Answered step by step

Verified Expert Solution

Question

1 Approved Answer

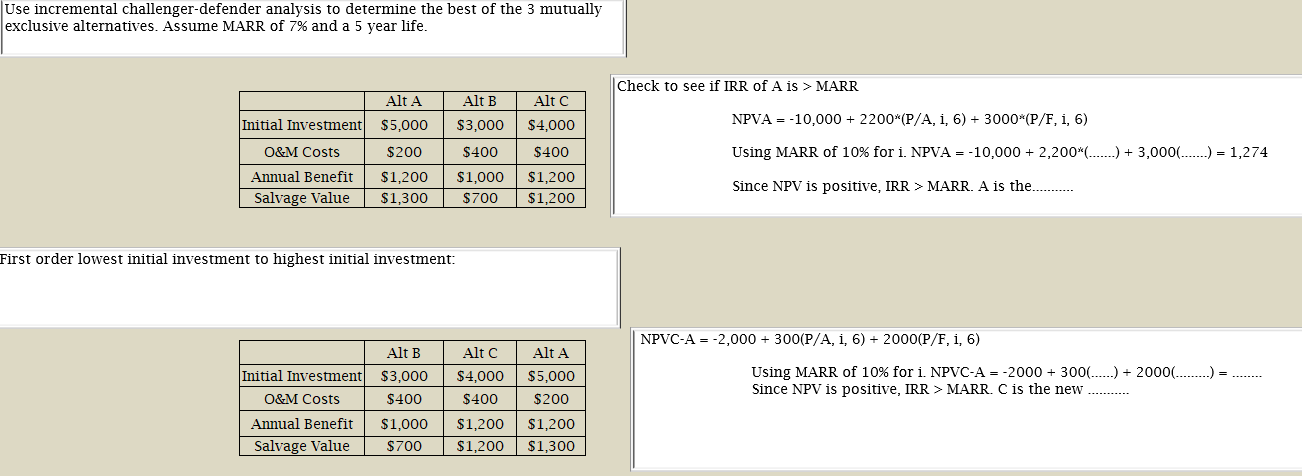

Use incremental challenger-defender analysis to determine the best of the 3 mutually exclusive alternatives. Assume MARR of 7% and a 5 year life. Initial

Use incremental challenger-defender analysis to determine the best of the 3 mutually exclusive alternatives. Assume MARR of 7% and a 5 year life. Initial Investment O&M Costs Annual Benefit Salvage Value Alt A $5,000 $200 $1,200 $1,300 First order lowest initial investment to highest initial investment: Alt B Initial Investment $3,000 O&M Costs Annual Benefit Salvage Value $400 $1,000 $700 Alt B $3,000 $400 $1,000 Alt C $4,000 $400 $1,200 $700 $1,200 Alt C $4,000 $400 Alt A $5,000 $200 $1,200 $1,200 $1,200 $1,300 Check to see if IRR of A is> MARR NPVA = -10,000+ 2200*(P/A, i, 6) + 3000*(P/F, i, 6) Using MARR of 10% for i. NPVA = -10,000+ 2,200*()+3,000(.....) = 1,274 Since NPV is positive, IRR > MARR. A is the............ |NPVC-A = -2,000 + 300(P/A, i, 6) + 2000(P/F, i, 6) Using MARR of 10% for i. NPVC-A-2000 + 300(...) + 2000(.....) =...... Since NPV is positive, IRR > MARR. C is the new

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations 1 Check IRR of Alternative A Cash Flows for A Initial Investmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started