Answered step by step

Verified Expert Solution

Question

1 Approved Answer

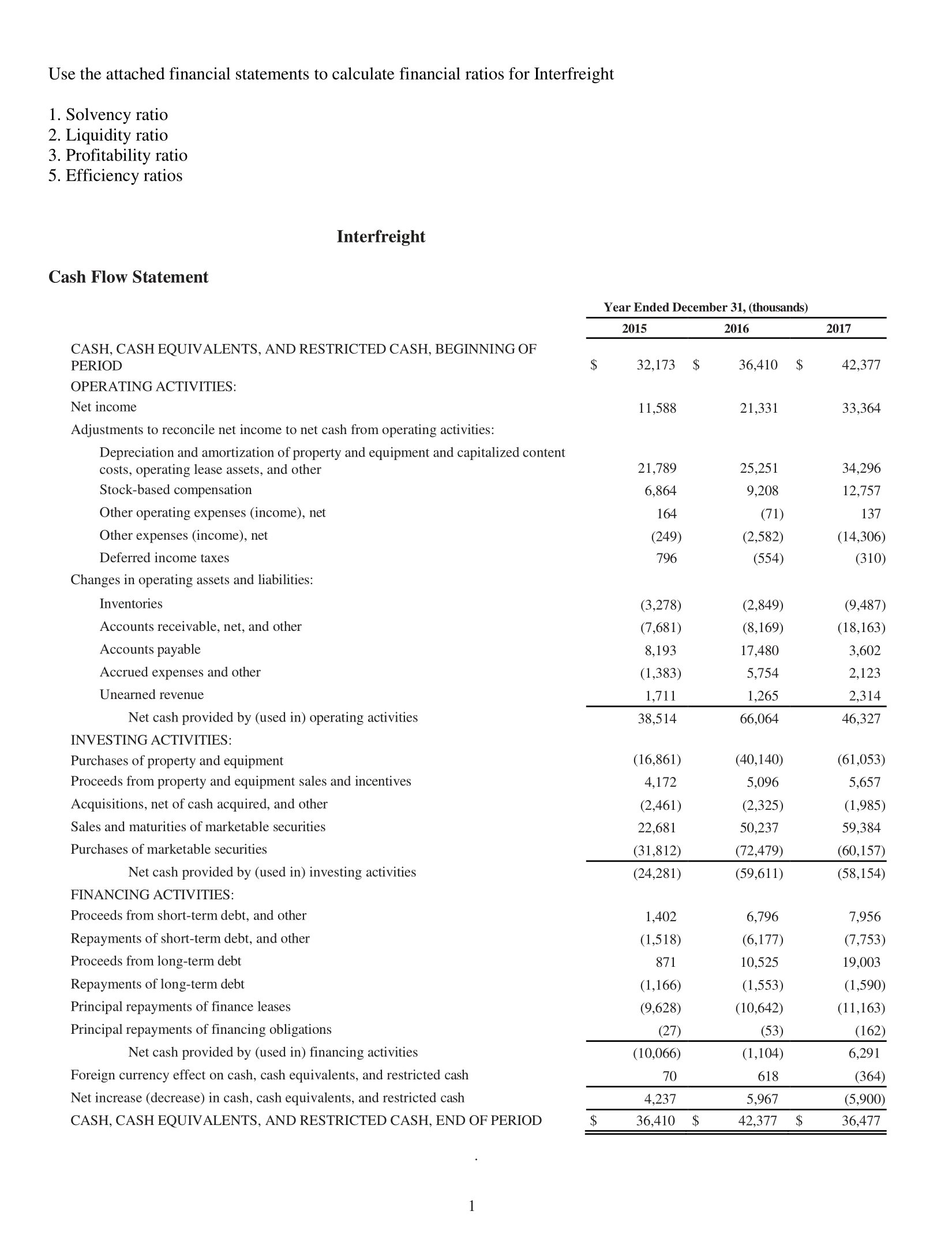

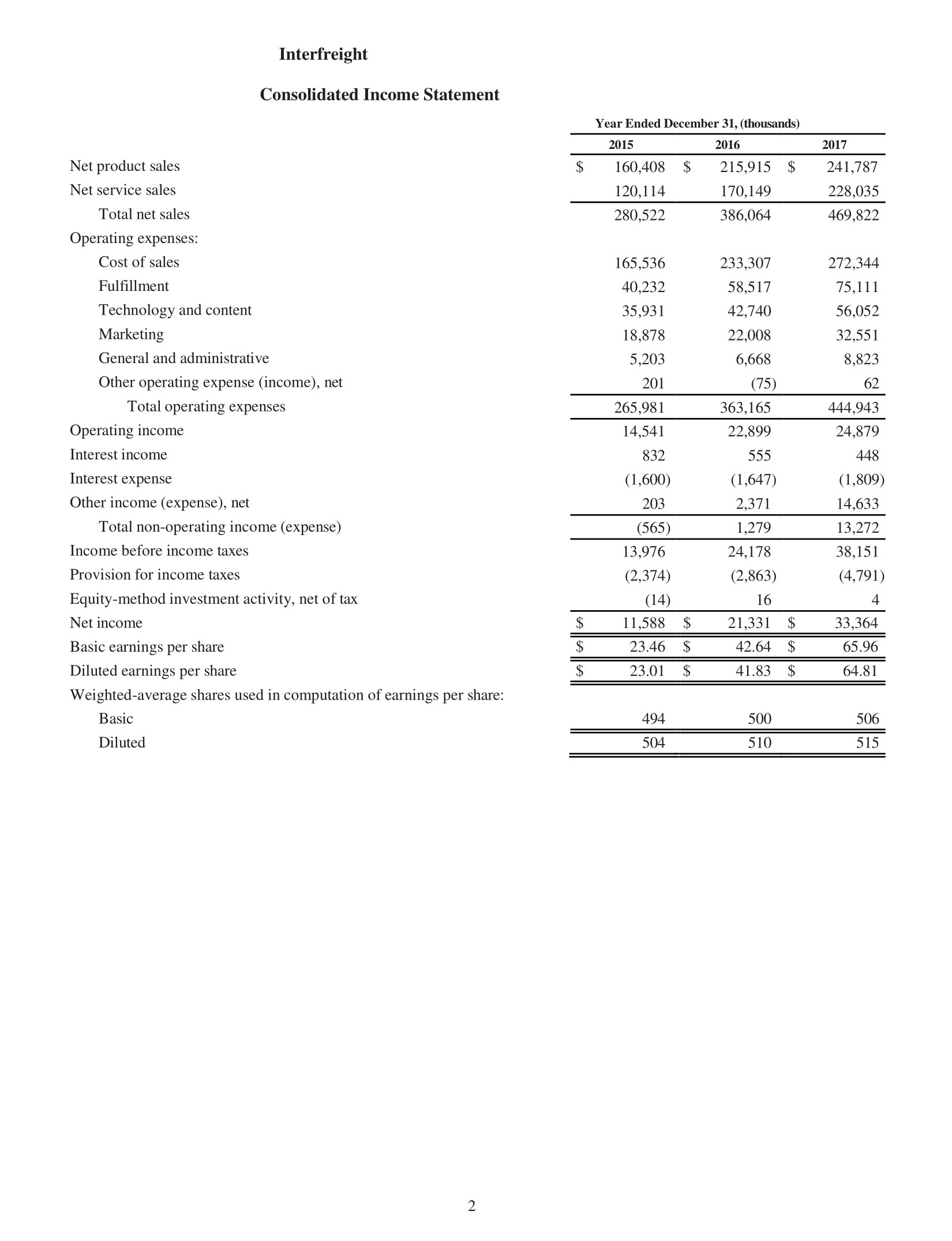

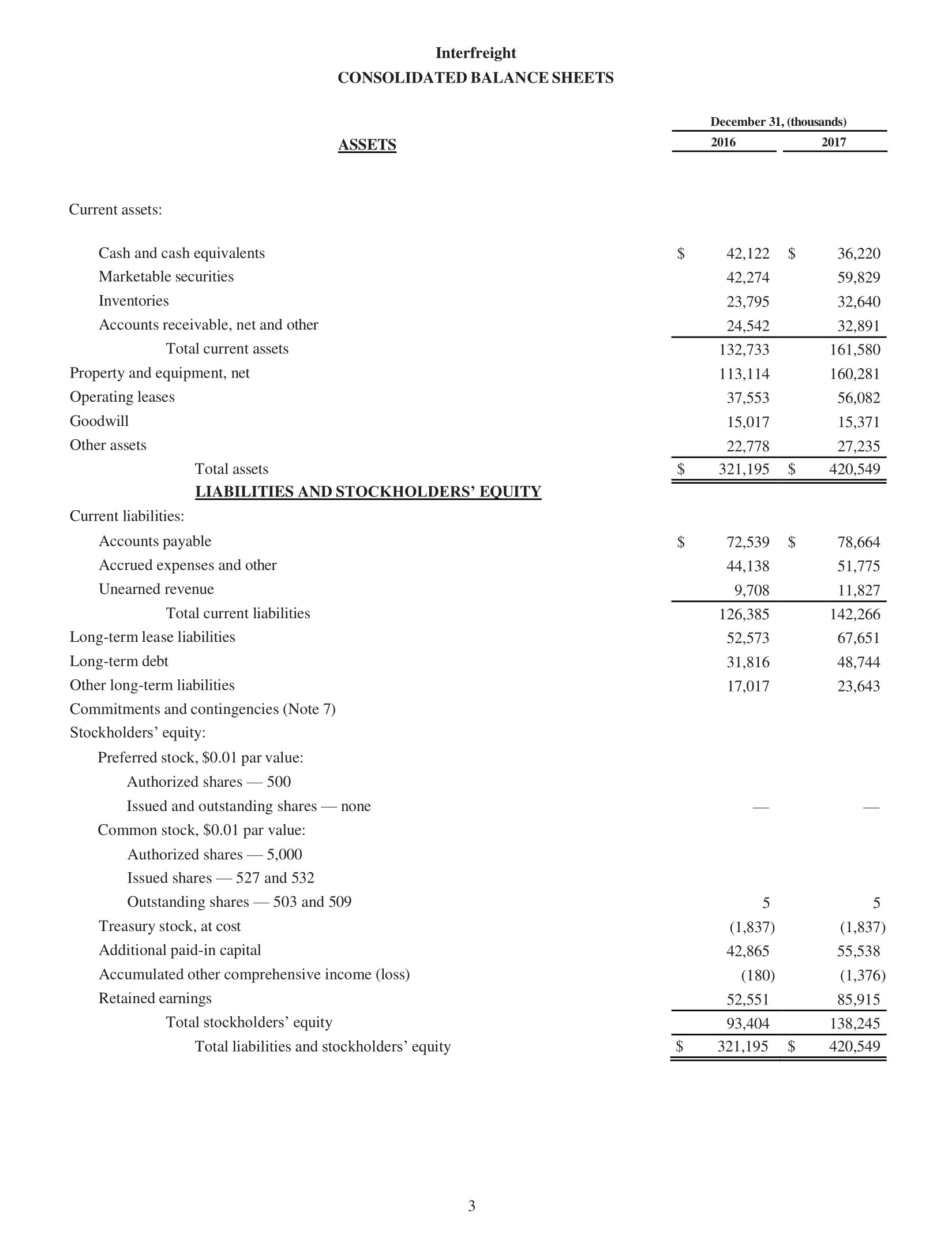

Use the attached financial statements to calculate financial ratios for Interfreight 1. Solvency ratio 2. Liquidity ratio 3. Profitability ratio 5. Efficiency ratios Use the

Use the attached financial statements to calculate financial ratios for Interfreight

1. Solvency ratio

2. Liquidity ratio

3. Profitability ratio

5. Efficiency ratios

Use the attached financial statements to calculate financial ratios for Interfreight 1. Solvency ratio 2. Liquidity ratio 3. Profitability ratio 5. Efficiency ratios Interfreight Interfreight Consolidated Income Statement Net product sales Net service sales Total net sales Operating expenses: Cost of sales Fulfillment Technology and content Marketing General and administrative Other operating expense (income), net Total operating expenses Operating income Interest income Interest expense Other income (expense), net Total non-operating income (expense) Income before income taxes Provision for income taxes Equity-method investment activity, net of tax Net income Basic earnings per share Diluted earnings per share Weighted-average shares used in computation of earnings per share: Basic Diluted \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{2}{|r|}{2015} & \multicolumn{2}{|c|}{2016} & \multicolumn{2}{|r|}{2017} \\ \hline$ & 160,408 & $ & 215,915 & $ & 241,787 \\ \hline & 120,114 & & 170,149 & & 228,035 \\ \hline & 280,522 & & 386,064 & & 469,822 \\ \hline & 165,536 & & 233,307 & & 272,344 \\ \hline & 40,232 & & 58,517 & & 75,111 \\ \hline & 35,931 & & 42,740 & & 56,052 \\ \hline & 18,878 & & 22,008 & & 32,551 \\ \hline & 5,203 & & 6,668 & & 8,823 \\ \hline & 201 & & (75) & & 62 \\ \hline & 265,981 & & 363,165 & & 444,943 \\ \hline & 14,541 & & 22,899 & & 24,879 \\ \hline & 832 & & 555 & & 448 \\ \hline & (1,600) & & (1,647) & & (1,809) \\ \hline & 203 & & 2,371 & & 14,633 \\ \hline & (565) & & 1,279 & & 13,272 \\ \hline & 13,976 & & 24,178 & & 38,151 \\ \hline & (2,374) & & (2,863) & & (4,791) \\ \hline & (14) & & 16 & & 4 \\ \hline$ & 11,588 & $ & 21,331 & $ & 33,364 \\ \hline$ & 23.46 & $ & 42.64 & $ & 65.96 \\ \hline$ & 23.01 & $ & 41.83 & $ & 64.81 \\ \hline & 494 & & 500 & & 506 \\ \hline & 504 & & 510 & & 515 \\ \hline \end{tabular} 2 Interfreight CONSOLIDATED BALANCE SHEETS ASSETS Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EOUITY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares - 500 Issued and outstanding shares - none Common stock, $0.01 par value: Authorized shares - 5,000 Issued shares - 527 and 532 Outstanding shares - 503 and 509 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity \begin{tabular}{l} December 31, (thousands) \\ \hline 2016 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{4}{*}{$} & 42,122 & $ & 36,220 \\ \hline & 42,274 & & 59,829 \\ \hline & 23,795 & & 32,640 \\ \hline & 24,542 & & 32,891 \\ \hline & 132,733 & & 161,580 \\ \hline & 113,114 & & 160,281 \\ \hline & 37,553 & & 56,082 \\ \hline & 15,017 & & 15,371 \\ \hline & 22,778 & & 27,235 \\ \hline$ & 321,195 & $ & 420,549 \\ \hline \end{tabular} \begin{tabular}{rrr} $2,539 & $ & 78,664 \\ 44,138 & & 51,775 \\ 9,708 & 11,827 \\ \hline 126,385 & 142,266 \\ 52,573 & 67,651 \\ 31,816 & 48,744 \\ 17,017 & 23,643 \end{tabular} 3

Use the attached financial statements to calculate financial ratios for Interfreight 1. Solvency ratio 2. Liquidity ratio 3. Profitability ratio 5. Efficiency ratios Interfreight Interfreight Consolidated Income Statement Net product sales Net service sales Total net sales Operating expenses: Cost of sales Fulfillment Technology and content Marketing General and administrative Other operating expense (income), net Total operating expenses Operating income Interest income Interest expense Other income (expense), net Total non-operating income (expense) Income before income taxes Provision for income taxes Equity-method investment activity, net of tax Net income Basic earnings per share Diluted earnings per share Weighted-average shares used in computation of earnings per share: Basic Diluted \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{2}{|r|}{2015} & \multicolumn{2}{|c|}{2016} & \multicolumn{2}{|r|}{2017} \\ \hline$ & 160,408 & $ & 215,915 & $ & 241,787 \\ \hline & 120,114 & & 170,149 & & 228,035 \\ \hline & 280,522 & & 386,064 & & 469,822 \\ \hline & 165,536 & & 233,307 & & 272,344 \\ \hline & 40,232 & & 58,517 & & 75,111 \\ \hline & 35,931 & & 42,740 & & 56,052 \\ \hline & 18,878 & & 22,008 & & 32,551 \\ \hline & 5,203 & & 6,668 & & 8,823 \\ \hline & 201 & & (75) & & 62 \\ \hline & 265,981 & & 363,165 & & 444,943 \\ \hline & 14,541 & & 22,899 & & 24,879 \\ \hline & 832 & & 555 & & 448 \\ \hline & (1,600) & & (1,647) & & (1,809) \\ \hline & 203 & & 2,371 & & 14,633 \\ \hline & (565) & & 1,279 & & 13,272 \\ \hline & 13,976 & & 24,178 & & 38,151 \\ \hline & (2,374) & & (2,863) & & (4,791) \\ \hline & (14) & & 16 & & 4 \\ \hline$ & 11,588 & $ & 21,331 & $ & 33,364 \\ \hline$ & 23.46 & $ & 42.64 & $ & 65.96 \\ \hline$ & 23.01 & $ & 41.83 & $ & 64.81 \\ \hline & 494 & & 500 & & 506 \\ \hline & 504 & & 510 & & 515 \\ \hline \end{tabular} 2 Interfreight CONSOLIDATED BALANCE SHEETS ASSETS Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EOUITY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares - 500 Issued and outstanding shares - none Common stock, $0.01 par value: Authorized shares - 5,000 Issued shares - 527 and 532 Outstanding shares - 503 and 509 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity \begin{tabular}{l} December 31, (thousands) \\ \hline 2016 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{4}{*}{$} & 42,122 & $ & 36,220 \\ \hline & 42,274 & & 59,829 \\ \hline & 23,795 & & 32,640 \\ \hline & 24,542 & & 32,891 \\ \hline & 132,733 & & 161,580 \\ \hline & 113,114 & & 160,281 \\ \hline & 37,553 & & 56,082 \\ \hline & 15,017 & & 15,371 \\ \hline & 22,778 & & 27,235 \\ \hline$ & 321,195 & $ & 420,549 \\ \hline \end{tabular} \begin{tabular}{rrr} $2,539 & $ & 78,664 \\ 44,138 & & 51,775 \\ 9,708 & 11,827 \\ \hline 126,385 & 142,266 \\ 52,573 & 67,651 \\ 31,816 & 48,744 \\ 17,017 & 23,643 \end{tabular} 3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started