Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the chart to complete. Danielle and John have obtained a $70,000 mortgage loan an annual interest rate of 6.00% for 30 years. What is

Use the chart to complete.

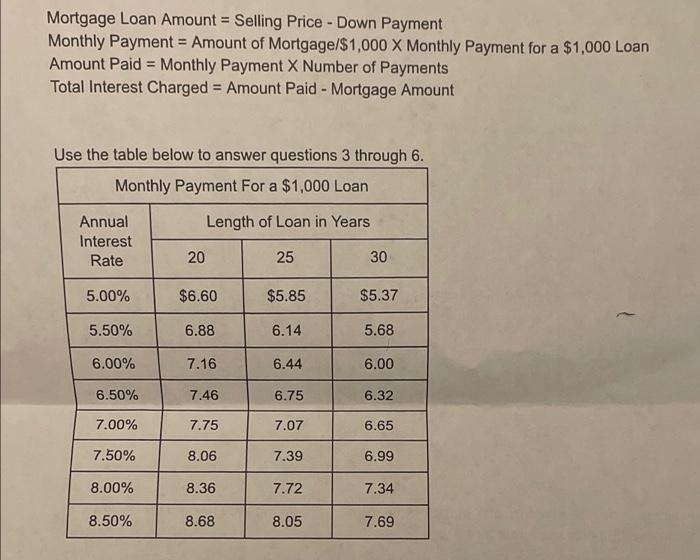

Mortgage Loan Amount = Selling Price - Down Payment Monthly Payment = Amount of Mortgage/$1,000 X Monthly Payment for a $1,000 Loan Amount Paid = Monthly Payment X Number of Payments Total Interest Charged = Amount Paid - Mortgage Amount = Use the table below to answer questions 3 through 6. Monthly Payment For a $1,000 Loan Length of Loan in Years Annual Interest Rate 20 25 30 5.00% $6.60 $5.85 $5.37 5.50% 6.88 6.14 5.68 6.00% 7.16 6.44 6.00 6.50% 7.46 6.75 6.32 7.00% 7.75 7.07 6.65 7.50% 8.06 7.39 6.99 8.00% 8.36 7.72 7.34 8.50% 8.68 8.05 7.69 3. Danelle and Jim have obtained a $70,000 mortgage loan at an annual interest rate of 6.00 percent for 30 years. What is the monthly payment? What is the total amount paid? What is the total interest? 4. Lee Hays has obtained a $240,000 mortgage loan at 5.50 percent interest for 25 years. What is the monthly payment? What is the total amount paid? What is the total interest? 5. How much can be saved in total interest by financing $120,000 at 7.50 percent for 20 years rather than 25 years? 6. How much can be saved in total interest by financing $120,000 at 8.00 percent for 25 years rather than 8.50 percent interest for 25 years Danielle and John have obtained a $70,000 mortgage loan an annual interest rate of 6.00% for 30 years.

What is the monthly payment?, what is the total amount paid?, what is the total interest?

Lee hayes has obtained a $240,000 mortgage loan at 5.50% interest for 25 years? What is the monthly payment?, what is the total amount paid?, what is the total interest?

How much can we see the total interest by financing $120,000 at 7.50 for 20 years rather than 25 years

How much can be saved in total interest by financing $120,000 at 8.00% for 25 years rathee than 8.50% interest for 25 years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started