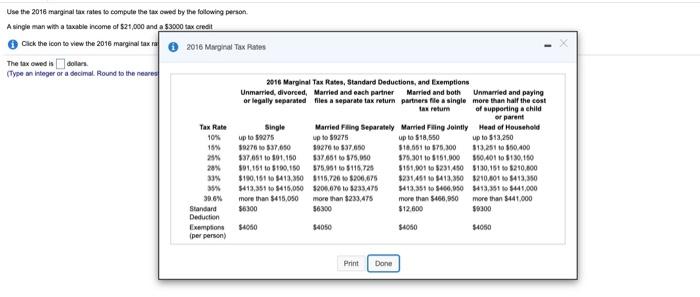

Use the 2016 marginal tax rates to compute the tax cwed by the following person A single man with a taxable income of $21,000 and a $3000 tax credit Click the icon to view the 2016 marginal taxa 2016 Marginal Tax Rates The tax swedis dolor (Type an integer or a decimal Round to the neares 2016 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried, divorced, Married and each partner Married and both Unmarried and paying or legally separated files a separate tax return partners file a single more than half the cost tax retum of supporting a child or parent Tax Rate Single Married Filing Separately Married Fring Jointly Head of Household 10% up to 3275 up to $9275 up to $18.00 up to $13,250 3927637,650 19270 10 537.00 318.661 to $75,300 313,25110 560.400 20 $37051 to 501.150 537461 to $75,000 $75.301 to $15.000 350.401 10 $130,150 20% $91,851 to $100,150 $7.961 to $115,728 5151,901 to 5231,450 $130,151 60 210,800 33% $190,161 40 5413,350 $115,726 to $200,675 $231451 10 5413,350 $210,01 $413,350 35% 5413,351 to $415,050 $201.676 10 1233,475 5413,351 to 5466,950 $493,35115445,000 39.6% more than $415.050 more than 1233,475 more than $400,950 more than $441.000 Standard $6300 56300 $12.600 $9300 Deduction Exemption $4050 54050 $4050 $4050 per person) 18% Print Done Use the 2016 marginal tax rates to compute the tax cwed by the following person A single man with a taxable income of $21,000 and a $3000 tax credit Click the icon to view the 2016 marginal taxa 2016 Marginal Tax Rates The tax swedis dolor (Type an integer or a decimal Round to the neares 2016 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried, divorced, Married and each partner Married and both Unmarried and paying or legally separated files a separate tax return partners file a single more than half the cost tax retum of supporting a child or parent Tax Rate Single Married Filing Separately Married Fring Jointly Head of Household 10% up to 3275 up to $9275 up to $18.00 up to $13,250 3927637,650 19270 10 537.00 318.661 to $75,300 313,25110 560.400 20 $37051 to 501.150 537461 to $75,000 $75.301 to $15.000 350.401 10 $130,150 20% $91,851 to $100,150 $7.961 to $115,728 5151,901 to 5231,450 $130,151 60 210,800 33% $190,161 40 5413,350 $115,726 to $200,675 $231451 10 5413,350 $210,01 $413,350 35% 5413,351 to $415,050 $201.676 10 1233,475 5413,351 to 5466,950 $493,35115445,000 39.6% more than $415.050 more than 1233,475 more than $400,950 more than $441.000 Standard $6300 56300 $12.600 $9300 Deduction Exemption $4050 54050 $4050 $4050 per person) 18% Print Done