Answered step by step

Verified Expert Solution

Question

1 Approved Answer

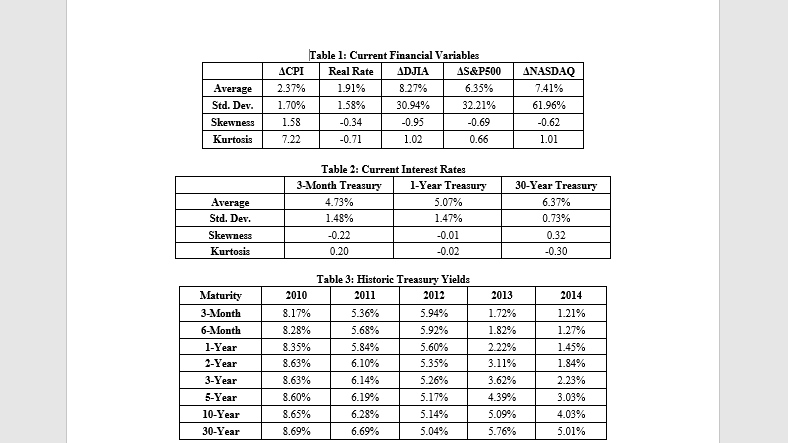

Use one or more of these tables to answer this question: Suppose you are standing in 2010. What would be expected rate of return on

Use one or more of these tables to answer this question:

to answer this question:

Suppose you are standing in 2010. What would be expected rate of return on a two-year Treasury purchased three years from now?

Use the arithmetic relationship:  f = n a ( 1 + r a ) n b ( 1 + r b ) ( n a n b ) 1

f = n a ( 1 + r a ) n b ( 1 + r b ) ( n a n b ) 1

a.) 8.35%

b.) 8.63%

c.) 8.91%

d.) 8.56%

e.) 9.01%

Average | Table 1: Current Financial Variables ACPI Real Rate ADJIA AS&P500 2.37% 1.91% 8.27% 6.35% 1.70% 1.58% 30.94% 32.21% 1.58 -0.34 -0.95 -0.69 7.22 -0.71 1.02 0.66 Std. Dev. ANASDAQ 7.41% 61.96% -0.62 1.01 Skewness Kurtosis Average Std. Dev. Skewness Kurtosis Table 2: Current Interest Rates 3-Month Treasury 1-Year Treasury 4.73% 5.07% 1.48% 1.47% -0.22 -0.01 0.20 -0.02 30-Year Treasury 6.37% 0.73% 0.32 -0.30 Maturity 3-Month 6-Month 1-Year 2-Year 3-Year 5-Year 10-Year 30-Year 2010 8.17% 8.28% 8.35% 8.63% 8.63% 8.60% 8.65% 8.69% Table 3: Historic Treasury Yields 2011 2012 5.36% 1 5.94% 5.68% 5.92% 5.84% 5.60% 6.10% 5.35% 6.14% 5.26% 6.19% 5.17% 6.28% 5.14% 6.69% 5.04% / 2013 1.72% 1.82% 2.22% 3.11% 3.62% 4.39% 5.09% 5.76% 2014 1.21% 1.27% 1.45% 1.84% 2.23% 3.03% 4.03% 5.01% Average | Table 1: Current Financial Variables ACPI Real Rate ADJIA AS&P500 2.37% 1.91% 8.27% 6.35% 1.70% 1.58% 30.94% 32.21% 1.58 -0.34 -0.95 -0.69 7.22 -0.71 1.02 0.66 Std. Dev. ANASDAQ 7.41% 61.96% -0.62 1.01 Skewness Kurtosis Average Std. Dev. Skewness Kurtosis Table 2: Current Interest Rates 3-Month Treasury 1-Year Treasury 4.73% 5.07% 1.48% 1.47% -0.22 -0.01 0.20 -0.02 30-Year Treasury 6.37% 0.73% 0.32 -0.30 Maturity 3-Month 6-Month 1-Year 2-Year 3-Year 5-Year 10-Year 30-Year 2010 8.17% 8.28% 8.35% 8.63% 8.63% 8.60% 8.65% 8.69% Table 3: Historic Treasury Yields 2011 2012 5.36% 1 5.94% 5.68% 5.92% 5.84% 5.60% 6.10% 5.35% 6.14% 5.26% 6.19% 5.17% 6.28% 5.14% 6.69% 5.04% / 2013 1.72% 1.82% 2.22% 3.11% 3.62% 4.39% 5.09% 5.76% 2014 1.21% 1.27% 1.45% 1.84% 2.23% 3.03% 4.03% 5.01%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started