Question

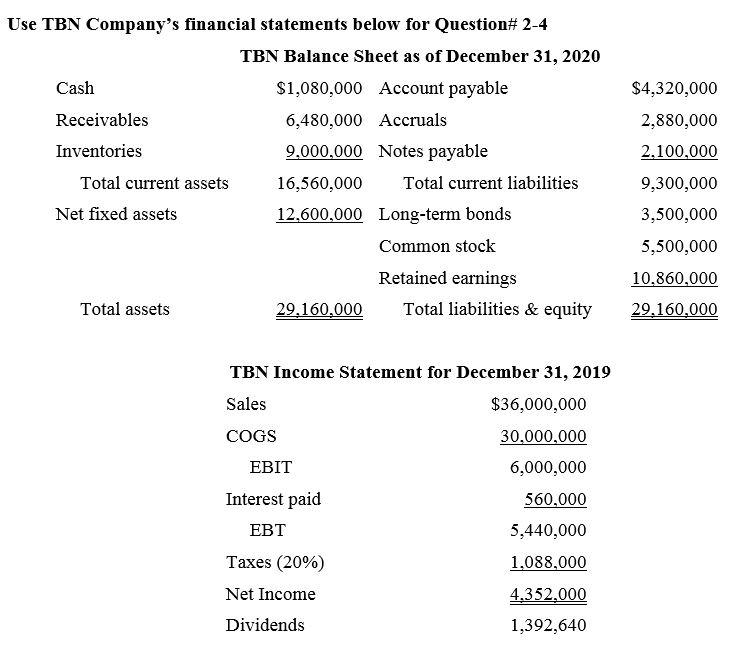

Use TBN Companys financial statements below for Question# 2-4 2. (4 points) Du Pont equation and analysis of the TBN Company . 2A) Show ROE

Use TBN Companys financial statements below for Question# 2-4

2. (4 points) Du Pont equation and analysis of the TBN Company.

2A) Show ROE Calculation using Du Pont equation.

ROE = net profit margin x total asset turnover x equity multiplier

ROEFirm X = 15.00% x 2.43 times x 1.50 times = 54.67%

2B) Explain what area(s) and how does the company improve to compete with its competitor, Firm X.

3. (4 points) Calculate Cash Conversion Cycle of the TBN Company in year 2020 and compare with Industry Average, given below. Use 365-day per year.

3A) Calculate Cash Conversion Cycle

CCC = inventory conversion period + DSO - payable deferral period

CCCIndustry = 95 days + 40 days - 50 days = 85 days

3B) Explain what area(s) and how does the company improve its CCC when compare with industry average.

4. (3 points) Use AFN formula. Suppose next year sales (year 2021E) will increase by 18.00% over current year sales. Assume TBN is operating at full capacity during the current year. The company will maintain its dividend payout policy, and net profit margin ratio. Calculate the additional funds needed for TBN Company. Show your calculation in details.

Use TBN Company's financial statements below for Question# 2-4 TBN Balance Sheet as of December 31, 2020 Cash $1,080,000 Account payable Receivables 6,480,000 Accruals Inventories 9,000,000 Notes payable Total current assets 16,560,000 Total current liabilities Net fixed assets 12,600,000 Long-term bonds Common stock Retained earnings Total assets 29,160,000 Total liabilities & equity $4,320,000 2,880,000 2.100,000 9,300,000 3,500,000 5,500,000 10.860,000 29.160,000 TBN Income Statement for December 31, 2019 Sales $36,000,000 COGS 30,000,000 EBIT 6,000,000 560,000 5,440,000 Interest paid EBT Taxes (20%) Net Income Dividends 1,088,000 4,352,000 1,392,640 Use TBN Company's financial statements below for Question# 2-4 TBN Balance Sheet as of December 31, 2020 Cash $1,080,000 Account payable Receivables 6,480,000 Accruals Inventories 9,000,000 Notes payable Total current assets 16,560,000 Total current liabilities Net fixed assets 12,600,000 Long-term bonds Common stock Retained earnings Total assets 29,160,000 Total liabilities & equity $4,320,000 2,880,000 2.100,000 9,300,000 3,500,000 5,500,000 10.860,000 29.160,000 TBN Income Statement for December 31, 2019 Sales $36,000,000 COGS 30,000,000 EBIT 6,000,000 560,000 5,440,000 Interest paid EBT Taxes (20%) Net Income Dividends 1,088,000 4,352,000 1,392,640Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started