Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. a.) Using the Capital Asset Pricing Model (CAPM), calculate whether the actual historical return on the Dukes' equity portfolio has underperformed, outperformed, or matches

1. a.) Using the Capital Asset Pricing Model (CAPM), calculate whether the actual historical return on the Dukes' equity portfolio has underperformed, outperformed, or matches the expected return.n

1. a.) Using the Capital Asset Pricing Model (CAPM), calculate whether the actual historical return on the Dukes' equity portfolio has underperformed, outperformed, or matches the expected return.n

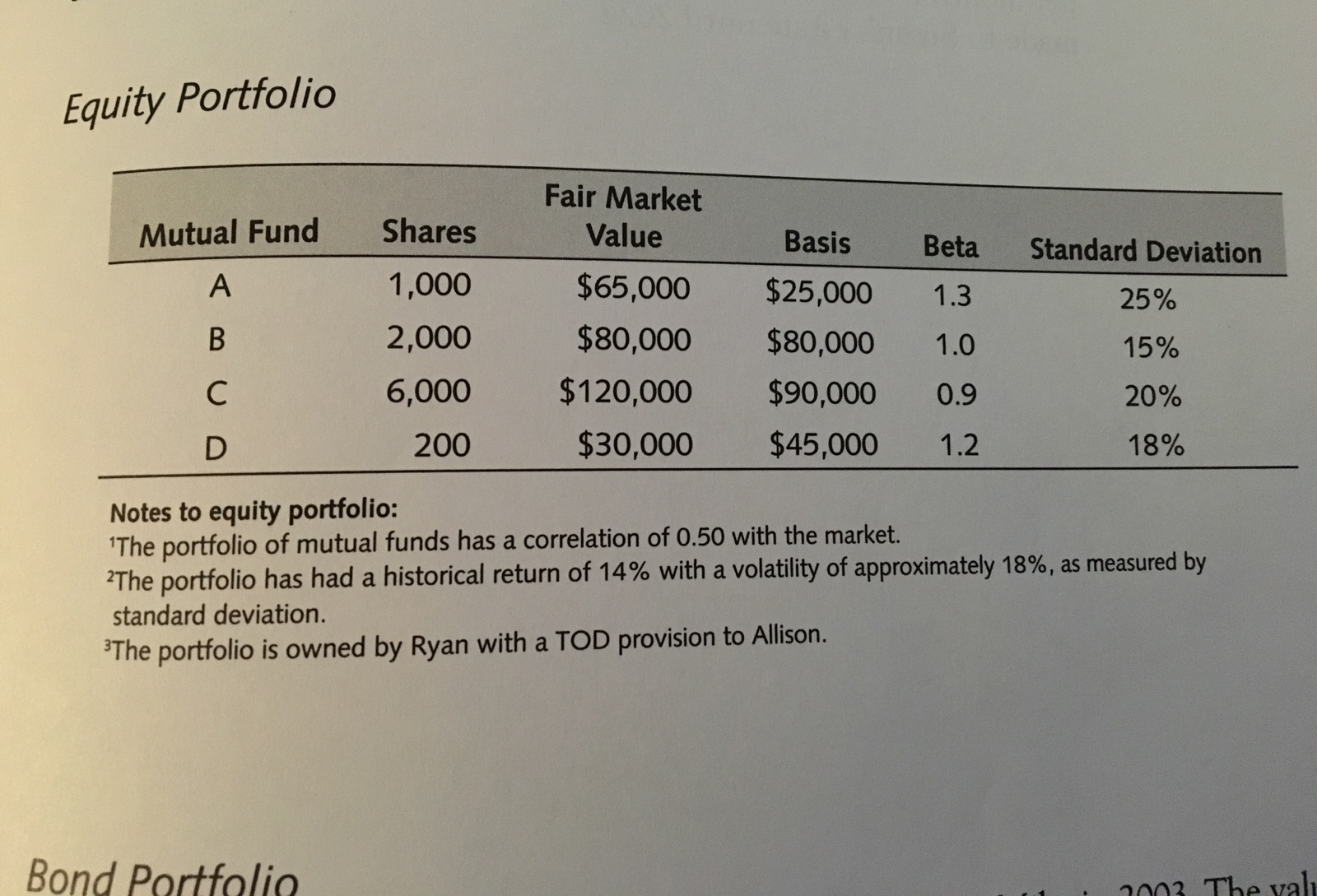

Equity Portfolio Mutual Fund A B D Shares 1,000 2,000 6,000 200 Bond Portfolio Fair Market Value $65,000 $80,000 $120,000 $30,000 Basis $25,000 $80,000 $90,000 $45,000 Beta Standard Deviation 1.3 1.0 0.9 1.2 25% 15% 20% 18% Notes to equity portfolio: The portfolio of mutual funds has a correlation of 0.50 with the market. 2The portfolio has had a historical return of 14% with a volatility of approximately 18%, as measured by standard deviation. The portfolio is owned by Ryan with a TOD provision to Allison. 2003 The valu Case 10 | Ryan and Allison Duke 137 Economic Information They expect inflation to average 4% over the long-term. The historical return on the market has been 12% and is expected to continue. The market has had a standard deviation of 14%, which is expected to continue. T-bills are currently yielding 3%, while T-bonds are yielding 4%.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The expected return on the portfolio is calculated based on the CAPM equation Re Rf beta Rm Rf Bet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started