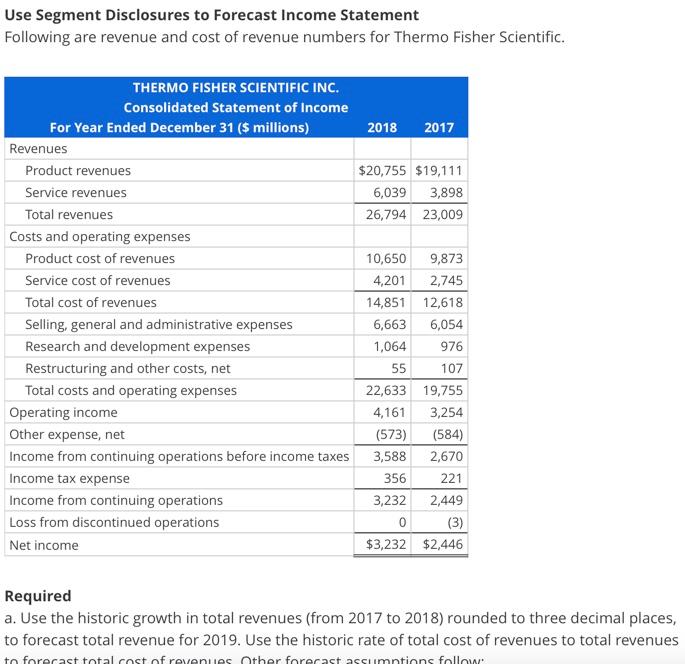

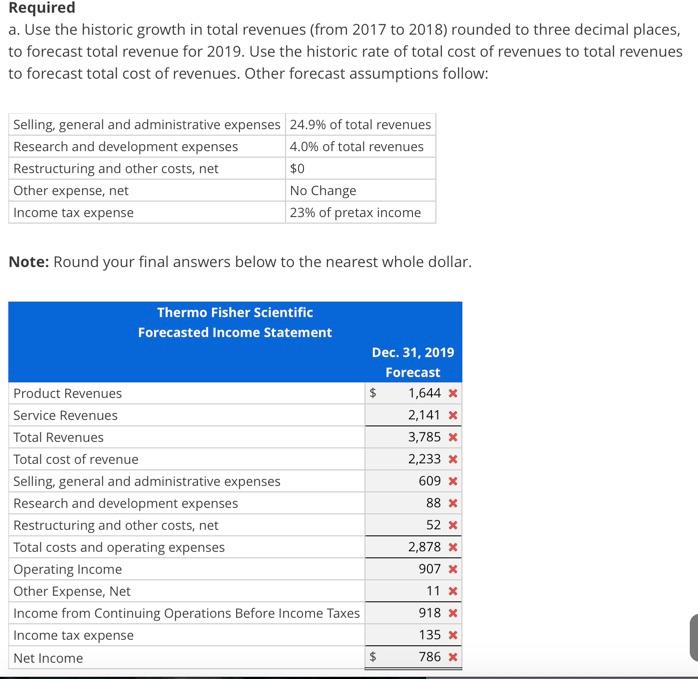

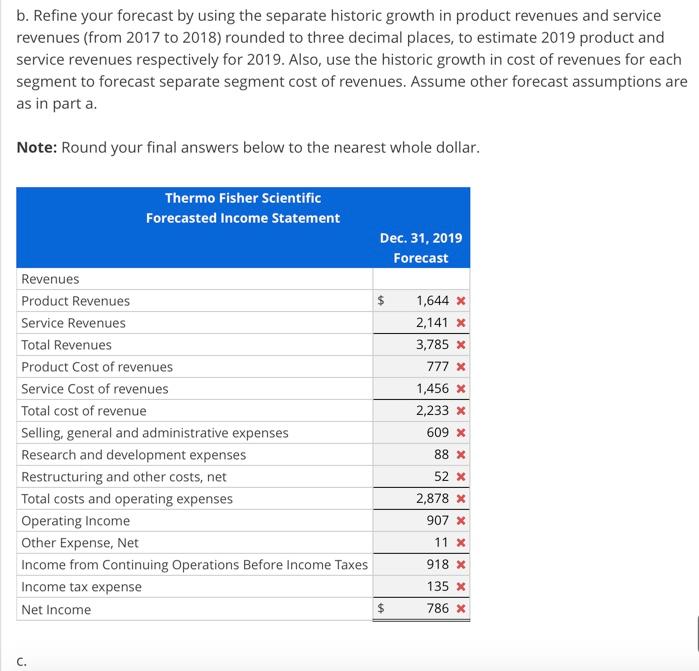

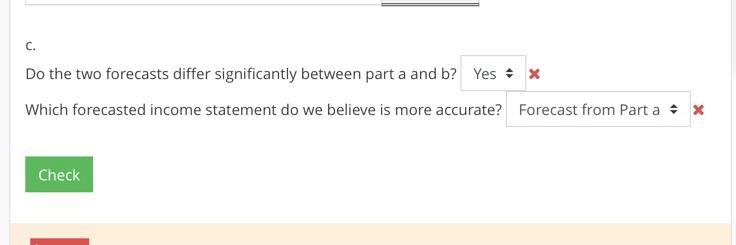

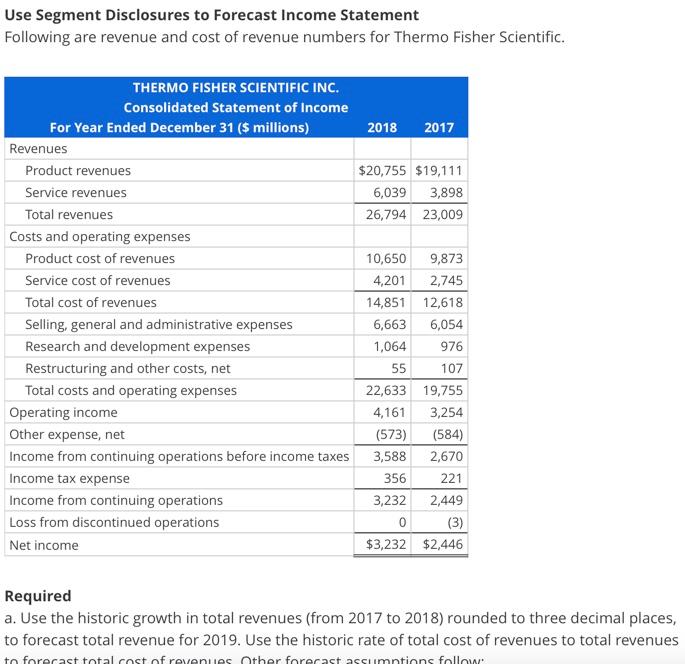

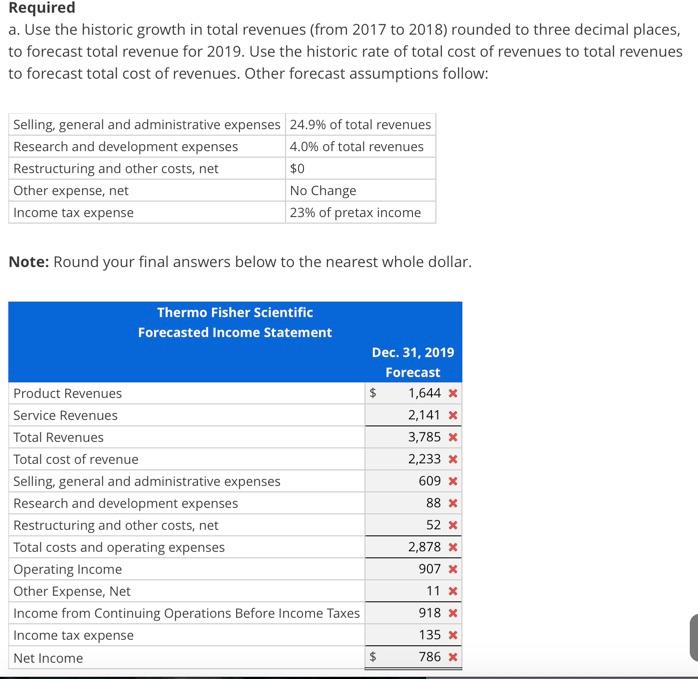

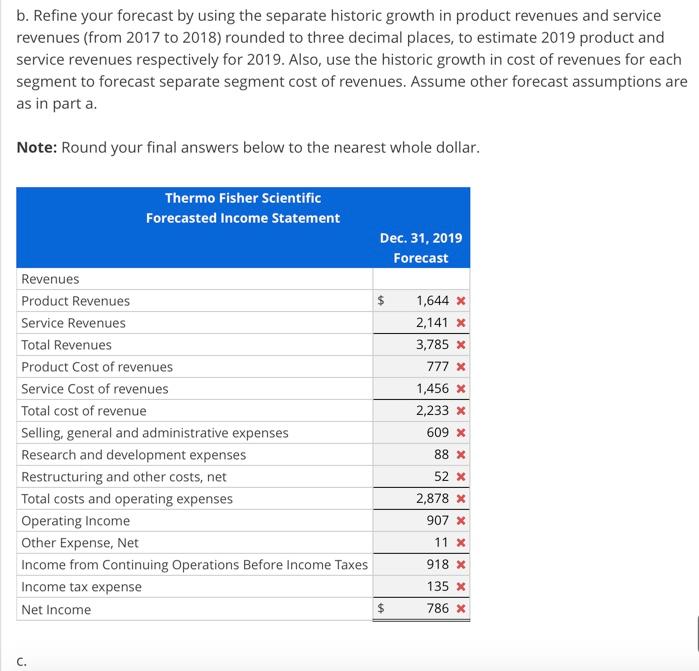

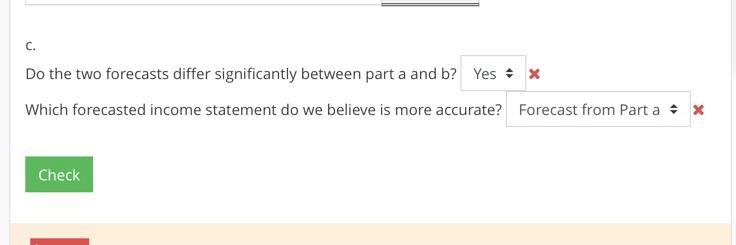

Use Segment Disclosures to Forecast Income Statement Following are revenue and cost of revenue numbers for Thermo Fisher Scientific. 2018 2017 $20,755 $19,111 6,039 3,898 26,794 23,009 THERMO FISHER SCIENTIFIC INC. Consolidated Statement of Income For Year Ended December 31 ($ millions) Revenues Product revenues Service revenues Total revenues Costs and operating expenses Product cost of revenues Service cost of revenues Total cost of revenues Selling, general and administrative expenses Research and development expenses Restructuring and other costs, net Total costs and operating expenses Operating income Other expense, net Income from continuing operations before income taxes Income tax expense Income from continuing operations Loss from discontinued operations Net income 10,650 9,873 4,201 2,745 14,851 12,618 6,663 6,054 1,064 976 55 107 22,633 19,755 4,161 3,254 (573) (584) 3,588 2,670 356 221 3,232 2,449 0 (3) $3,232 $2,446 Required a. Use the historic growth in total revenues (from 2017 to 2018) rounded to three decimal places, to forecast total revenue for 2019. Use the historic rate of total cost of revenues to total revenues to forecast total cost of revenues Other forecast assumptions follow Required a. Use the historic growth in total revenues (from 2017 to 2018) rounded to three decimal places, to forecast total revenue for 2019. Use the historic rate of total cost of revenues to total revenues to forecast total cost of revenues. Other forecast assumptions follow: Selling general and administrative expenses 24.9% of total revenues Research and development expenses 4.0% of total revenues Restructuring and other costs, net $0 Other expense, net No Change Income tax expense 23% of pretax income Note: Round your final answers below to the nearest whole dollar. Thermo Fisher Scientific Forecasted Income Statement Product Revenues Service Revenues Total Revenues Total cost of revenue Selling, general and administrative expenses Research and development expenses Restructuring and other costs, net Total costs and operating expenses Operating Income Other Expense, Net Income from Continuing Operations Before Income Taxes Income tax expense Net Income Dec. 31, 2019 Forecast $ 1,644 x 2,141 x 3,785 x 2,233 x 609 X 88 x 52 x 2,878 x 907 x 11 x 918 x 135 x $ 786 X b. Refine your forecast by using the separate historic growth in product revenues and service revenues (from 2017 to 2018) rounded to three decimal places, to estimate 2019 product and service revenues respectively for 2019. Also, use the historic growth in cost of revenues for each segment to forecast separate segment cost of revenues. Assume other forecast assumptions are as in part a. Note: Round your final answers below to the nearest whole dollar. Thermo Fisher Scientific Forecasted Income Statement Dec. 31, 2019 Forecast $ Revenues Product Revenues Service Revenues Total Revenues Product Cost of revenues Service Cost of revenues Total cost of revenue Selling, general and administrative expenses Research and development expenses Restructuring and other costs, net Total costs and operating expenses Operating Income Other Expense, Net Income from Continuing Operations Before Income Taxes Income tax expense Net Income 1,644 X 2,141 x 3,785 x 777 X 1,456 x 2,233 x 609 X 88 X 52 x 2,878 x 907 x 11 x 918 x 135 x 786 x $ C. Do the two forecasts differ significantly between part a and b? Yes = x Which forecasted income statement do we believe is more accurate? Forecast from Part a - * Check