Answered step by step

Verified Expert Solution

Question

1 Approved Answer

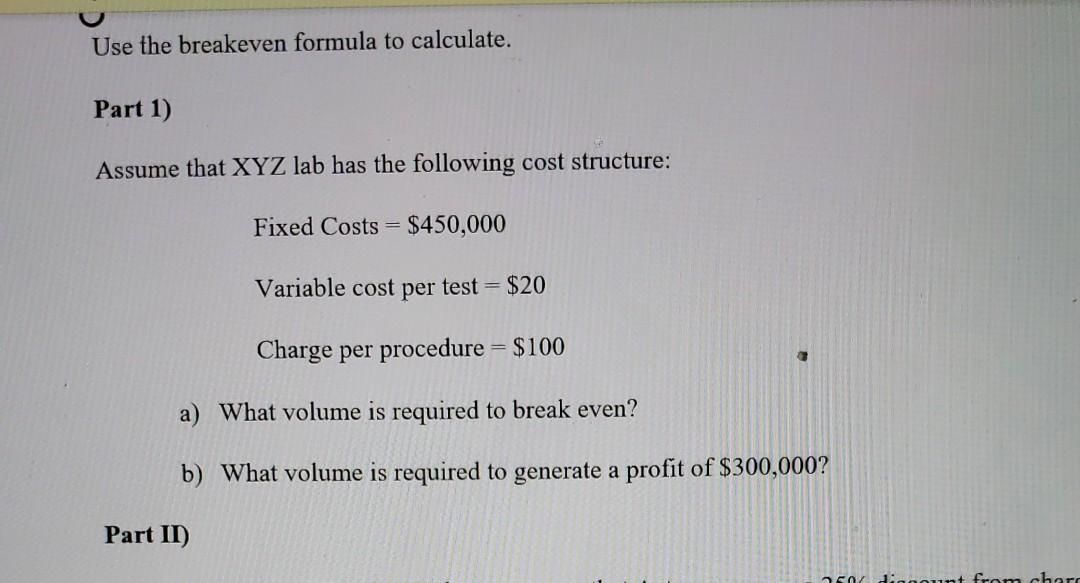

Use the breakeven formula to calculate. Part 1) Assume that XYZ lab has the following cost structure: Fixed Costs = $450,000 Variable cost per test

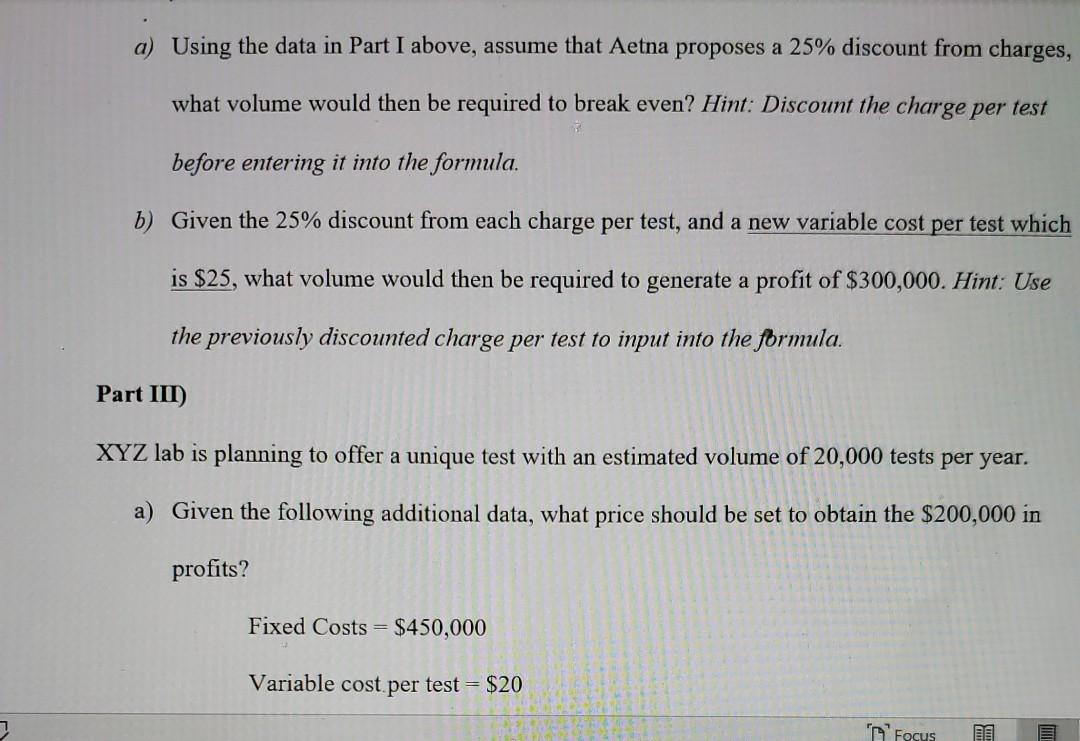

Use the breakeven formula to calculate. Part 1) Assume that XYZ lab has the following cost structure: Fixed Costs = $450,000 Variable cost per test = $20 Charge per procedure = $100 a) What volume is required to break even? b) What volume is required to generate a profit of $300,000? Part II) from bar a) Using the data in Part I above, assume that Aetna proposes a 25% discount from charges, what volume would then be required to break even? Hint: Discount the charge per test before entering it into the formula. b) Given the 25% discount from each charge per test, and a new variable cost per test which is $25, what volume would then be required to generate a profit of $300,000. Hint: Use the previously discounted charge per test to input into the formula. Part III) XYZ lab is planning to offer a unique test with an estimated volume of 20,000 tests per year. a) Given the following additional data, what price should be set to obtain the $200,000 in profits? Fixed Costs = $450,000 Variable cost per test = $20 'Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started