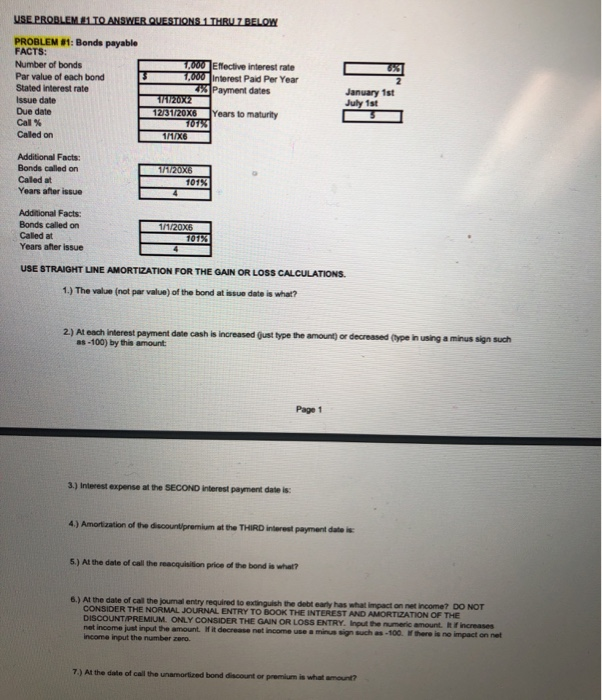

USE PROBLEM81 TO ANSWER QUESTIONS 1 THRU 7 BELOW URT PROBLEM 81: Bonds payable FACTS: Number of bonds Par value of each bond 3 Stated interest rate Issue date Due date Call% Caled on 1,000 Effective interest rate 1 ,000 interest Paid Per Year Payment dates 17120X2 123120X6Years to maturity 107% HD January 1st July 1st 11120X6 Additional Facts: Bonds called on Caled at Years after issue 4 Additional Facts: Bonds called on Called at Years after issue 1/1/20X6 101% USE STRAIGHT LINE AMORTIZATION FOR THE GAIN OR LOSS CALCULATIONS 1.) The value (not par value) of the bond at issue date is what? 2.) At each interest payment date cash is increased (just type the amount or decreased (ype in using a minus sign such as-100) by this amount: 3.) Interest expense at the SECOND interest payment date is: 4.) Amortization of the discountpremium at the THIRD interest payment date is 5.) At the date of call the reacquisition price of the bondia what? 6.) At the date of call the journal entry required to extinguish the debt earty has what impact on net income? DO NOT CONSIDER THE NORMAL JOURNAL ENTRY TO BOOK THE INTEREST AND AMORTIZATION OF THE DISCOUNT PREMIUM ONLY CONSIDER THE GAIN OR LOSS ENTRY. Inout the numeric amount of increases net income just input the amount it decrease net income use a mis such as -100. there is no impact on net income input the number zero 7.) At the date of call the namortized bond discount or premium is what amount? USE PROBLEM81 TO ANSWER QUESTIONS 1 THRU 7 BELOW URT PROBLEM 81: Bonds payable FACTS: Number of bonds Par value of each bond 3 Stated interest rate Issue date Due date Call% Caled on 1,000 Effective interest rate 1 ,000 interest Paid Per Year Payment dates 17120X2 123120X6Years to maturity 107% HD January 1st July 1st 11120X6 Additional Facts: Bonds called on Caled at Years after issue 4 Additional Facts: Bonds called on Called at Years after issue 1/1/20X6 101% USE STRAIGHT LINE AMORTIZATION FOR THE GAIN OR LOSS CALCULATIONS 1.) The value (not par value) of the bond at issue date is what? 2.) At each interest payment date cash is increased (just type the amount or decreased (ype in using a minus sign such as-100) by this amount: 3.) Interest expense at the SECOND interest payment date is: 4.) Amortization of the discountpremium at the THIRD interest payment date is 5.) At the date of call the reacquisition price of the bondia what? 6.) At the date of call the journal entry required to extinguish the debt earty has what impact on net income? DO NOT CONSIDER THE NORMAL JOURNAL ENTRY TO BOOK THE INTEREST AND AMORTIZATION OF THE DISCOUNT PREMIUM ONLY CONSIDER THE GAIN OR LOSS ENTRY. Inout the numeric amount of increases net income just input the amount it decrease net income use a mis such as -100. there is no impact on net income input the number zero 7.) At the date of call the namortized bond discount or premium is what amount