Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use Gulf Corp.'s financial statements to compute the below ratios. Compared to the industry averages provided in the question data determine if the ratio

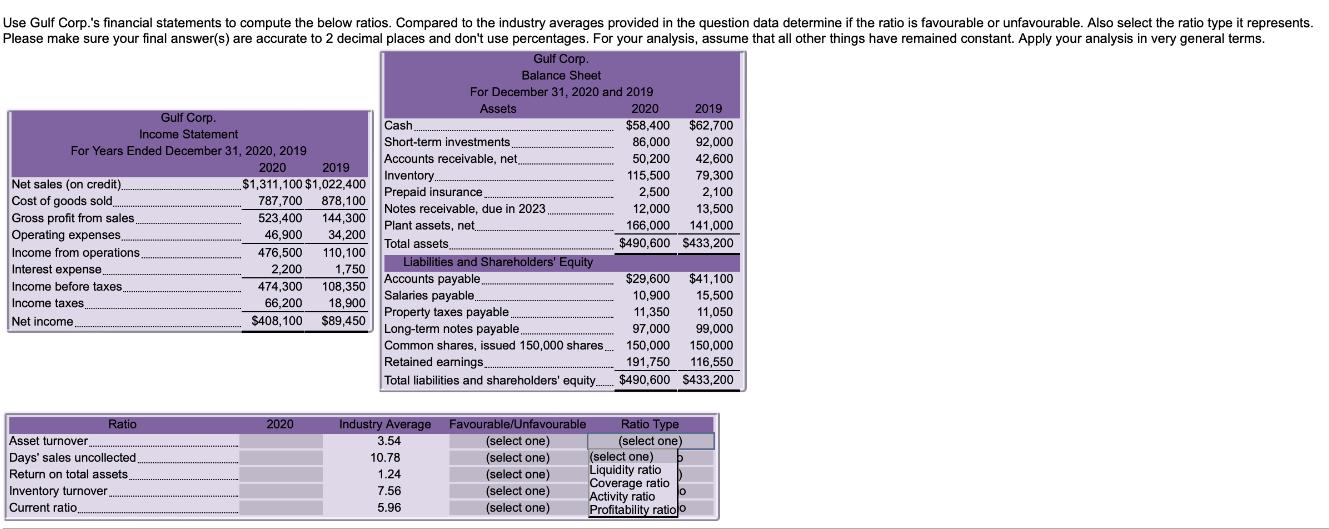

Use Gulf Corp.'s financial statements to compute the below ratios. Compared to the industry averages provided in the question data determine if the ratio is favourable or unfavourable. Also select the ratio type it represents. Please make sure your final answer(s) are accurate to 2 decimal places and don't use percentages. For your analysis, assume that all other things have remained constant. Apply your analysis in very general terms. Gulf Corp. Balance Sheet For December 31, 2020 and 2019 Assets Gulf Corp. Income Statement Cash For Years Ended December 31, 2020, 2019 Net sales (on credit). 2020 $1,311,100 $1,022,400 2019 Short-term investments Accounts receivable, net, Inventory.. Prepaid insurance 2020 $58,400 $62,700 86,000 92,000 50,200 42,600 2019 115,500 79,300 Cost of goods sold... Gross profit from sales. Operating expenses. Income from operations. Interest expense, Income before taxes. Income taxes. Net income. 787,700 878,100 523,400 144,300 46,900 476,500 2,200 Notes receivable, due in 2023, Plant assets, net.. 2,500 2,100 12,000 13,500 166,000 141,000 474,300 34,200 110,100 1,750 108,350 Total assets, $490,600 $433,200 Liabilities and Shareholders' Equity Accounts payable. $29,600 $41,100 Salaries payable.. 10,900 15,500 66,200 18,900 $408,100 Property taxes payable.. 11,350 11,050 $89,450 Long-term notes payable.. 97,000 Common shares, issued 150,000 shares. 150,000 Retained earnings. 99,000 150,000 191,750 116,550 Total liabilities and shareholders' equity. $490,600 $433,200 Ratio 2020 Industry Average Favourable/Unfavourable Ratio Type 3.54 (select one) (select one) 10.78 (select one) (select one) 1.24 (select one) Liquidity ratio 7.56 (select one) Activity ratio 5.96 (select one) Coverage ratio Profitability ratio o Asset turnover. Days' sales uncollected. Return on total assets. Inventory turnover Current ratio,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started