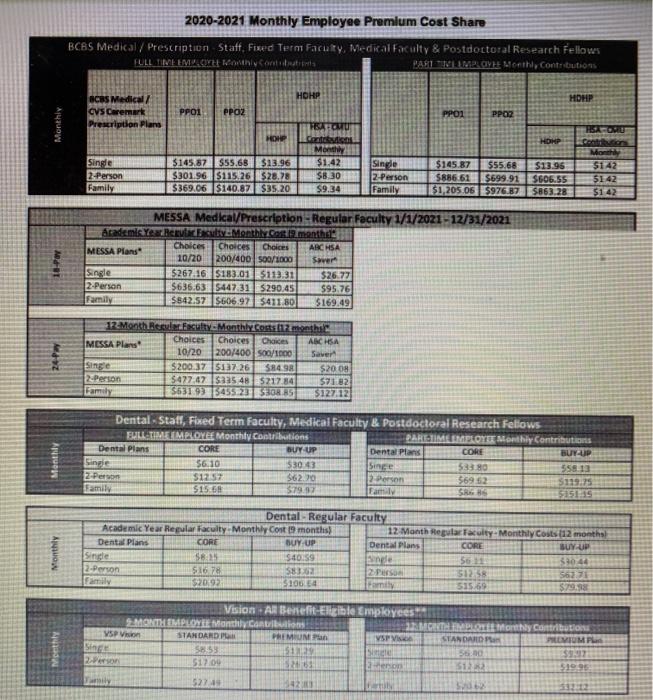

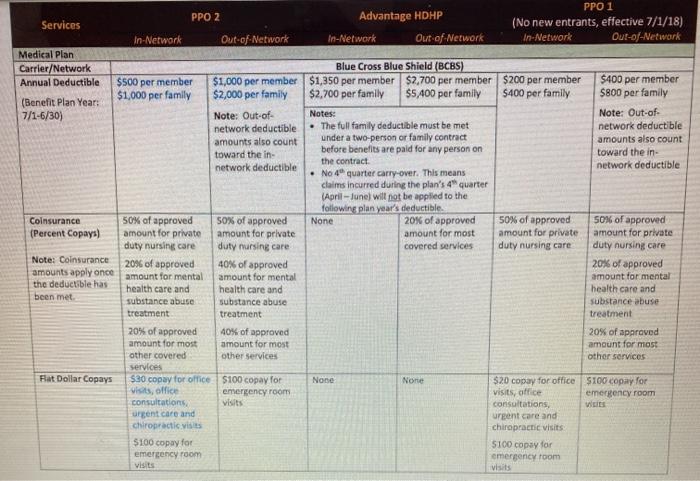

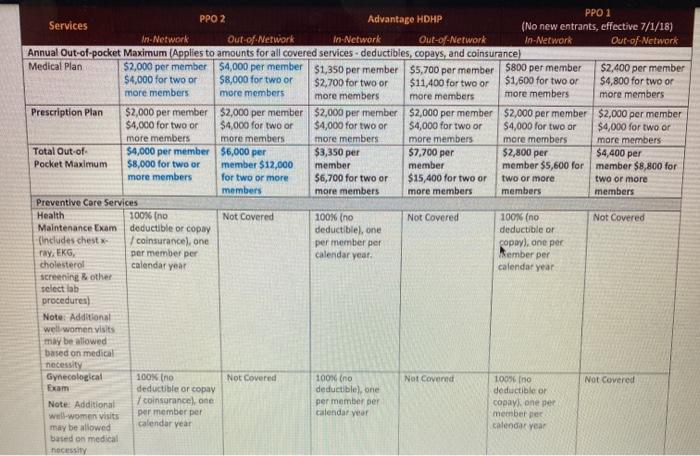

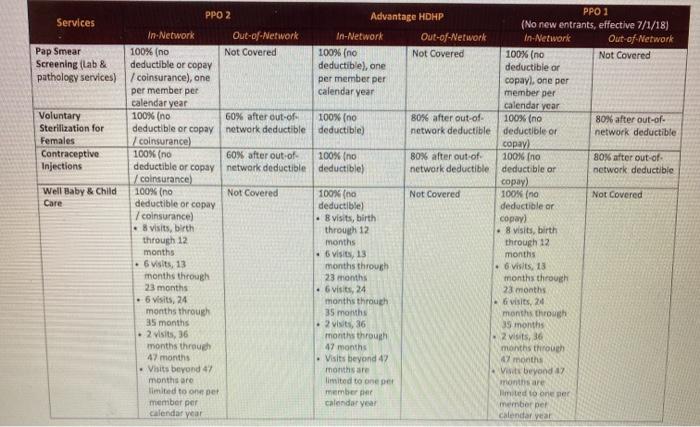

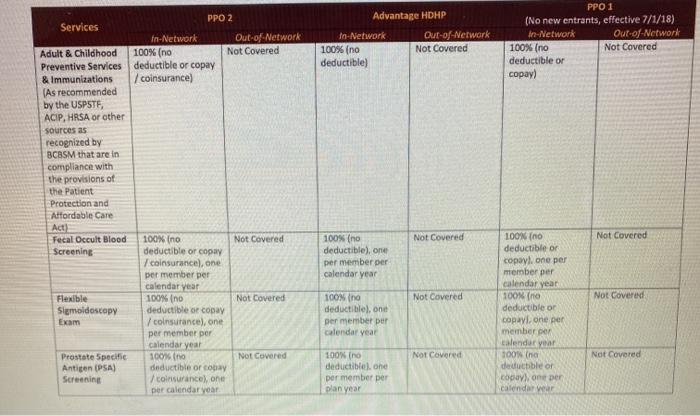

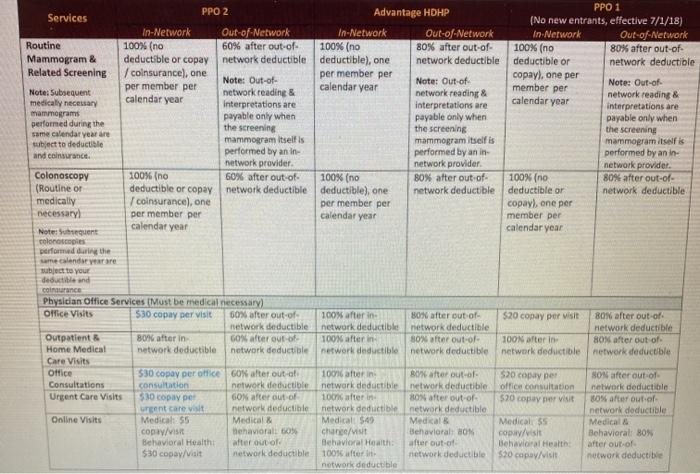

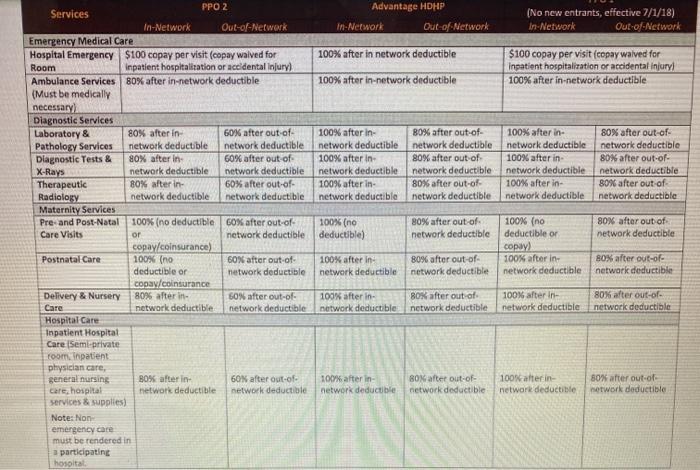

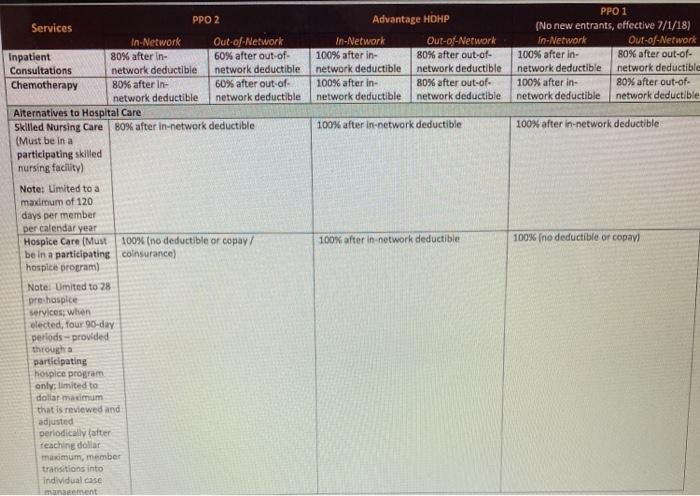

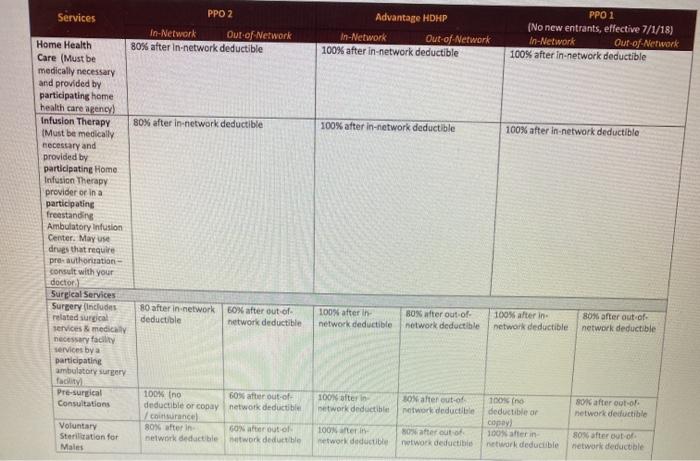

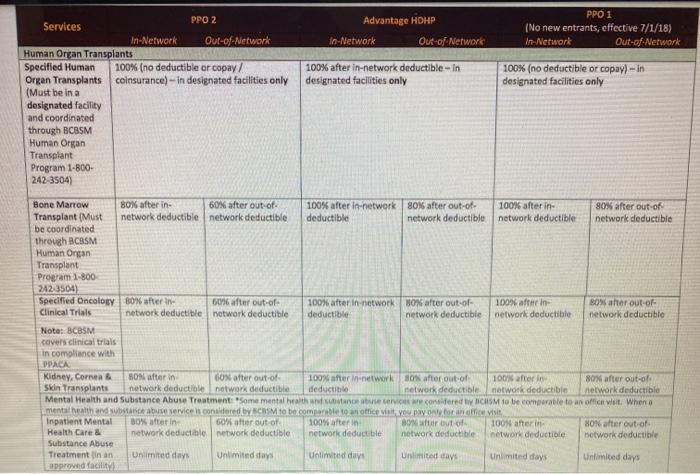

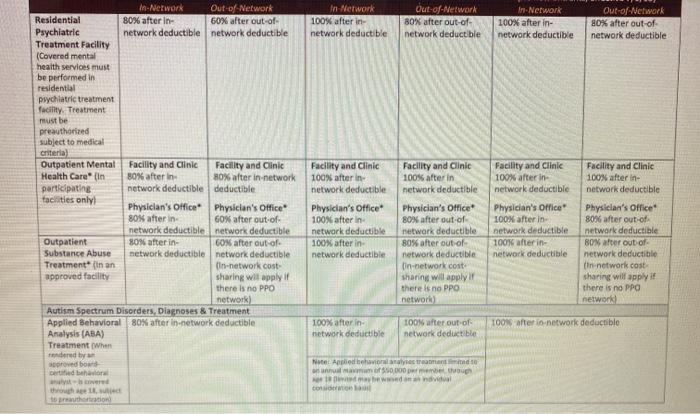

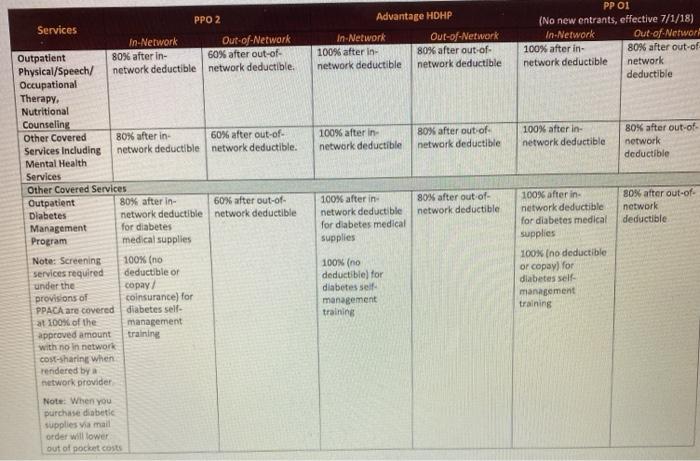

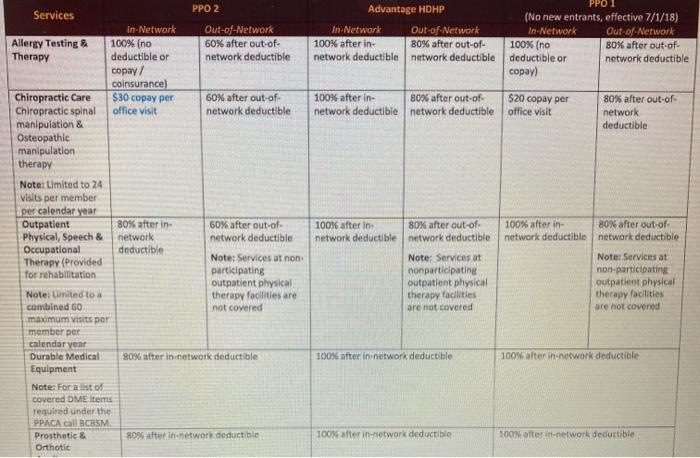

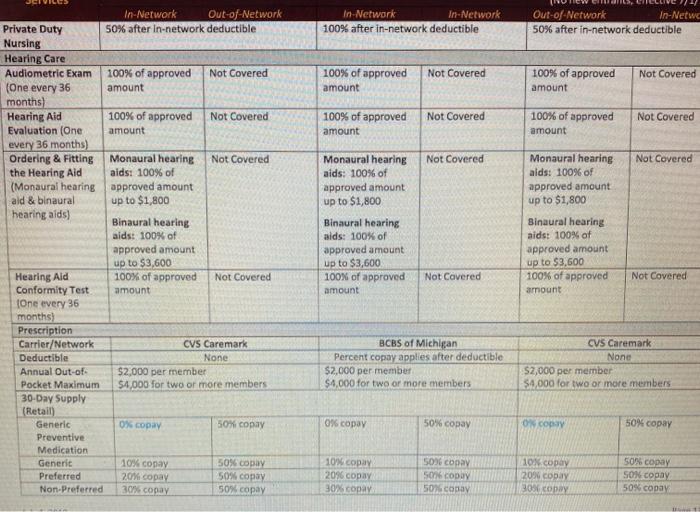

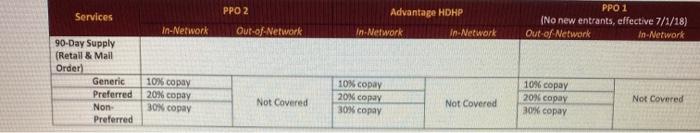

Use the attached sheets analyze the cost of insurance for a young family with an income of 60,000.00 and very little savings. Identify which of the Three health plans they should choose and why? Be sure to lake into account cash flow issues and the chance of a costly illness. Show the approximate cost under each plan and which one you recommend. PPO 1 PPO 2 Advantage HDHP Services (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out of Network In-Network Out-of-Network Medical Plan Carrier/Network Blue Cross Blue Shield (BCBS) Annual Deductible $500 per member $1,000 per member $1,350 per member $2,700 per member $200 per member $400 per member $1,000 per family $2,000 per family $2,700 per family $5.400 per family $400 per family $800 per family (Benefit Plan Year: 7/1-6/30) Note: Out-of- Notes: Note: Out of network deductible The full family deductible must be met network deductible amounts also count under a two-person or family contract amounts also count toward the in- before benefits are paid for any person on toward the in- the contract network deductible network deductible No 4 quarter carry-over. This means claims incurred during the plan's 4 quarter (April-June) will not be applied to the following plan year's deductible Coinsurance 50% of approved 50% of approved None 20% of approved 50% of approved 50% of approved (Percent Copays) amount for private amount for private amount for most amount for private amount for private duty nursing care duty nursing care covered services duty nursing care duty nursing care Note: Coinsurance 20% of approved 40% of approved 20% of approved amounts apply once amount for mental amount for mental amount for mental the deductible has health care and health care and health care and been met substance abuse substance abuse substance abuse treatment treatment treatment 20% of approved 40% of approved 20% of approved amount for most amount for most amount for most other covered other services other services services Fat Dollar Copays $30 copay for office $100 copay for None None $20 copay for office $100 copay for visits, office emergency room visits, office emergency room consultations visits consultations urgent care and urgent care and chiropractic visits chiropractic visits $100 copay for S100 copay for emergency room emergency room Visits visits PPO 1 PPO 2 Advantage HDHP Services (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network Annual Out-of-pocket Maximum (Applies to amounts for all covered services - deductibles, copays, and coinsurance) Medical Plan $2,000 per member 54,000 per member $1,350 per member $5,700 per member $800 per member $2.400 per member $4,000 for two or $8,000 for two or $2,700 for two or $11,400 for two or $1,600 for two or $4,800 for two or more members more members more members more members more members more members Prescription Plan $2,000 per member $2,000 per member $2,000 per member $2,000 per member $2,000 per member $2,000 per member $4,000 for two or $4,000 for two or $4,000 for two or $4,000 for two or $4,000 for two or $4,000 for two or more members more members more members more members more members more members Total Out-of- $4,000 per member $6,000 per $3,350 per $7,700 per $2,800 per $4,400 per Pocket Maximum $8,000 for two or member $12,000 member member member $5,600 for member $8,800 for more members for two or more $6,700 for two or $15,400 for two or two or more two or more members more members more members members members Preventive Care Services Health 100% (no Not Covered 100% (no Not Covered 100% (no Not Covered Maintenance Exam deductible or copay deductible), one deductible or (Includes chest 1 cainsurance, one per member per copay), one per ray, EKG, per member per calendar year Member per cholesterol calendar year calendar year screening other select lab procedures) Note: Additional well women visits may be allowed based on medical necessity Gynecological 100% (no Not Covered 100% (no Not Covernd 100% no Not Covered Exam deductible or copy deductible), one deductible or coinsurance one per member per copy one per Note: Additional per member per calendar year well-women visits member per may be allowed Calendar year calendar year based on medical nec Services Pap Smear Screening (Lab & pathology services) Voluntary Sterilization for Females Contraceptive Injections Well Baby & Child Care PPO 1 PPO 2 Advantage HDHP (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network 100% (no Not Covered 100% (no Not Covered 100% (no Not Covered deductible or copay deductible), one deductible or 7 coinsurance), one per member per copayl, one per per member per calendar year member per calendar year calendar year 100% (no 60% after out of 100% (no 80% after out-of- 100% (no 80% after out-of- deductible or copay network deductible deductible) network deductible deductible or network deductible colnsurance) ) 100% (no 60% after out of 100% (no 80% after out of 100% (no 80% after out of deductible or copay network deductible deductible) network deductible deductible or network deductible /coinsurance) copal 100% (no Not Covered 100% (no Not Covered 100% (na Not Covered deductible or copay deductible) deductible or 7 coinsurance) visits, birth copy) .visits, birth through 12 8 visits, birth through 12 months through 12 months 6 visits, 13 months 6 Waits, 13 months through 6 visits, 13 months through 23 months months through 23 months 6 visits, 24 23 months .6 visits, 24 months through 6 visits, 24 months through 35 months months through 35 months 2 visits, 36 39 months 2 visits, 36 months through 2 visits, 36 months through 47 months months through 47 months Visits beyond 42 47 months Visits beyond 47 months are Visit beyond months are limited to one per months are limited to one per member mited to one per member per calendar year member per calendar year Calendar year Services PPO 2 In-Network Out-of-Network 100% (no Not Covered deductible or copay 7 coinsurance) Advantage HDHP In-Network Out-of-Network 100% (no Not Covered deductible) PPO 1 (No new entrants, effective 7/1/18) in-Network Out-of-Network 100% (no Not Covered deductible or copay) Adult & Childhood Preventive Services & Immunizations (As recommended by the USPSTE, ACIP, HRSA or other sources as recognized by BCBSM that are in compliance with the provisions of the Patient Protection and Affordable Care Act) Fecal Occult Blood Screening Not Covered Not Covered 100% (no deductible), one per member per calendar year Not Covered Not Covered Flexible Sigmoidoscopy Exam 100% (no Not Covered deductible or copay 1 coinsurance, one per member per calendar year 100% (no Not Covered deductible of copy /coinsurance), one per member per calendar year 100% (no Not Covered deductible or coa /coinsurance on per calendar year 100% (no deductible), one per member per calendar year 100% (no deductible or copayl one per member per calendar year 100N (no deductible or copavlone per memberger calendar year 100% na deductible or copavone per Calendar Wear Not Covered Not Covered Prostate Specific Antigen (PSA) Screening 100% (no deductiblel.one per member per plan year PPO 1 PPO 2 Advantage HDHP Services (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network In Network Out-of-Network Routine 100% (no 60% after out-of- 100% (no 80% after out-of- 100% (no 80% after out-of- Mammogram & deductible or copay network deductible deductible), one network deductible deductible or network deductible Related Screening coinsurance), one per member per Note: Out-of- copay), one per Note: Out-of- calendar year per member per member per Note: Out-of- Note: Subsequent calendar year network reading & network reading & medically necessary network reading & calendar year Interpretations are interpretations are interpretations are mammograms payable only when payable only when payable only when performed during the the screening the screening the screening same calendar year are mammogram itself is mammogram itself is subject to deductible mammogram itself is and coinsurance performed by an in performed by an in- performed by an in network provider network provider network provider. Colonoscopy 100% (no 60% after out of 100% (no 80% after out of 100% (no 80% after out-of- (Routine or deductible or copay network deductible deductible), one network deductible deductible or network deductible medically coinsurance), one per member per copay), one per necessary per member per calendar year member per calendar year calendar year Note: Sunt loompies performed during the same clander yarare subject to your deductible and coingurance Physician Office Services (Must be medical necessary) Office Visits $30 copay per visit 60% after out-of- 100% after in B0% after out of $20 copay per visit 80% after out of network deductible network deductible network deductible network deductible Outpatient B0% after in GON after out of 100% after in 30% after out-of- 100N after in BON after out of Home Medical network deductible network deductible network deductible network deductible network deductible network deductible Care Visits Office 530 copay per office GO after out of 10016 after in after out of 520 copay per SON after out of Consultations consultation network deductible network deductible network deductible office consultation network deductible Urgent Care Visits 530 copaye GON after out of 100 after in BON after out of $20 copy nervist 80% after out of rent care network deductible network deductible network deductible network deductible Online Visits Medical 55 Medical Medical $49 Medals Medical $5 Medical copy/visit Behavioralt % chance/visit Behavioral HON co/Visit Behavioral: 80% Behavioral Health after out of Behavioral Health after out of Behavioral Health after out of $30 copy/Valt network deductible 10016 after it network deductible $20 copay visit network deductible network deductible Advantage HDHP In-Network Out of Network (No new entrants, effective 7/1/18) In-Network Out of Network 100% after in network deductible $100 copay per visit (copay walved for Inpatient hospitalization or accidental Injuryl 100% after in-network deductible 100% after in-network deductible 100% after in network deductible 100% after in network deductible 100% after in network deductible B0% after out-of- network deductible 80% after out of network deductible 80% after out-of- network deductible 100% after in network deductible 100% after in network deductible 100% after in network deductible 80% after out-of- network deductible 80% after out-of- network deductible 80% after out of network deductible PPO 2 Services In-Network Out-of-Network Emergency Medical Care Hospital Emergency $100 copay per visit (copay waived for Room Inpatient hospitalitation or accidental Injury) Ambulance Services 80% after in-network deductible (Must be medically necessary) Diagnostic Services Laboratory & 80% after in 60% after out of Pathology Services network deductible network deductible Diagnostic Tests & 80% after in 60% after out of X-Rays network deductible network deductible Therapeutic 80% after in 60% after out of Radiology network deductible network deductible Maternity Services Pre- and Post-Natal 100% (no deductible 60% after out-of- Care Visits or network deductible copay/coinsurance) Postnatal Care 100% (no 60% after out-of- deductible or network deductible copa/coinsurance Delivery & Nursery 80% after in 60% after out-of- Care network deductible network deductible Hospital Care Inpatient Hospital Care Semi-private room in patient physician care, general nursing B0% after in 60% after out-of- care hospital network deductible network deductible Services & supplies) Note: Non emergency care must be rendered in 1 participating hospital 100% (no deductible) 80% after out of network deductible 80% after out of network deductible 100% (no deductible or ) 100% after in network deductible 100% after in network deductible 80% after out of network deductible 80% after out of network deductible 100% after in network deductible 80% after out of network deductible 100% after in network deductible 80% after out of network deductible 100% after in network deductible BON after out-of- network deductible 100Mater in network deductible 80% after out of network deductible PPO 1 Advantage HDHP (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network 100% after in 80% after out-of- 100% after in- 80% after out-of- network deductible network deductible network deductible network deductible 100% after in- 80% after out-of- 100% after in- 80% after out-of- network deductible network deductible network deductible network deductible 100% after in.network deductible 100% after in-network deductible 100% after in-network deductible 100% (no deductible or copay) PPO 2 Services In-Network Out-of-Network Inpatient 80% after in 60% after out of Consultations network deductible network deductible Chemotherapy 80% after in 60% after out of network deductible network deductible Alternatives to Hospital Care Skilled Nursing Care 80% after in-network deductible (Must be in a participating skilled nursing facility) Note: Limited to a maximum of 120 days per member per calendar year Hospice Care (Must 100% (no deductible or copay/ be in a participating coinsurance) hospice program Note: Umited to 28 pre hospice Services when elected, four 90-day periods provided through participating hospice program only limited to dollar maximum that is reviewed and adjusted periodically after Teaching dollar maximum, member transitions into individual case management Advantage HDHP In-Network Out-of-Network 100% after in-network deductible PPO 1 (No new entrants, effective 7/1/18) In-Network Our of Network 100% after in-network deductible 100% after in-network deductible 100% after in-network deductible PPO 2 Services In-Network Out of Network Home Health 80% after in-network deductible Care (Must be medically necessary and provided by participating home health care agency! Infusion Therapy 80% after in-network deductible (Must be medically necessary and provided by participating Home Infusion Therapy provider orina participating freestanding Ambulatory Infusion Center. May use drugs that require pre authorization consult with your doctor Surgical Services Surgery (Includes 80 after in network 50% after out of related surgical deductible network deductible services & medical necessary facility services by a participating ambulatory surgery facility Pre-surgical 100% no 60% after out of Consultations deductible or copy network deductible I coinsurancel Voluntary 80% after in GON atter out of Sterilization for betwork deductible twork deductible Males 100% after in network deductible B0% after out of network deductible 100% alter in network deductible BON after out of network deductible 100N after in network deductible BON after out of network deductible 80% after oot-o! network deductible 100 na deductible or copal 100terin network deductible 100% after in network deductible after out of network deductible 80% after out of network deducible Advantage HDHP PPO 1 (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out of Network 100% after in-network deductible-In designated facilities only 100% (no deductible or copy) - in designated facilities only Services PPO 2 In-Network Out-of-Network Human Organ Transplants Specified Human 100% (no deductible or copay Organ Transplants coinsurance) - in designated facilities only (Must be in a designated facility and coordinated through BCBSM Human Organ Transplant Program 1-800- 242-3504) Bone Marrow 80% after in 60% after out of 100% after in-network 80% after out-of- 100% after in 90% after out of Transplant (Must network deductible network deductible deductible network deductible network deductible network deductible be coordinated through BCBSM Human Organ Transplant Program 1-800 242 3504) Specified Oncology 80% after in 60% after out of 100% after in-network 30% after out-of- 100% after in B0% after out of Clinical Trials network deductible network deductible deductible network deductible network deductible network deductible Note: BCBSM covers clinical trials in compliance with Kidney, Cornea SON after in GON after out of 100% after network 10% after out of 100% after in So after out of Skin Transplants network deductible network deductible deductible network deductible network deductible network deductible Mental Health and Substance Abuse Treatment. Some mental health and service we considered CHSM to be comparable to an office wit. When mental health and substance abuse service is considered to be comparable to an office is you pay only for Inpatient Mental 30% after in 60% after out of 100% after in Bfter out of 100Nanterin HOW after out of Health Care network deductale network deductible network deductible network deductible network deductible network deductible Substance Abuse Treatment in an Unlimited days Unlimited day Unlimited days Unlimited days Unlimited days Unlimited days approved facility In Network 100% after in network deductible Out-of-Network 80% after out-of- network deductible In-Network 100% after in- network deductible Out-of-Network 80% after out of network deductible In-Network Out of Network Residential 80% after in 60% after out of Psychiatric network deductible network deductible Treatment Facility (Covered mental health services must be performed in residential psychiatric treatment facility Treatment must be preauthorized subject to medical criteria) Outpatient Mental Facility and Clinic Facility and Clinic Health Care" (in 80% after in 80% after in-network participating network deductible deductible facilities only) Physician's Office Physician's Office 80% after in 60% after out of network deductible network deductible Outpatient 80% after in 60% after out of Substance Abuse network deductible network deductible Treatment in an in-network cost approved facility sharing will apply it there is no PPO network) Autism Spectrum Disorders, Diagnoses & Treatment Applied Behavioral 80% after in network deductible Analysis (ABA) Treatment when dered by rovedbo berth Facility and Clinic 100% after in network deductible Physician's Office 100% after in network deductible 100% after in network deductible Facility and Clinic 100% after in network deductible Physician's Office 80% after out-of- network deductible 80% after out of network deductible tin-network cost sharing will apply there is no PPO network) Facility and Clinic 100% after in network deductible Physician's Office 100% after in network deductible 100% after in network deductible Facility and Clinic 100% after in network deductible Physician's Office 80% after out of network deductible 80% after out of network deductible (in network cost sharing will apply if there is no PPO network 100% after lo-network deductible 100% after in network deductible LOON after out of network deductible Nedavilystreamento su me po sendal to throw automation Advantage HDHP In-Network Out-of-Network 100% after in 80% after outof- network deductible network deductible PP OI (No new entrants, effective 7/1/18) In-Network Out-of Networ 100% after in 80% after out of network deductible network deductible 100% after in network deductible 80% after out of network deductible 100% after in- network deductible 80% after out of network deductible 80% after out of network deductible PPO 2 Services In-Network Out-of-Network Outpatient 80% after in- 60% after out-of- Physical/Speech/ network deductible network deductible Occupational Therapy, Nutritional Counseling Other Covered 80% after in 60% after out-of- Services including network deductible network deductible. Mental Health Services Other Covered Services Outpatient 80% after in 60% after out-of- Diabetes network deductible network deductible Management for diabetes Program medical supplies Note: Screening 100% (no services required deductible or under the copay/ provisions of coinsurance) for PPACA are covered diabetes self- at 100% of the management approved amount training with no In network Cost-sharing when rendered by network provider Note: When you purchase diabetic supplies via mail order will lower out of pocket costs 80% after out-of- network deductible 100% after in network deductible for diabetes medical supplies 100% after in network deductible for diabetes medical supplies 100% (no deductible or copay) for diabetes self- management training 100% (no deductible) for diabetes selle management training Advantage HDHP In Network Out-of-Network 100% after in 80% after out-of- network deductible network deductible (No new entrants, effective 7/1/18) In-Network Out-of-Network 100% (no 80% after out-of- deductible or network deductible ) ) 100% after in- 80% after out of network deductible network deductible $20 copay per office visit 80% after out-of- network deductible PPO 2 Services In-Network Out-of-Network Allergy Testing & 100% (no 60% after out of Therapy deductible or network deductible copay/ coinsurance) Chiropractic Care $30 copay per 60% after out-of- Chiropractic spinal office visit network deductible manipulation & Osteopathic manipulation therapy Notat Limited to 24 Visits per member per calendar year Outpatient 80% after in 60% after out-of- Physical, Speech & network network deductible Occupational deductible Note: Services at non Therapy (Provided for rehabilitation participating outpatient physical Note: Limited to a therapy facilities are combined 60 not covered maximum visits per member per calendar year Durable Medical 80% after in network deductible Equipment Note: Forsist of covered DME Items required under the OPACA call BCBSM Prosthetic & 80% after in network deductible Orthotic 100% after in 80% after out of network deductible network deductible 100% after in 80% after out-of- network deductible network deductible Note: Services at nonparticipating outpatient physical therapy facilities are not covered Note: Services at non participating outpatient physical therapy facilities are not covered 100% after in-network deducible 100% after in-network deductible 100% after in-network deductible 100% after in-network deductible In-Network In-Network 100% after in-network deductible Out-of-Network In-Netwc 50% after in-network deductible Not Covered Not Covered 100% of approved amount 100% of approved amount 100% of approved Not Covered 100% of approved amount Not Covered amount Not Covered Not Covered In-Network Out-of-Network Private Duty 50% after In-network deductible Nursing Hearing Care Audiometric Exam 100% of approved Not Covered (One every 36 amount months) Hearing Aid 100% of approved Not Covered Evaluation (One amount every 36 months) Ordering & Fitting Monaural hearing Not Covered the Hearing Aid aids: 100% of (Monaural hearing approved amount ald & binaural up to $1,800 hearing aids) Binaural hearing aids: 100% of approved amount up to $3,600 Hearing Ald 100% of approved Not Covered Conformity Test amount One every 36 months) Prescription Carrier/Network CVS Caremark Deductible None Annual Out-of- $2,000 per member Pocket Maximum $4,000 for two or more members 30-Day Supply (Retail) Generic 0% copa 50% copay Preventive Medication Generit 10% copay 50% copy Preferred 20% copay 50% copy Non-Preferred 30% copy 50% copy Monaural hearing aids: 100% of approved amount up to $1,800 Binaural hearing alds: 100% of approved amount up to $3,600 100% of approved amount Monaural hearing alds: 100% of approved amount up to $1,800 Binaural hearing aids: 100% of approved amount up to $3,600 100% of approved amount Not Covered Not Covered BCBS of Michigan Percent copay applies after deductible $2,000 per member $4,000 for two or more members CVS Caremark None $2,000 per member $4,000 for two or more members 0% copy 50% copay O copy 50% copay 10% copy 20% copay 30% copy SOS copy 56 CODY 50 con 10 copy 20% copy 303 copy 50% copy SON copay 50% copay Services PPO2 Advantage HDHP PPO 1 (No new entrants, effective 7/1/18) Out of Network In-Network In-Network Out-of-Network In-Network In-Network 90-Day Supply (Retail & Mail Order) Generic Preferred Non Preferred 10% copay 20% copy 30% copy 10% copay 20% copy 30% copy 10% copay 20% copy 30% copy Not Covered Not Covered Not Covered Use the attached sheets analyze the cost of insurance for a young family with an income of 60,000.00 and very little savings. Identify which of the Three health plans they should choose and why? Be sure to lake into account cash flow issues and the chance of a costly illness. Show the approximate cost under each plan and which one you recommend. PPO 1 PPO 2 Advantage HDHP Services (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out of Network In-Network Out-of-Network Medical Plan Carrier/Network Blue Cross Blue Shield (BCBS) Annual Deductible $500 per member $1,000 per member $1,350 per member $2,700 per member $200 per member $400 per member $1,000 per family $2,000 per family $2,700 per family $5.400 per family $400 per family $800 per family (Benefit Plan Year: 7/1-6/30) Note: Out-of- Notes: Note: Out of network deductible The full family deductible must be met network deductible amounts also count under a two-person or family contract amounts also count toward the in- before benefits are paid for any person on toward the in- the contract network deductible network deductible No 4 quarter carry-over. This means claims incurred during the plan's 4 quarter (April-June) will not be applied to the following plan year's deductible Coinsurance 50% of approved 50% of approved None 20% of approved 50% of approved 50% of approved (Percent Copays) amount for private amount for private amount for most amount for private amount for private duty nursing care duty nursing care covered services duty nursing care duty nursing care Note: Coinsurance 20% of approved 40% of approved 20% of approved amounts apply once amount for mental amount for mental amount for mental the deductible has health care and health care and health care and been met substance abuse substance abuse substance abuse treatment treatment treatment 20% of approved 40% of approved 20% of approved amount for most amount for most amount for most other covered other services other services services Fat Dollar Copays $30 copay for office $100 copay for None None $20 copay for office $100 copay for visits, office emergency room visits, office emergency room consultations visits consultations urgent care and urgent care and chiropractic visits chiropractic visits $100 copay for S100 copay for emergency room emergency room Visits visits PPO 1 PPO 2 Advantage HDHP Services (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network Annual Out-of-pocket Maximum (Applies to amounts for all covered services - deductibles, copays, and coinsurance) Medical Plan $2,000 per member 54,000 per member $1,350 per member $5,700 per member $800 per member $2.400 per member $4,000 for two or $8,000 for two or $2,700 for two or $11,400 for two or $1,600 for two or $4,800 for two or more members more members more members more members more members more members Prescription Plan $2,000 per member $2,000 per member $2,000 per member $2,000 per member $2,000 per member $2,000 per member $4,000 for two or $4,000 for two or $4,000 for two or $4,000 for two or $4,000 for two or $4,000 for two or more members more members more members more members more members more members Total Out-of- $4,000 per member $6,000 per $3,350 per $7,700 per $2,800 per $4,400 per Pocket Maximum $8,000 for two or member $12,000 member member member $5,600 for member $8,800 for more members for two or more $6,700 for two or $15,400 for two or two or more two or more members more members more members members members Preventive Care Services Health 100% (no Not Covered 100% (no Not Covered 100% (no Not Covered Maintenance Exam deductible or copay deductible), one deductible or (Includes chest 1 cainsurance, one per member per copay), one per ray, EKG, per member per calendar year Member per cholesterol calendar year calendar year screening other select lab procedures) Note: Additional well women visits may be allowed based on medical necessity Gynecological 100% (no Not Covered 100% (no Not Covernd 100% no Not Covered Exam deductible or copy deductible), one deductible or coinsurance one per member per copy one per Note: Additional per member per calendar year well-women visits member per may be allowed Calendar year calendar year based on medical nec Services Pap Smear Screening (Lab & pathology services) Voluntary Sterilization for Females Contraceptive Injections Well Baby & Child Care PPO 1 PPO 2 Advantage HDHP (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network 100% (no Not Covered 100% (no Not Covered 100% (no Not Covered deductible or copay deductible), one deductible or 7 coinsurance), one per member per copayl, one per per member per calendar year member per calendar year calendar year 100% (no 60% after out of 100% (no 80% after out-of- 100% (no 80% after out-of- deductible or copay network deductible deductible) network deductible deductible or network deductible colnsurance) ) 100% (no 60% after out of 100% (no 80% after out of 100% (no 80% after out of deductible or copay network deductible deductible) network deductible deductible or network deductible /coinsurance) copal 100% (no Not Covered 100% (no Not Covered 100% (na Not Covered deductible or copay deductible) deductible or 7 coinsurance) visits, birth copy) .visits, birth through 12 8 visits, birth through 12 months through 12 months 6 visits, 13 months 6 Waits, 13 months through 6 visits, 13 months through 23 months months through 23 months 6 visits, 24 23 months .6 visits, 24 months through 6 visits, 24 months through 35 months months through 35 months 2 visits, 36 39 months 2 visits, 36 months through 2 visits, 36 months through 47 months months through 47 months Visits beyond 42 47 months Visits beyond 47 months are Visit beyond months are limited to one per months are limited to one per member mited to one per member per calendar year member per calendar year Calendar year Services PPO 2 In-Network Out-of-Network 100% (no Not Covered deductible or copay 7 coinsurance) Advantage HDHP In-Network Out-of-Network 100% (no Not Covered deductible) PPO 1 (No new entrants, effective 7/1/18) in-Network Out-of-Network 100% (no Not Covered deductible or copay) Adult & Childhood Preventive Services & Immunizations (As recommended by the USPSTE, ACIP, HRSA or other sources as recognized by BCBSM that are in compliance with the provisions of the Patient Protection and Affordable Care Act) Fecal Occult Blood Screening Not Covered Not Covered 100% (no deductible), one per member per calendar year Not Covered Not Covered Flexible Sigmoidoscopy Exam 100% (no Not Covered deductible or copay 1 coinsurance, one per member per calendar year 100% (no Not Covered deductible of copy /coinsurance), one per member per calendar year 100% (no Not Covered deductible or coa /coinsurance on per calendar year 100% (no deductible), one per member per calendar year 100% (no deductible or copayl one per member per calendar year 100N (no deductible or copavlone per memberger calendar year 100% na deductible or copavone per Calendar Wear Not Covered Not Covered Prostate Specific Antigen (PSA) Screening 100% (no deductiblel.one per member per plan year PPO 1 PPO 2 Advantage HDHP Services (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network In Network Out-of-Network Routine 100% (no 60% after out-of- 100% (no 80% after out-of- 100% (no 80% after out-of- Mammogram & deductible or copay network deductible deductible), one network deductible deductible or network deductible Related Screening coinsurance), one per member per Note: Out-of- copay), one per Note: Out-of- calendar year per member per member per Note: Out-of- Note: Subsequent calendar year network reading & network reading & medically necessary network reading & calendar year Interpretations are interpretations are interpretations are mammograms payable only when payable only when payable only when performed during the the screening the screening the screening same calendar year are mammogram itself is mammogram itself is subject to deductible mammogram itself is and coinsurance performed by an in performed by an in- performed by an in network provider network provider network provider. Colonoscopy 100% (no 60% after out of 100% (no 80% after out of 100% (no 80% after out-of- (Routine or deductible or copay network deductible deductible), one network deductible deductible or network deductible medically coinsurance), one per member per copay), one per necessary per member per calendar year member per calendar year calendar year Note: Sunt loompies performed during the same clander yarare subject to your deductible and coingurance Physician Office Services (Must be medical necessary) Office Visits $30 copay per visit 60% after out-of- 100% after in B0% after out of $20 copay per visit 80% after out of network deductible network deductible network deductible network deductible Outpatient B0% after in GON after out of 100% after in 30% after out-of- 100N after in BON after out of Home Medical network deductible network deductible network deductible network deductible network deductible network deductible Care Visits Office 530 copay per office GO after out of 10016 after in after out of 520 copay per SON after out of Consultations consultation network deductible network deductible network deductible office consultation network deductible Urgent Care Visits 530 copaye GON after out of 100 after in BON after out of $20 copy nervist 80% after out of rent care network deductible network deductible network deductible network deductible Online Visits Medical 55 Medical Medical $49 Medals Medical $5 Medical copy/visit Behavioralt % chance/visit Behavioral HON co/Visit Behavioral: 80% Behavioral Health after out of Behavioral Health after out of Behavioral Health after out of $30 copy/Valt network deductible 10016 after it network deductible $20 copay visit network deductible network deductible Advantage HDHP In-Network Out of Network (No new entrants, effective 7/1/18) In-Network Out of Network 100% after in network deductible $100 copay per visit (copay walved for Inpatient hospitalization or accidental Injuryl 100% after in-network deductible 100% after in-network deductible 100% after in network deductible 100% after in network deductible 100% after in network deductible B0% after out-of- network deductible 80% after out of network deductible 80% after out-of- network deductible 100% after in network deductible 100% after in network deductible 100% after in network deductible 80% after out-of- network deductible 80% after out-of- network deductible 80% after out of network deductible PPO 2 Services In-Network Out-of-Network Emergency Medical Care Hospital Emergency $100 copay per visit (copay waived for Room Inpatient hospitalitation or accidental Injury) Ambulance Services 80% after in-network deductible (Must be medically necessary) Diagnostic Services Laboratory & 80% after in 60% after out of Pathology Services network deductible network deductible Diagnostic Tests & 80% after in 60% after out of X-Rays network deductible network deductible Therapeutic 80% after in 60% after out of Radiology network deductible network deductible Maternity Services Pre- and Post-Natal 100% (no deductible 60% after out-of- Care Visits or network deductible copay/coinsurance) Postnatal Care 100% (no 60% after out-of- deductible or network deductible copa/coinsurance Delivery & Nursery 80% after in 60% after out-of- Care network deductible network deductible Hospital Care Inpatient Hospital Care Semi-private room in patient physician care, general nursing B0% after in 60% after out-of- care hospital network deductible network deductible Services & supplies) Note: Non emergency care must be rendered in 1 participating hospital 100% (no deductible) 80% after out of network deductible 80% after out of network deductible 100% (no deductible or ) 100% after in network deductible 100% after in network deductible 80% after out of network deductible 80% after out of network deductible 100% after in network deductible 80% after out of network deductible 100% after in network deductible 80% after out of network deductible 100% after in network deductible BON after out-of- network deductible 100Mater in network deductible 80% after out of network deductible PPO 1 Advantage HDHP (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out-of-Network 100% after in 80% after out-of- 100% after in- 80% after out-of- network deductible network deductible network deductible network deductible 100% after in- 80% after out-of- 100% after in- 80% after out-of- network deductible network deductible network deductible network deductible 100% after in.network deductible 100% after in-network deductible 100% after in-network deductible 100% (no deductible or copay) PPO 2 Services In-Network Out-of-Network Inpatient 80% after in 60% after out of Consultations network deductible network deductible Chemotherapy 80% after in 60% after out of network deductible network deductible Alternatives to Hospital Care Skilled Nursing Care 80% after in-network deductible (Must be in a participating skilled nursing facility) Note: Limited to a maximum of 120 days per member per calendar year Hospice Care (Must 100% (no deductible or copay/ be in a participating coinsurance) hospice program Note: Umited to 28 pre hospice Services when elected, four 90-day periods provided through participating hospice program only limited to dollar maximum that is reviewed and adjusted periodically after Teaching dollar maximum, member transitions into individual case management Advantage HDHP In-Network Out-of-Network 100% after in-network deductible PPO 1 (No new entrants, effective 7/1/18) In-Network Our of Network 100% after in-network deductible 100% after in-network deductible 100% after in-network deductible PPO 2 Services In-Network Out of Network Home Health 80% after in-network deductible Care (Must be medically necessary and provided by participating home health care agency! Infusion Therapy 80% after in-network deductible (Must be medically necessary and provided by participating Home Infusion Therapy provider orina participating freestanding Ambulatory Infusion Center. May use drugs that require pre authorization consult with your doctor Surgical Services Surgery (Includes 80 after in network 50% after out of related surgical deductible network deductible services & medical necessary facility services by a participating ambulatory surgery facility Pre-surgical 100% no 60% after out of Consultations deductible or copy network deductible I coinsurancel Voluntary 80% after in GON atter out of Sterilization for betwork deductible twork deductible Males 100% after in network deductible B0% after out of network deductible 100% alter in network deductible BON after out of network deductible 100N after in network deductible BON after out of network deductible 80% after oot-o! network deductible 100 na deductible or copal 100terin network deductible 100% after in network deductible after out of network deductible 80% after out of network deducible Advantage HDHP PPO 1 (No new entrants, effective 7/1/18) In-Network Out-of-Network In-Network Out of Network 100% after in-network deductible-In designated facilities only 100% (no deductible or copy) - in designated facilities only Services PPO 2 In-Network Out-of-Network Human Organ Transplants Specified Human 100% (no deductible or copay Organ Transplants coinsurance) - in designated facilities only (Must be in a designated facility and coordinated through BCBSM Human Organ Transplant Program 1-800- 242-3504) Bone Marrow 80% after in 60% after out of 100% after in-network 80% after out-of- 100% after in 90% after out of Transplant (Must network deductible network deductible deductible network deductible network deductible network deductible be coordinated through BCBSM Human Organ Transplant Program 1-800 242 3504) Specified Oncology 80% after in 60% after out of 100% after in-network 30% after out-of- 100% after in B0% after out of Clinical Trials network deductible network deductible deductible network deductible network deductible network deductible Note: BCBSM covers clinical trials in compliance with Kidney, Cornea SON after in GON after out of 100% after network 10% after out of 100% after in So after out of Skin Transplants network deductible network deductible deductible network deductible network deductible network deductible Mental Health and Substance Abuse Treatment. Some mental health and service we considered CHSM to be comparable to an office wit. When mental health and substance abuse service is considered to be comparable to an office is you pay only for Inpatient Mental 30% after in 60% after out of 100% after in Bfter out of 100Nanterin HOW after out of Health Care network deductale network deductible network deductible network deductible network deductible network deductible Substance Abuse Treatment in an Unlimited days Unlimited day Unlimited days Unlimited days Unlimited days Unlimited days approved facility In Network 100% after in network deductible Out-of-Network 80% after out-of- network deductible In-Network 100% after in- network deductible Out-of-Network 80% after out of network deductible In-Network Out of Network Residential 80% after in 60% after out of Psychiatric network deductible network deductible Treatment Facility (Covered mental health services must be performed in residential psychiatric treatment facility Treatment must be preauthorized subject to medical criteria) Outpatient Mental Facility and Clinic Facility and Clinic Health Care" (in 80% after in 80% after in-network participating network deductible deductible facilities only) Physician's Office Physician's Office 80% after in 60% after out of network deductible network deductible Outpatient 80% after in 60% after out of Substance Abuse network deductible network deductible Treatment in an in-network cost approved facility sharing will apply it there is no PPO network) Autism Spectrum Disorders, Diagnoses & Treatment Applied Behavioral 80% after in network deductible Analysis (ABA) Treatment when dered by rovedbo berth Facility and Clinic 100% after in network deductible Physician's Office 100% after in network deductible 100% after in network deductible Facility and Clinic 100% after in network deductible Physician's Office 80% after out-of- network deductible 80% after out of network deductible tin-network cost sharing will apply there is no PPO network) Facility and Clinic 100% after in network deductible Physician's Office 100% after in network deductible 100% after in network deductible Facility and Clinic 100% after in network deductible Physician's Office 80% after out of network deductible 80% after out of network deductible (in network cost sharing will apply if there is no PPO network 100% after lo-network deductible 100% after in network deductible LOON after out of network deductible Nedavilystreamento su me po sendal to throw automation Advantage HDHP In-Network Out-of-Network 100% after in 80% after outof- network deductible network deductible PP OI (No new entrants, effective 7/1/18) In-Network Out-of Networ 100% after in 80% after out of network deductible network deductible 100% after in network deductible 80% after out of network deductible 100% after in- network deductible 80% after out of network deductible 80% after out of network deductible PPO 2 Services In-Network Out-of-Network Outpatient 80% after in- 60% after out-of- Physical/Speech/ network deductible network deductible Occupational Therapy, Nutritional Counseling Other Covered 80% after in 60% after out-of- Services including network deductible network deductible. Mental Health Services Other Covered Services Outpatient 80% after in 60% after out-of- Diabetes network deductible network deductible Management for diabetes Program medical supplies Note: Screening 100% (no services required deductible or under the copay/ provisions of coinsurance) for PPACA are covered diabetes self- at 100% of the management approved amount training with no In network Cost-sharing when rendered by network provider Note: When you purchase diabetic supplies via mail order will lower out of pocket costs 80% after out-of- network deductible 100% after in network deductible for diabetes medical supplies 100% after in network deductible for diabetes medical supplies 100% (no deductible or copay) for diabetes self- management training 100% (no deductible) for diabetes selle management training Advantage HDHP In Network Out-of-Network 100% after in 80% after out-of- network deductible network deductible (No new entrants, effective 7/1/18) In-Network Out-of-Network 100% (no 80% after out-of- deductible or network deductible ) ) 100% after in- 80% after out of network deductible network deductible $20 copay per office visit 80% after out-of- network deductible PPO 2 Services In-Network Out-of-Network Allergy Testing & 100% (no 60% after out of Therapy deductible or network deductible copay/ coinsurance) Chiropractic Care $30 copay per 60% after out-of- Chiropractic spinal office visit network deductible manipulation & Osteopathic manipulation therapy Notat Limited to 24 Visits per member per calendar year Outpatient 80% after in 60% after out-of- Physical, Speech & network network deductible Occupational deductible Note: Services at non Therapy (Provided for rehabilitation participating outpatient physical Note: Limited to a therapy facilities are combined 60 not covered maximum visits per member per calendar year Durable Medical 80% after in network deductible Equipment Note: Forsist of covered DME Items required under the OPACA call BCBSM Prosthetic & 80% after in network deductible Orthotic 100% after in 80% after out of network deductible network deductible 100% after in 80% after out-of- network deductible network deductible Note: Services at nonparticipating outpatient physical therapy facilities are not covered Note: Services at non participating outpatient physical therapy facilities are not covered 100% after in-network deducible 100% after in-network deductible 100% after in-network deductible 100% after in-network deductible In-Network In-Network 100% after in-network deductible Out-of-Network In-Netwc 50% after in-network deductible Not Covered Not Covered 100% of approved amount 100% of approved amount 100% of approved Not Covered 100% of approved amount Not Covered amount Not Covered Not Covered In-Network Out-of-Network Private Duty 50% after In-network deductible Nursing Hearing Care Audiometric Exam 100% of approved Not Covered (One every 36 amount months) Hearing Aid 100% of approved Not Covered Evaluation (One amount every 36 months) Ordering & Fitting Monaural hearing Not Covered the Hearing Aid aids: 100% of (Monaural hearing approved amount ald & binaural up to $1,800 hearing aids) Binaural hearing aids: 100% of approved amount up to $3,600 Hearing Ald 100% of approved Not Covered Conformity Test amount One every 36 months) Prescription Carrier/Network CVS Caremark Deductible None Annual Out-of- $2,000 per member Pocket Maximum $4,000 for two or more members 30-Day Supply (Retail) Generic 0% copa 50% copay Preventive Medication Generit 10% copay 50% copy Preferred 20% copay 50% copy Non-Preferred 30% copy 50% copy Monaural hearing aids: 100% of approved amount up to $1,800 Binaural hearing alds: 100% of approved amount up to $3,600 100% of approved amount Monaural hearing alds: 100% of approved amount up to $1,800 Binaural hearing aids: 100% of approved amount up to $3,600 100% of approved amount Not Covered Not Covered BCBS of Michigan Percent copay applies after deductible $2,000 per member $4,000 for two or more members CVS Caremark None $2,000 per member $4,000 for two or more members 0% copy 50% copay O copy 50% copay 10% copy 20% copay 30% copy SOS copy 56 CODY 50 con 10 copy 20% copy 303 copy 50% copy SON copay 50% copay Services PPO2 Advantage HDHP PPO 1 (No new entrants, effective 7/1/18) Out of Network In-Network In-Network Out-of-Network In-Network In-Network 90-Day Supply (Retail & Mail Order) Generic Preferred Non Preferred 10% copay 20% copy 30% copy 10% copay 20% copy 30% copy 10% copay 20% copy 30% copy Not Covered Not Covered Not Covered