Answered step by step

Verified Expert Solution

Question

1 Approved Answer

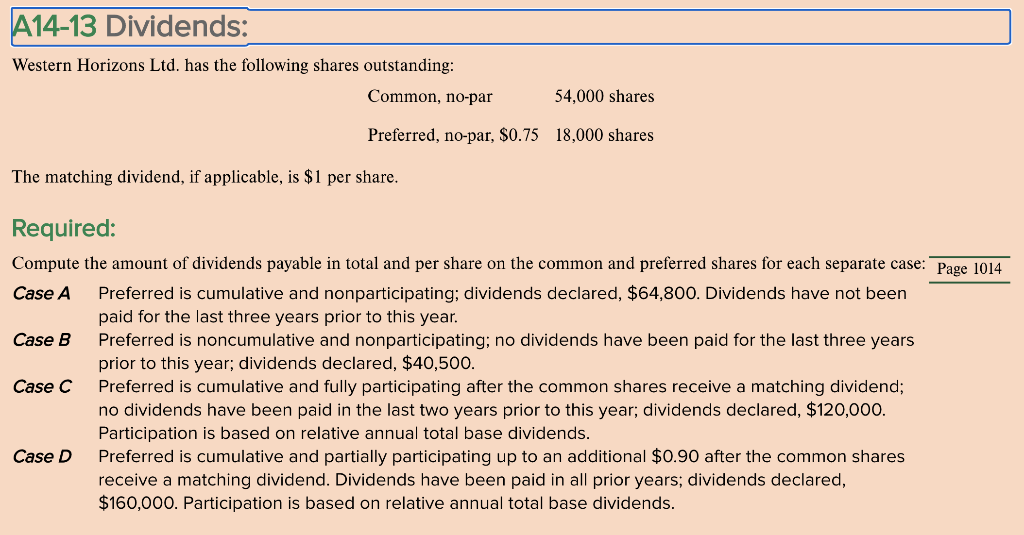

Use layout provided. A14-13 Dividends: Western Horizons Ltd. has the following shares outstanding: Common, no-par 54,000 shares Preferred, no-par, $0.75 18,000 shares The matching dividend,

Use layout provided.

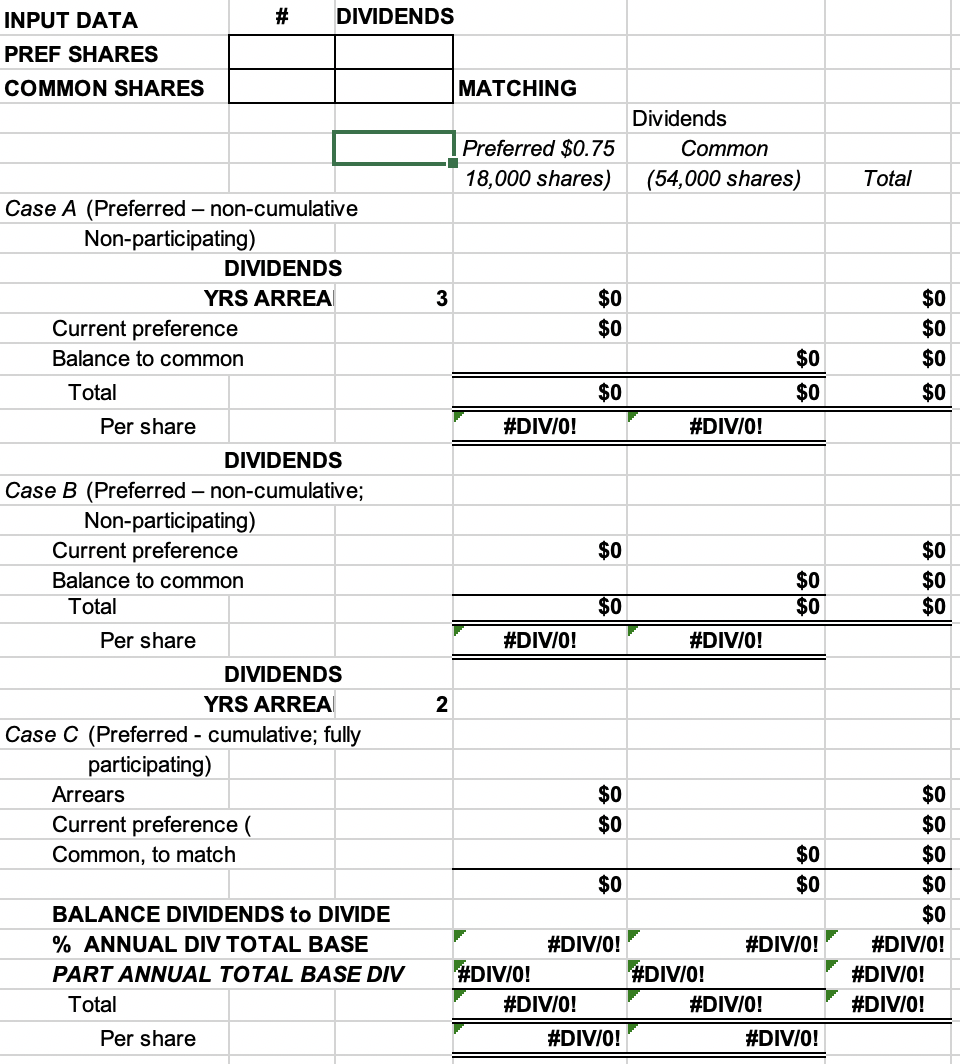

A14-13 Dividends: Western Horizons Ltd. has the following shares outstanding: Common, no-par 54,000 shares Preferred, no-par, $0.75 18,000 shares The matching dividend, if applicable, is $1 per share. Required: Compute the amount of dividends payable in total and per share on the common and preferred shares for each separate case: Page 1014 Case A Preferred is cumulative and nonparticipating; dividends declared, $64,800. Dividends have not been paid for the last three years prior to this year. Case B Preferred is noncumulative and nonparticipating; no dividends have been paid for the last three years prior to this year; dividends declared, $40,500. Case C Preferred is cumulative and fully participating after the common shares receive a matching dividend; no dividends have been paid in the last two years prior to this year; dividends declared, $120,000. Participation is based on relative annual total base dividends. Case D Preferred is cumulative and partially participating up to an additional $0.90 after the common shares receive a matching dividend. Dividends have been paid in all prior years, dividends declared, $160,000. Participation is based on relative annual total base dividends. # DIVIDENDS INPUT DATA PREF SHARES COMMON SHARES MATCHING Preferred $0.75 18,000 shares) Dividends Common (54,000 shares) Total 3 $0 $0 $0 $0 $0 $0 $0 $0 $0 #DIV/O! #DIV/0! Case A (Preferred non-cumulative Non-participating) DIVIDENDS YRS ARREA Current preference Balance to common Total Per share DIVIDENDS Case B (Preferred non-cumulative; Non-participating) Current preference Balance to common Total Per share DIVIDENDS YRS ARREA Case C (Preferred - cumulative; fully participating) Arrears Current preference ( Common, to match $0 $0 $0 $0 $0 $0 $0 #DIV/0! #DIV/0! 2 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 #DIV/0! #DIV/0! #DIV/0! BALANCE DIVIDENDS to DIVIDE % ANNUAL DIV TOTAL BASE PART ANNUAL TOTAL BASE DIV Total #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started