Question

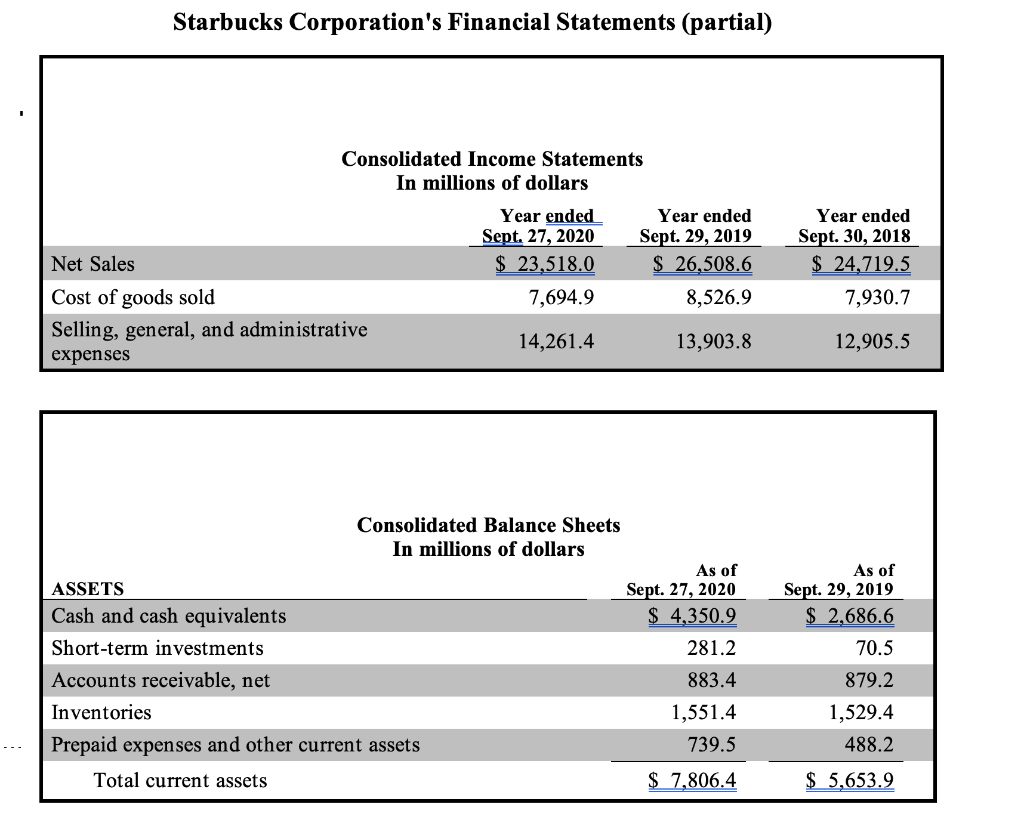

Use Starbucks most recent financial statements to answer the following three questions. 1. Which inventory cost flow assumption does Starbucks use to value its inventories?

Use Starbucks most recent financial statements to answer the following three questions.

1. Which inventory cost flow assumption does Starbucks use to value its inventories?

- LIFO

- FIFO

- Weighted Average Cost

- Specific Identification

- What is the most likely reason that Starbucks chose this inventory cost flow assumption (given rising price trend)?

- To report higher Net Income on its Income Statement.

- To report higher Total Assets on its Balance Sheet.

- To pay less taxes.

- Both a and b are true.

- Which of the following statements about Starbucks is TRUE?

- Fiscal year 2020 Gross Profit

- Fiscal year 2020 COGS > Fiscal year 2019 COGS.

- Fiscal year 2019 Gross Profit

- Fiscal year 2019 Operating Income

- Both a and c are true.

| Notes to Consolidated Financial Statements (partial) |

| 1.3 Fiscal Year Our fiscal year ends on the Sunday closest to September 30. Fiscal year 2020 ended on September 27, 2020, fiscal year 2019 ended on September 29, 2019, and fiscal year 2018 ended on September 30, 2018. 1.11 Inventories The Company values inventories at the lower of cost or net realizable value using the first-in, first-out ("FIFO") method. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started