Question

Use Table 28.1 to answer the following questions: How many Turkish lira do you get for your dollar? Note: Round your answer to 4 decimal

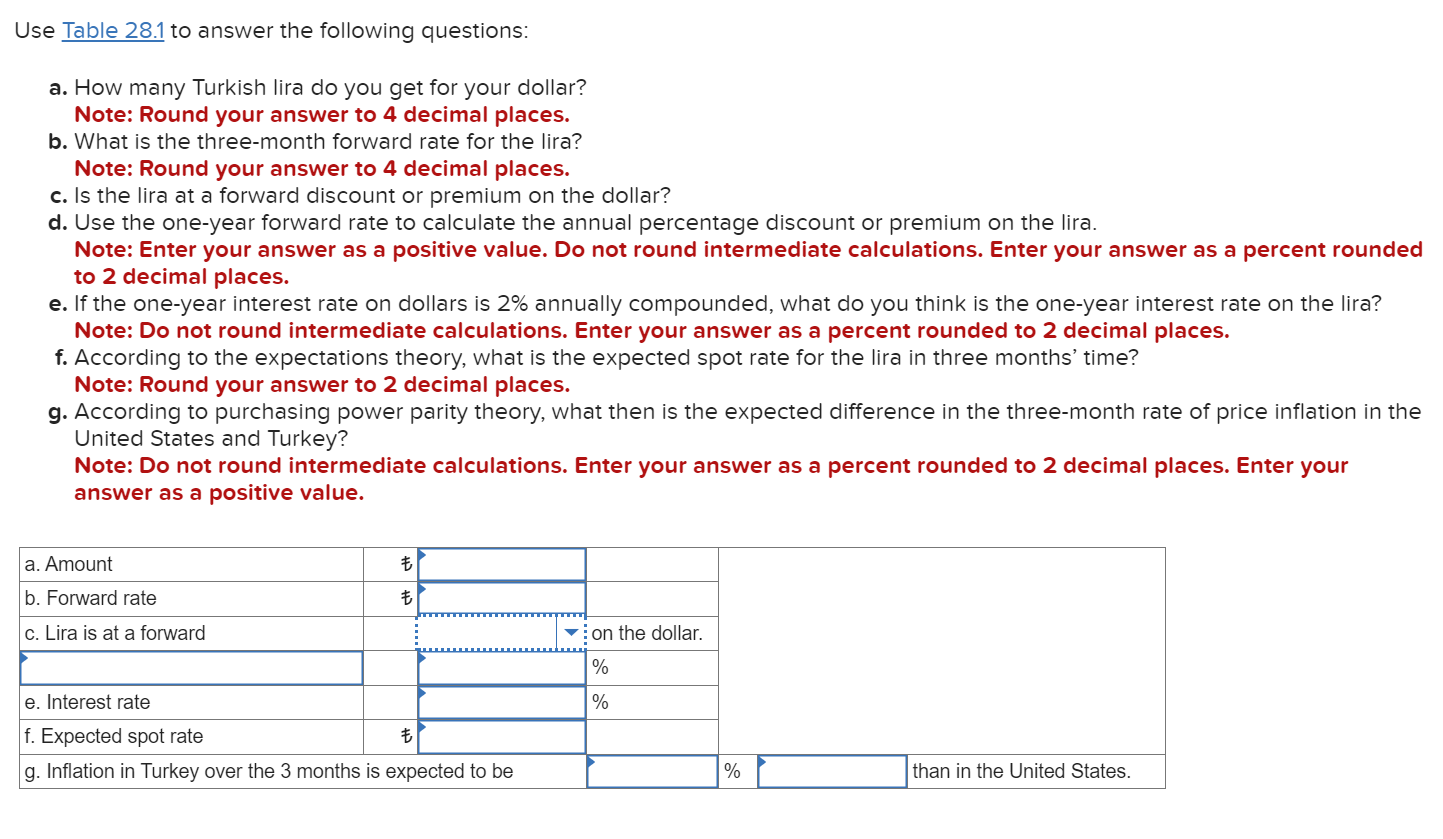

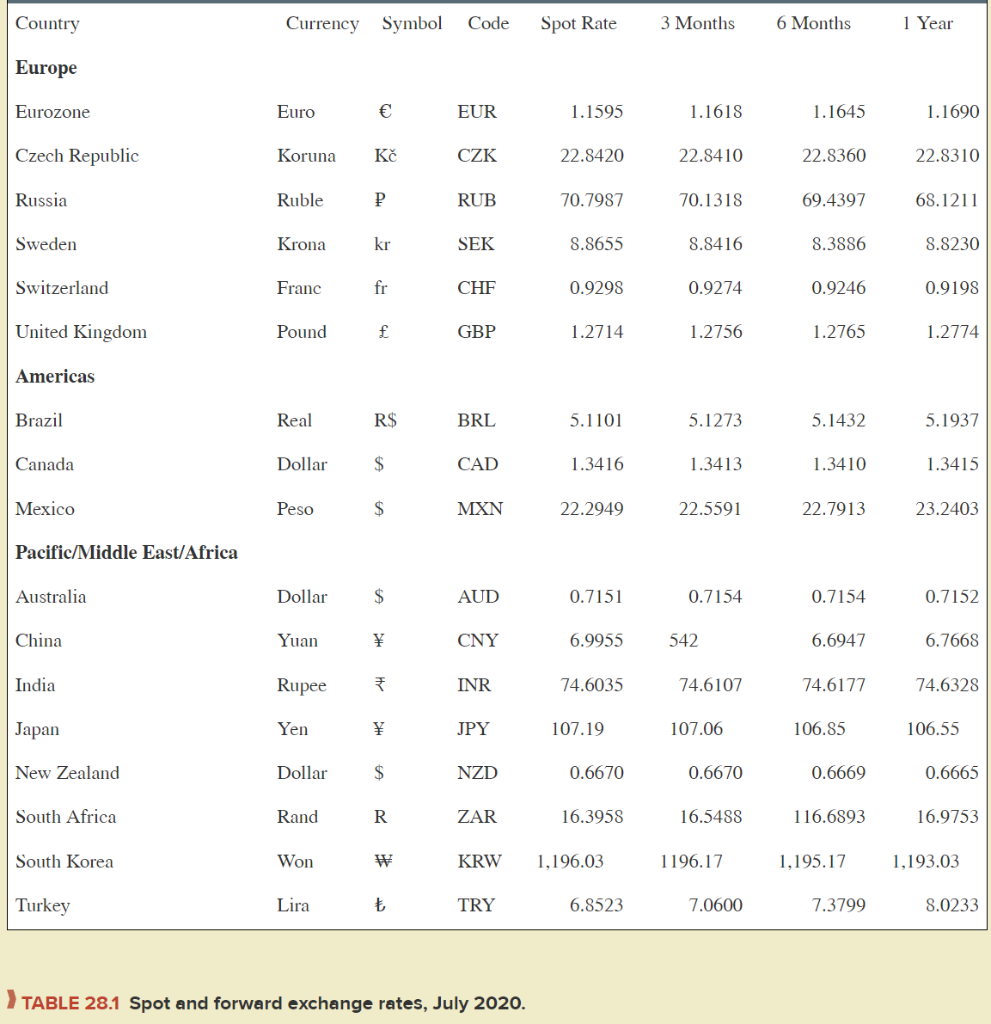

Use Table 28.1 to answer the following questions:

How many Turkish lira do you get for your dollar?

Note: Round your answer to 4 decimal places.

What is the three-month forward rate for the lira?

Note: Round your answer to 4 decimal places.

Is the lira at a forward discount or premium on the dollar?

Use the one-year forward rate to calculate the annual percentage discount or premium on the lira.

Note: Enter your answer as a positive value. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

If the one-year interest rate on dollars is 2% annually compounded, what do you think is the one-year interest rate on the lira?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

According to the expectations theory, what is the expected spot rate for the lira in three months time?

Note: Round your answer to 2 decimal places.

According to purchasing power parity theory, what then is the expected difference in the three-month rate of price inflation in the United States and Turkey?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Enter your answer as a positive value.

Use Table 28.1 to answer the following questions: a. How many Turkish lira do you get for your dollar? Note: Round your answer to 4 decimal places. b. What is the three-month forward rate for the lira? Note: Round your answer to 4 decimal places. c. Is the lira at a forward discount or premium on the dollar? d. Use the one-year forward rate to calculate the annual percentage discount or premium on the lira. Note: Enter your answer as a positive value. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. e. If the one-year interest rate on dollars is 2% annually compounded, what do you think is the one-year interest rate on the lira? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. f. According to the expectations theory, what is the expected spot rate for the lira in three months' time? Note: Round your answer to 2 decimal places. g. According to purchasing power parity theory, what then is the expected difference in the three-month rate of price inflation in the United States and Turkey? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Enter your answer as a positive value. TABLE 28.1 Spot and forward exchange rates, July 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started