Question

Use internet tax resources to address the following questions. Look for reliable websites and blogs of the IRS and other government agencies, media outlets, businesses,

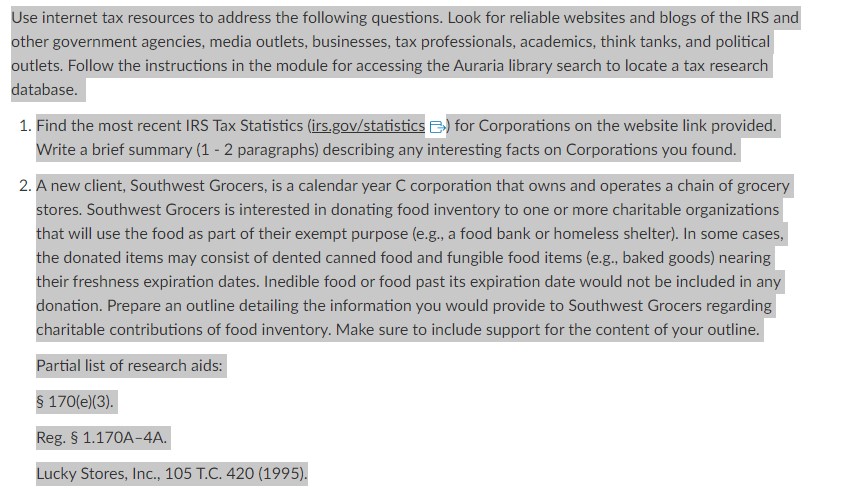

Use internet tax resources to address the following questions. Look for reliable websites and blogs of the IRS and other government agencies, media outlets, businesses, tax professionals, academics, think tanks, and political outlets. Follow the instructions in the module for accessing the Auraria library search to locate a tax research database.

Find the most recent IRS Tax Statistics (irs.gov/statisticsLinks to an external site.) for Corporations on the website link provided. Describing any interesting facts on Corporations you found.

A new client, Southwest Grocers, is a calendar year C corporation that owns and operates a chain of grocery stores. Southwest Grocers is interested in donating food inventory to one or more charitable organizations that will use the food as part of their exempt purpose (e.g., a food bank or homeless shelter). In some cases, the donated items may consist of dented canned food and fungible food items (e.g., baked goods) nearing their freshness expiration dates. Inedible food or food past its expiration date would not be included in any donation. Prepare an outline detailing the information you would provide to Southwest Grocers regarding charitable contributions of food inventory. Make sure to include support for the content of your outline.

Partial list of research aids:

170(e)(3).

Reg. 1.170A-4A.

Lucky Stores, Inc., 105 T.C. 420 (1995).

Use internet tax resources to address the following questions. Look for reliable websites and blogs of the IRS and other government agencies, media outlets, businesses, tax professionals, academics, think tanks, and political outlets. Follow the instructions in the module for accessing the Auraria library search to locate a tax research database. 1. Find the most recent IRS Tax Statistics (irs.gov/statistics B) for Corporations on the website link provided. Write a brief summary (1 - 2 paragraphs) describing any interesting facts on Corporations you found. 2. A new client, Southwest Grocers, is a calendar year C corporation that owns and operates a chain of grocery stores. Southwest Grocers is interested in donating food inventory to one or more charitable organizations that will use the food as part of their exempt purpose (e.g., a food bank or homeless shelter). In some cases, the donated items may consist of dented canned food and fungible food items (e.g., baked goods) nearing their freshness expiration dates. Inedible food or food past its expiration date would not be included in any donation. Prepare an outline detailing the information you would provide to Southwest Grocers regarding charitable contributions of food inventory. Make sure to include support for the content of your outline. Partial list of research aids: 170(e)(3). Reg. 1.170A-4A. Lucky Stores, Inc., 105 T.C. 420 (1995).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started