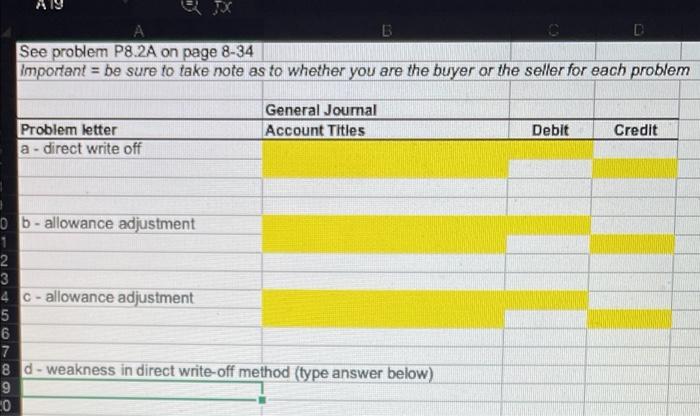

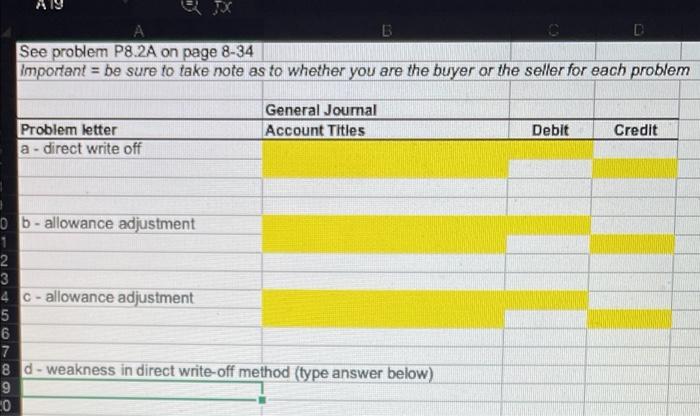

Use questions in the 2nd picture provided to fill out the worksheet below

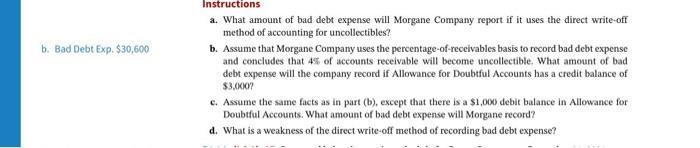

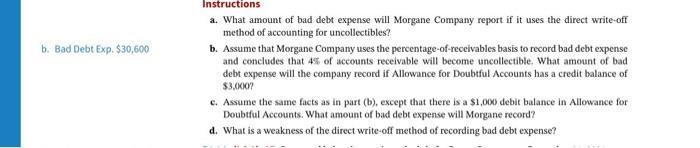

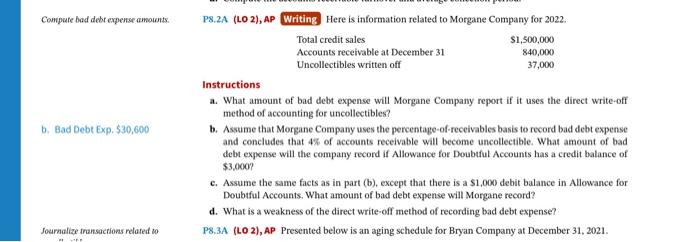

Aly A B D See problem P8.2A on page 8-34 Important = be sure to take note as to whether you are the buyer or the seller for each problem General Joumal Account Titles Debit Credit Problem letter a - direct write off ob - allowance adjustment 1 2 3 4 C - allowance adjustment 5 6 7 8 d - weakness in direct write-off method (type answer below) 9 CO O O b. Bad Debt Exp. $30,600 Instructions a. What amount of bad debt expense will Morgane Company report if it uses the direct write-off method of accounting for uncollectibles? b. Assume that Morgane Company uses the percentage-of-receivables basis to record bad debt expense and concludes that 4% of accounts receivable will become uncollectible. What amount of bad debt expense will the company record if Allowance for Doubtful Accounts has a credit balance of $3.00 c. Assume the same facts as in part (b), except that there is a $1,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Morgane record? d. What is a weakness of the direct write-off method of recording bad debt expense? Compute bad debt expense amount b. Bad Debt Exp, $30,600 PS.2A (LO 2), AP Writing Here is information related to Morgane Company for 2022. Total credit sales $1,500,000 Accounts receivable at December 31 840,000 Uncollectibles written off 37,000 Instructions a. What amount of bad debt expense will Morgane Company report if it uses the direct write-off method of accounting for uncollectibles? b. Assume that Morgane Company uses the percentage-of-receivables basis to record bad debt expense and concludes that 4% of accounts receivable will become uncollectible. What amount of bad debt expense will the company record it Allowance for Doubtful Accounts has a credit balance of $3.00 c. Assume the same facts as in part (b), except that there is a $1,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Morgane record? d. What is a weakness of the direct write-off method of recording bad debt expense? P8,3A (LO2), AP Presented below is an aging schedule for Bryan Company at December 31, 2021 Journalize transactions related to Aly A B D See problem P8.2A on page 8-34 Important = be sure to take note as to whether you are the buyer or the seller for each problem General Joumal Account Titles Debit Credit Problem letter a - direct write off ob - allowance adjustment 1 2 3 4 C - allowance adjustment 5 6 7 8 d - weakness in direct write-off method (type answer below) 9 CO O O b. Bad Debt Exp. $30,600 Instructions a. What amount of bad debt expense will Morgane Company report if it uses the direct write-off method of accounting for uncollectibles? b. Assume that Morgane Company uses the percentage-of-receivables basis to record bad debt expense and concludes that 4% of accounts receivable will become uncollectible. What amount of bad debt expense will the company record if Allowance for Doubtful Accounts has a credit balance of $3.00 c. Assume the same facts as in part (b), except that there is a $1,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Morgane record? d. What is a weakness of the direct write-off method of recording bad debt expense? Compute bad debt expense amount b. Bad Debt Exp, $30,600 PS.2A (LO 2), AP Writing Here is information related to Morgane Company for 2022. Total credit sales $1,500,000 Accounts receivable at December 31 840,000 Uncollectibles written off 37,000 Instructions a. What amount of bad debt expense will Morgane Company report if it uses the direct write-off method of accounting for uncollectibles? b. Assume that Morgane Company uses the percentage-of-receivables basis to record bad debt expense and concludes that 4% of accounts receivable will become uncollectible. What amount of bad debt expense will the company record it Allowance for Doubtful Accounts has a credit balance of $3.00 c. Assume the same facts as in part (b), except that there is a $1,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Morgane record? d. What is a weakness of the direct write-off method of recording bad debt expense? P8,3A (LO2), AP Presented below is an aging schedule for Bryan Company at December 31, 2021 Journalize transactions related to