of Property: 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental 2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe) Income: \begin{tabular}{cc} \hline 3 & Rent \\ 4 & Royaltios: \\ Expenses: \\ 5 & Adve \end{tabular} 6 Auto and travel (see instructions) 7 Cleaning and maintenance. 8 Commissions. 9 Insurance. 10 Legal and other professional fees . . . . . . . 11 Management fees . . . . . . . . . . . . 12 Mortgage interest paid to banks, etc. (see instructions) 13 Other interest. 14 Repairs. 15 Supplies 18 Depreciation expense or depletion . . . . . . . 19 Other (list) 21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file Form 6198 . . . . . . . . . . . . . . . . . 22 Deductible rental real estate loss after limitation, if any, on Form 8582 (see instructions) 23a Total of all amounts reported on line 3 for all rental properties b Total of all amounts reported on line 4 for all royalty properties c Total of all amounts reported on line 12 for all properties d Total of all amounts reported on line 18 for all properties e Total of all amounts reported on line 20 for all properties 2425Income.Addpositiveamountsshownonline21.DonotincludeanylossesLosses.Addroyaltylossesfromline21andrentalrealestatelossesfromline22.Entertotallosseshere. 26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25 . Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 . 26 For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11344L Schedule E (Form 1040) 2021 Schedule E (Form 1040) 2021 Attachment Sequence No. 13 Page 2 Name(s) shown on return. Do not enter name and social security number if shown on other side. Your social security number Caution: The IRS compares amounts reported on your tax return with amounts shown on Schedule(s) K-1. Part II Income or Loss From Partnerships and S Corporations - Note: If you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an S corporation, you must check the box in column (e) on line 28 and attach the required basis computation. If you report a loss from an at-risk activity for which any amount is not at risk, you must check the box in column (f) on line 28 and attach Form 6198. See instructions. 27 Are you reporting any loss not allowed in a prior year due to the at-risk or basis limitations, a prior year unallowed loss from a passive activity (if that loss was not reported on Form 8582), or unreimbursed partnership expenses? If you answered "Yes," see instructions before completing this section . Part III Income or Loss From Estates and Trusts 33 (a) Name (b) Employer \begin{tabular}{l|} \hline A \\ \hline B \\ \hline \end{tabular} identification number \begin{tabular}{l} \hline \multicolumn{3}{c|}{ Passive Income and Loss } & \multicolumn{3}{c}{ Nonpassive Income and Loss } \\ \hline \multicolumn{3}{c|}{ (c) Passive deduction or loss allowed } \\ (attach Form 8582 if required) \end{tabular} Schedule E (Form 1040) 2021