Answered step by step

Verified Expert Solution

Question

1 Approved Answer

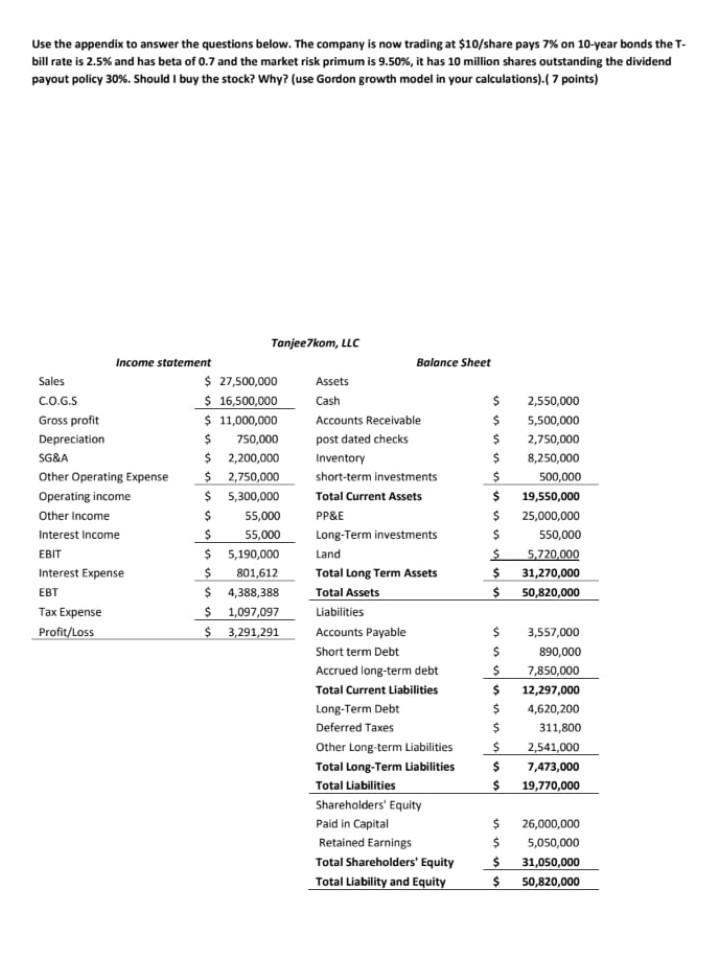

Use the appendix to answer the questions below. The company is now trading at $10/share pays 7% on 10-year bonds the T- bill rate

Use the appendix to answer the questions below. The company is now trading at $10/share pays 7% on 10-year bonds the T- bill rate is 2.5% and has beta of 0.7 and the market risk primum is 9.50%, it has 10 million shares outstanding the dividend payout policy 30%. Should I buy the stock? Why? (use Gordon growth model in your calculations).( 7 points) Sales C.O.G.S Gross profit Depreciation Income statement SG&A Other Operating Expense Operating income Other Income Interest Income EBIT Interest Expense EBT Tax Expense Profit/Loss Tanjee7kom, LLC $ 27,500,000 $ 16,500,000 $ 11,000,000 $ 750,000 $ 2,200,000 $ 2,750,000 $ 5,300,000 $ 55,000 55,000 $ $ 5,190,000 $ 801,612 $ 4,388,388 $ 1,097,097 $ 3,291,291 Balance Sheet Assets Cash Accounts Receivable post dated checks Inventory short-term investments Total Current Assets PP&E Long-Term investments Land Total Long Term Assets Total Assets Liabilities Accounts Payable Short term Debt Accrued long-term debt Total Current Liabilities Long-Term Debt Deferred Taxes Other Long-term Liabilities Total Long-Term Liabilities Total Liabilities Shareholders' Equity Paid in Capital Retained Earnings Total Shareholders' Equity Total Liability and Equity $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 2,550,000 5,500,000 2,750,000 8,250,000 500,000 19,550,000 25,000,000 550,000 5,720,000 31,270,000 50,820,000 3,557,000 890,000 7,850,000 12,297,000 4,620,200 311,800 2,541,000 7,473,000 19,770,000 $ 26,000,000 $ 5,050,000 $ 31,050,000 $ 50,820,000

Step by Step Solution

★★★★★

3.32 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The Gordon Growth Model is a model used to calculate the intrinsic value of a stock The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started