Question

Following are two years of income statements and balance sheets for the Munich Exports Corporation. A. Calculate the cash build, cash burn, and net cash

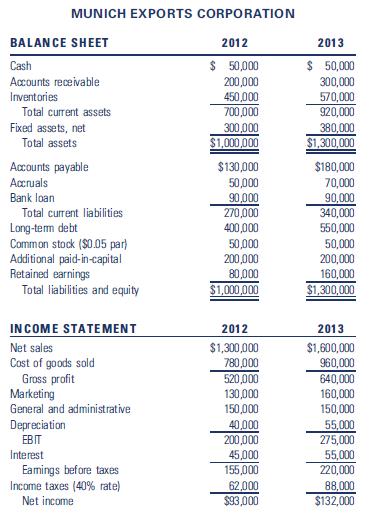

Following are two years of income statements and balance sheets for the Munich Exports Corporation.

A. Calculate the cash build, cash burn, and net cash burn or build for Munich Exports in 2013.

B. Assume that 2014 will be a repeat of 2013. If your answer in Part A resulted in a net cash burn position, calculate the net cash burn monthly rate and indicate the number of months remaining “until out of cash.” If your answer in Part A resulted in a net cash build position, calculate the net cash build monthly rate and indicate the expected cash balance at the end of 2014.

MUNICH EXPORTS CORPORATION BALANCE SHEET 2012 2013 Cash $ 50,000 $ 50,000 Accounts receivable Inventories 200,000 300,000 570,000 920,000 450,000 700,000 300,000 $1,000,000 Total current assets Fixed assets, net 380,000 Total assets $1,300,000 Acounts payable $130,000 50,000 90,000 270,000 $180,000 Accruals 70,000 90,000 340,000 550,000 50,000 200,000 160,000 $1,300,000 Bank loan Total current liabilities Long-term debt Common stock ($0.05 par) Additional paid-in-capital Retained earnings Total liabilities and equity 400,000 50,000 200,000 80,000 $1,000,000 INCOME STATEMENT 2012 2013 Net sales Cost of goods sold Gross profit Marketing $1,300,000 $1,600,000 960,000 780,000 520,000 130,000 150,000 640,000 160,000 150,000 General and administrative Depreciation 40,000 200,000 55,000 275,000 EBIT Interest 45,000 155,000 55,000 220,000 Eamings before taxes Income taxes (40% rate) 62,000 $93,000 88,000 $132,000 Net income

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 15 Ratio Analysis It measures the relationship between the two values or amount from the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d9b44db27f_177219.pdf

180 KBs PDF File

635d9b44db27f_177219.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started