use harvard intext refrencing with refrence list

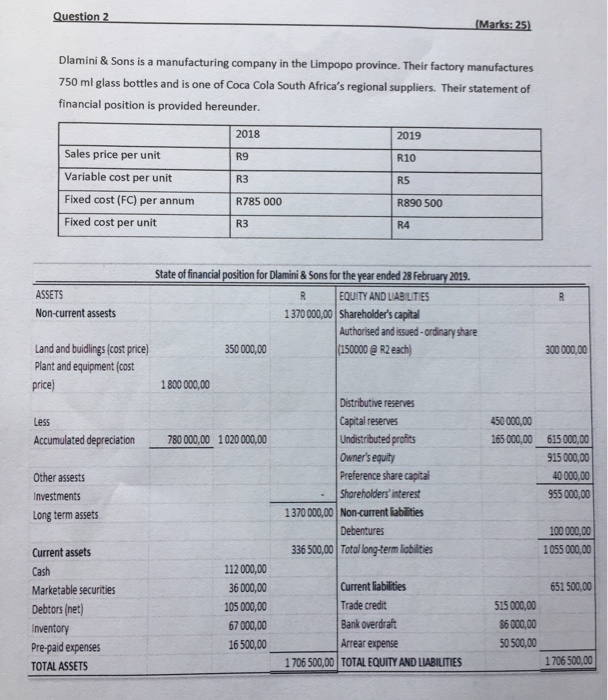

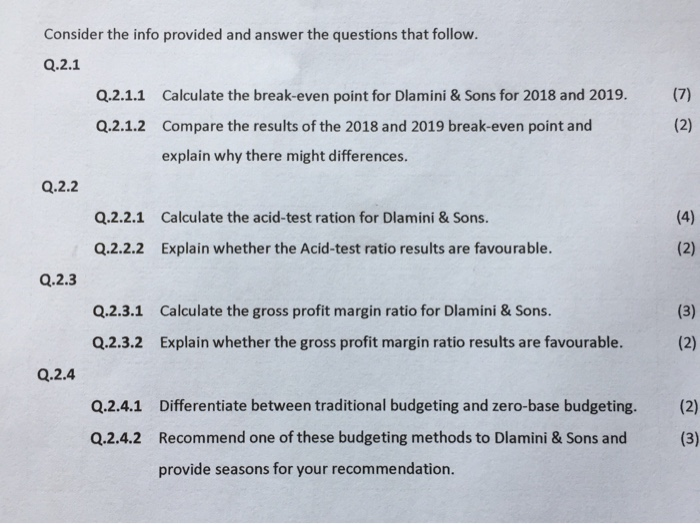

Question 2 (Marks:25) Dlamini & Sons is a manufacturing company in the Limpopo province. Their factory manufactures 750 ml glass bottles and is one of Coca Cola South Africa's regional suppliers. Their statement of financial position is provided hereunder. 2018 2019 R9 R10 R3 R5 Sales price per unit Variable cost per unit Fixed cost (FC) per annum Fixed cost per unit R785 000 R890 500 R3 R4 ASSETS Non-current assests State of financial position for Dlamini & Sons for the year ended 28 February 2019. R EQUITY AND LIABILITIES 1 370 000,00 Shareholder's capital Authorised and issued - ordinary share 350 000,00 |(150000 R2 each 300 000,00 Land and buidlings (cost price) Plant and equipment (cost price 1 800 000,00 Less Accumulated depreciation 780 000,00 1 020 000,00 Distributive reserves Capital reserves Undistributed profits Owner's equity Preference share capital Shareholders interest 1370 000,00 Non-current liabilities Debentures 336 500,00 Total long-term liabilities 450 000,00 165 000,00 615 000,00 915 000,00 40 000,00 955 000,00 Other assests Investments Long term assets 100 000,00 1055 000,00 651 500,00 Current assets Cash Marketable securities Debtors (net) Inventory Pre-paid expenses TOTAL ASSETS 112 000,00 36 000,00 105 000,00 67 000,00 16 500,00 Current liabilities Trade credit Bank overdraft Arrear expense 1706 500,00 TOTAL EQUITY AND LIABILITIES 515 000,00 36 000,00 50500,00 1706 500,00 (7) (2) Consider the info provided and answer the questions that follow. Q.2.1 Q.2.1.1 Calculate the break-even point for Dlamini & Sons for 2018 and 2019. Q.2.1.2 Compare the results of the 2018 and 2019 break-even point and explain why there might differences. Q.2.2 Q.2.2.1 Calculate the acid-test ration for Dlamini & Sons. Q.2.2.2 Explain whether the Acid-test ratio results are favourable. (4) (2) Q.2.3 (3) Q.2.3.1 Calculate the gross profit margin ratio for Dlamini & Sons. Q.2.3.2 Explain whether the gross profit margin ratio results are favourable. (2) Q.2.4 (2) Q.2.4.1 Differentiate between traditional budgeting and zero-base budgeting. Q.2.4.2 Recommend one of these budgeting methods to Dlamini & Sons and provide seasons for your recommendation. (3)