Use the below inputs to Compute discounted net cash flow starting from the development period. development period production period Royalty Cost Recovery Exploration costs Tax

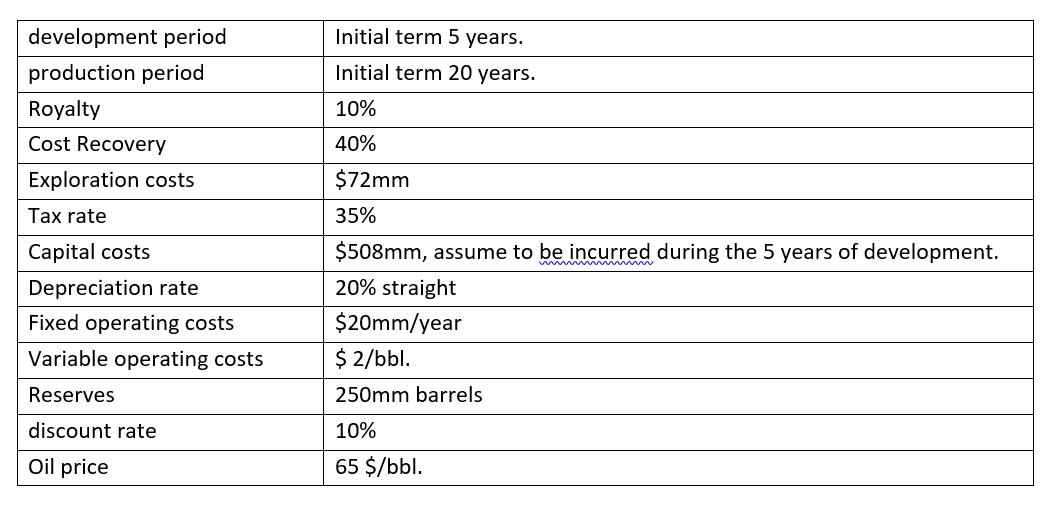

Use the below inputs to Compute discounted net cash flow starting from the development period.

Use the below inputs to Compute discounted net cash flow starting from the development period.

development period production period Royalty Cost Recovery Exploration costs Tax rate Capital costs Depreciation rate Fixed operating costs Variable operating costs Reserves discount rate Oil price Initial term 5 years. Initial term 20 years. 10% 40% $72mm 35% $508mm, assume to be incurred during the 5 years of development. 20% straight $20mm/year $ 2/bbl. 250mm barrels 10% 65 $/bbl.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Discounted Cash flow z Valuat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started