Answered step by step

Verified Expert Solution

Question

1 Approved Answer

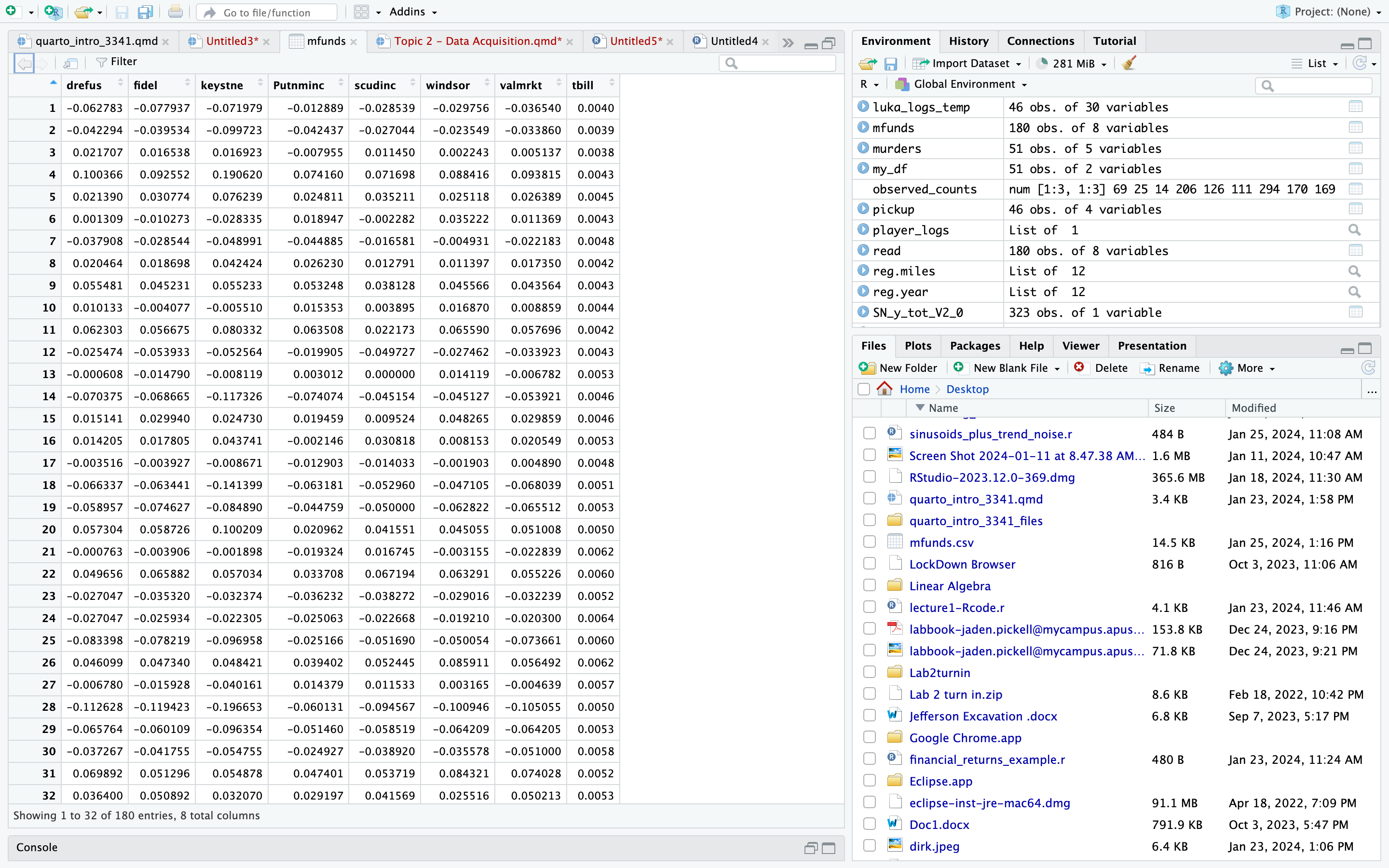

use R studio to answer the following: Consider the Capital Asset Pricing Model ( CAPM ) in the lecture and the data set mfunds.csv we

use R studio to answer the following:

Consider the Capital Asset Pricing Model CAPM in the lecture and the data set mfunds.csv we

covered in the class, answer the following questions.

There are mutual funds included in the dataset tbill is Treasury bill, it is not a mutual

fund which mutual fund has the largest correlation with the market return, valmrkt?

Which mutual fund has the smallest correlation with valmrkt?

Fit the CAPM model for the mutual fund which has the largest correlation with valmrkt,

and write it down hint: valmrkt is the predictor

Fit the CAPM model for the mutual fund which has the smallest correlation with valmrkt,

and write it down hint: valmrkt is the predictor

Plot the two scatterplots of two mutual funds vs valmrkt along with their respective fitted

line use clear labels in the plots

Conduct a hypothesis test to examine whether the chosen mutual fund in part follows

exactly the market or not use alpha Write down the hypothesis, test statistic, p

value, and your conclusion hint refer to Page in Lecture

Conduct a hypothesis test to examine whether the chosen mutual fund in part softens

the market moves use alpha Write down the hypothesis, test statistic, pvalue, and

your conclusion hint refer to Page in Lecture again, but softens means the fund

does not follow as much as the market moves

Suppose the market return is at what would you expect the return of the mutual fund

in part to be What is the predictive interval for the mutual fund return? What is

the predictive interval for the mutual fund return? Which one gives you narrower

prediction interval?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started