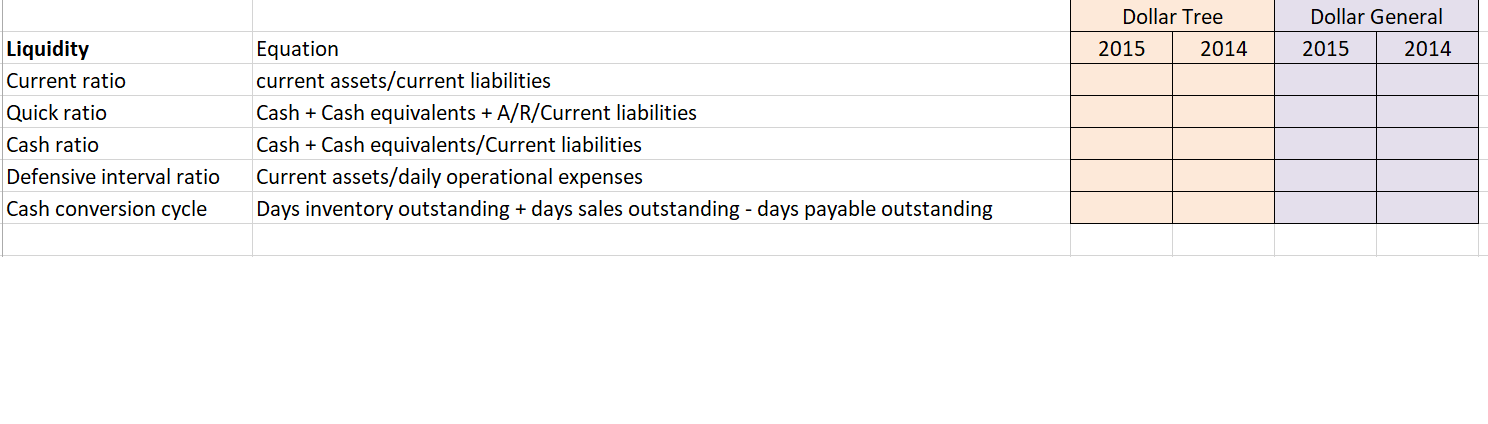

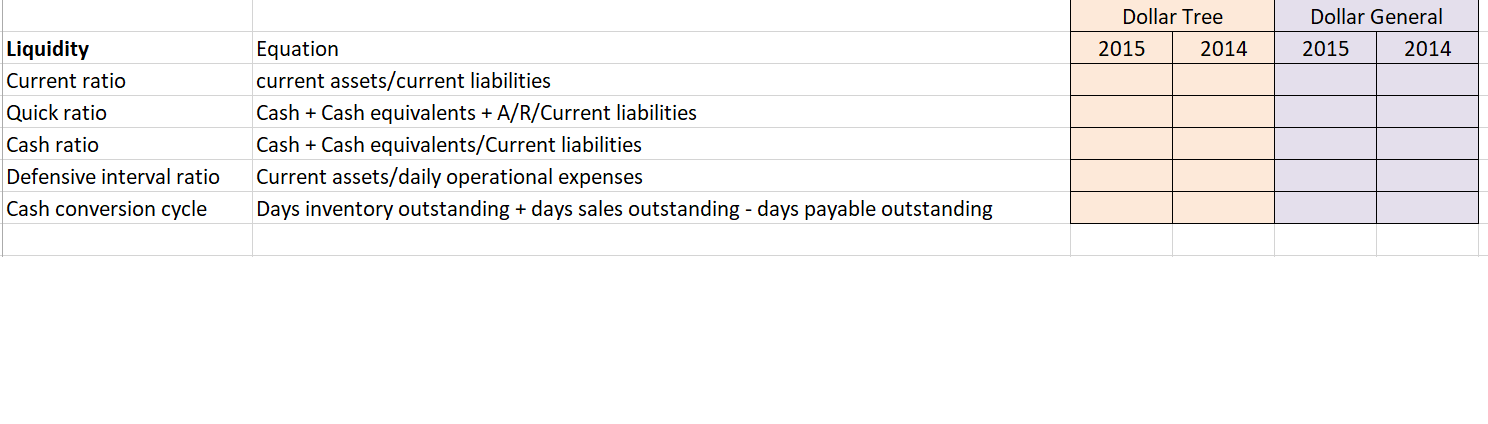

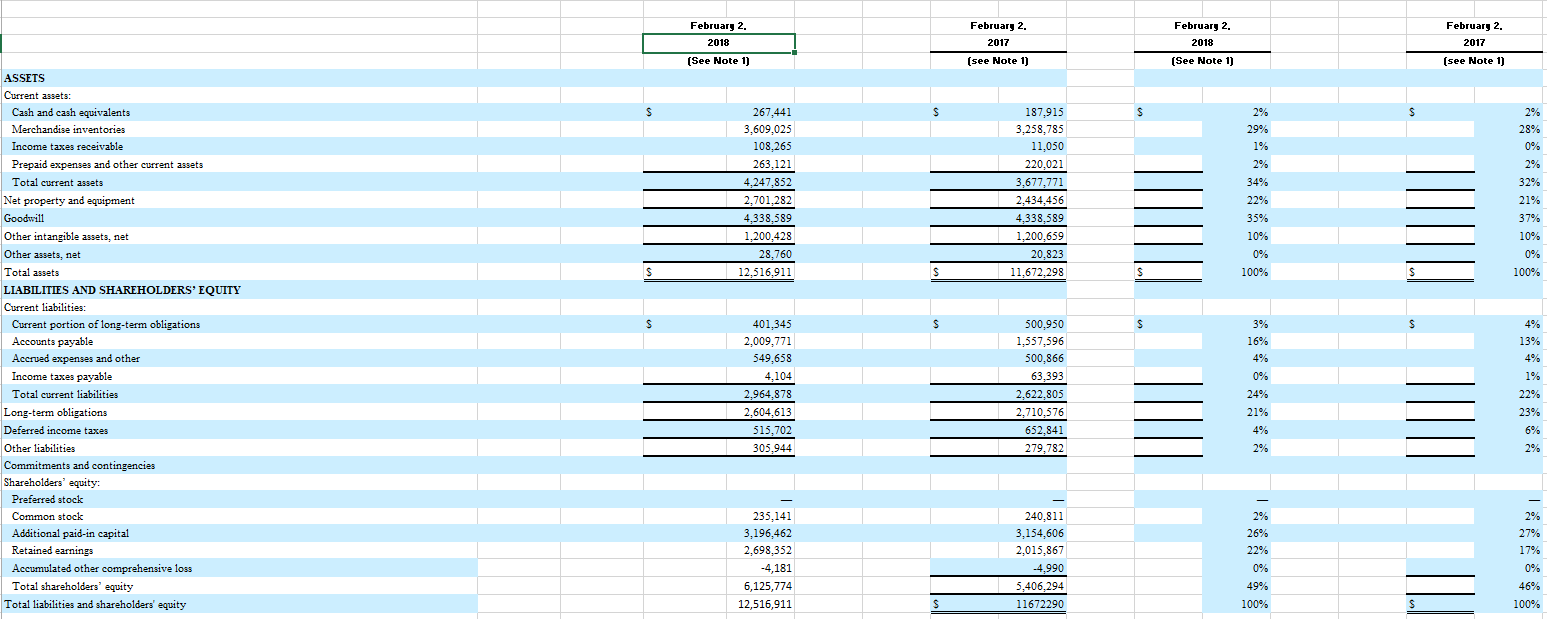

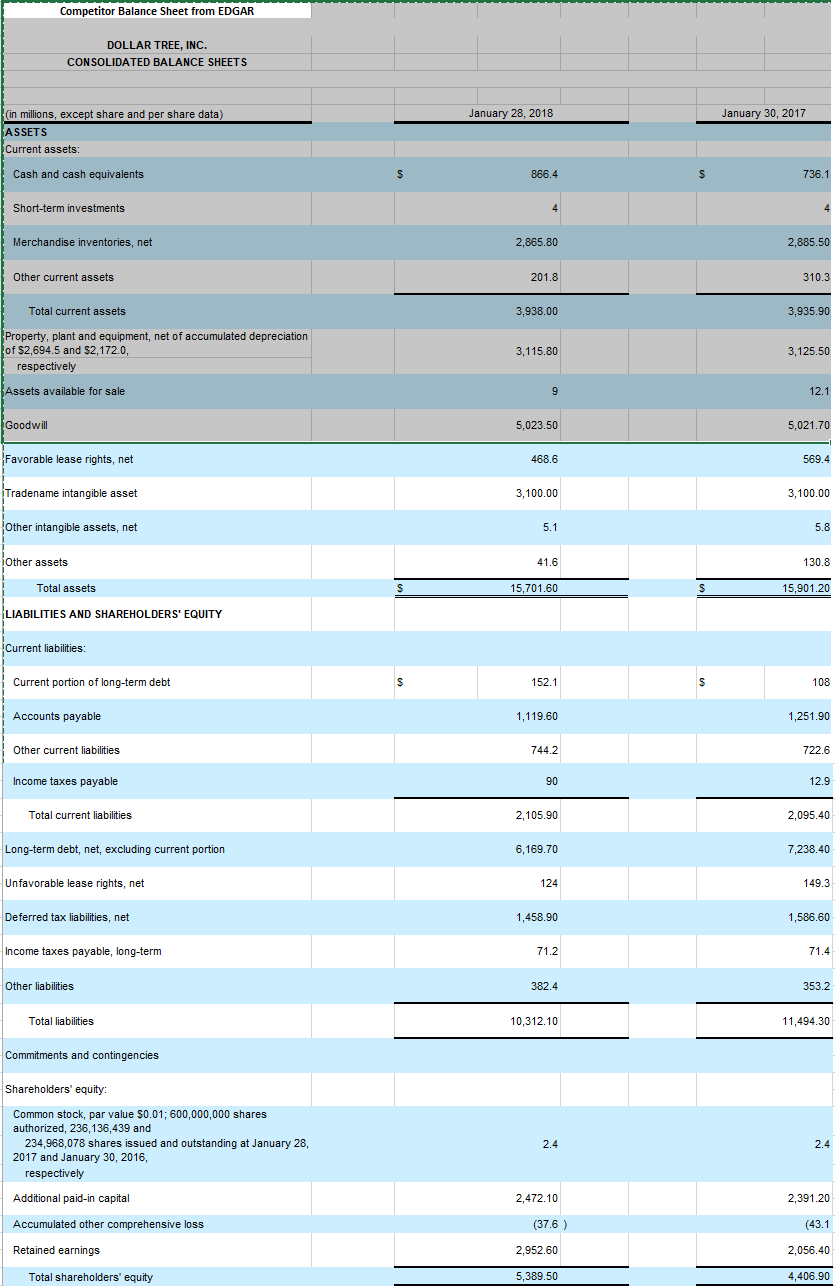

Use the charts below. Pretend that year 2018 equals 2015 and 2017 equals 2014

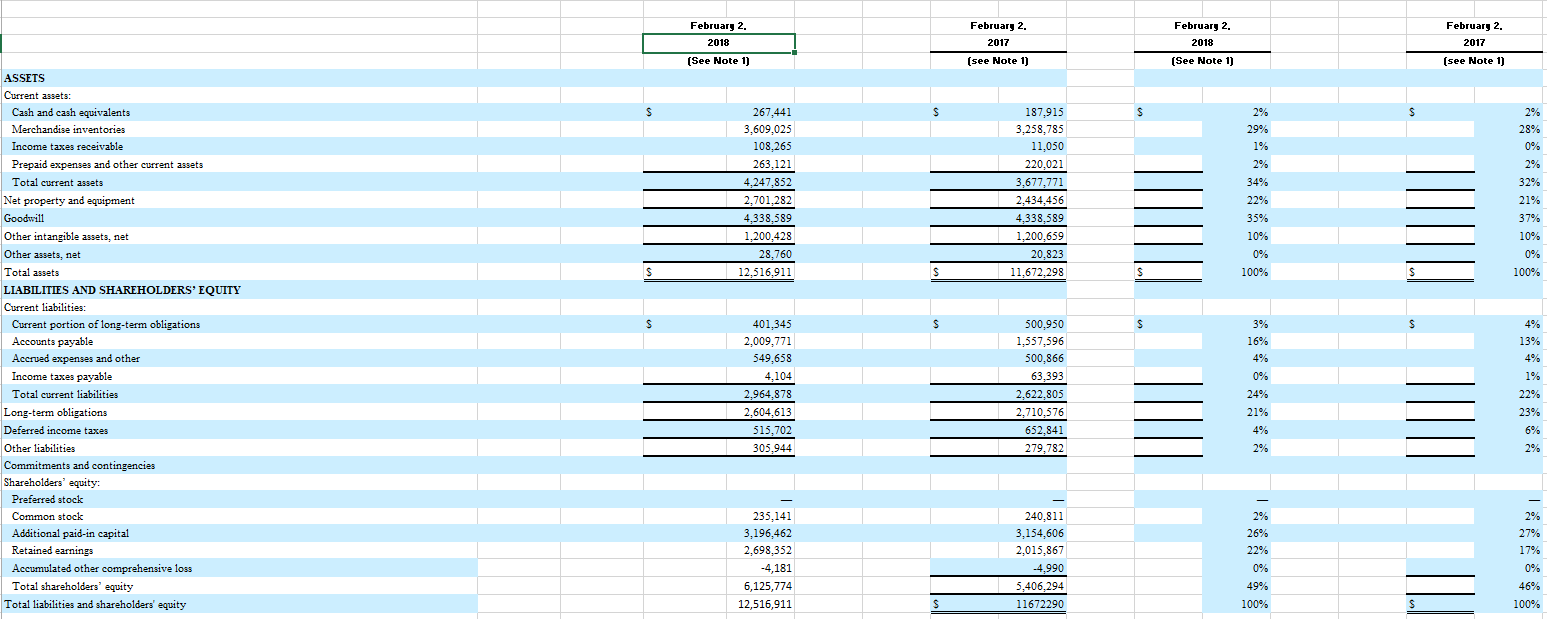

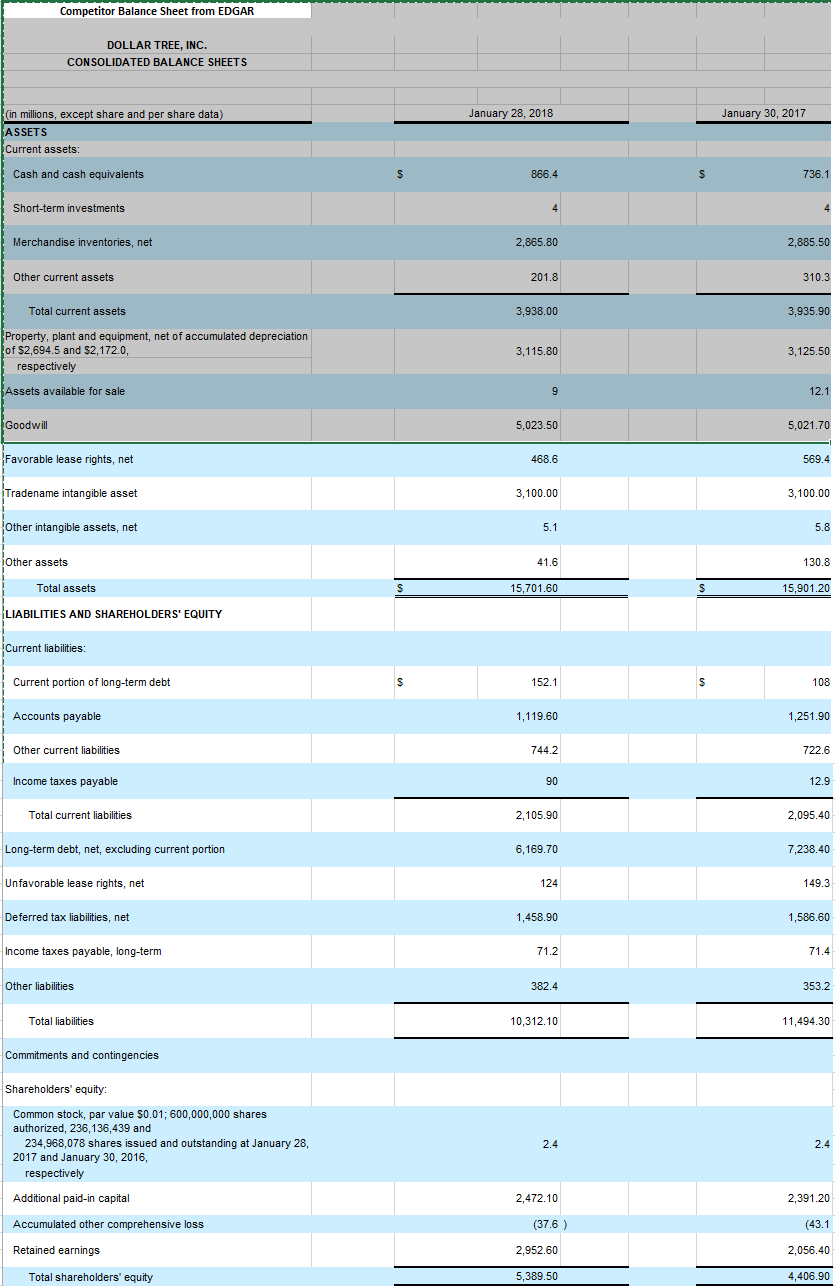

Dollar Tree 2015 2014 Dollar General 2015 2014 Liquidity Current ratio Quick ratio Cash ratio Defensive interval ratio Cash conversion cycle Equation current assets/current liabilities Cash + Cash equivalents + A/R/Current liabilities Cash + Cash equivalents/Current liabilities Current assets/daily operational expenses Days inventory outstanding + days sales outstanding - days payable outstanding February 2. February 2. 2018 (See Note 1) February 2. 2017 (see Note 1) February 2. 2017 2018 (See Note 1) (see Note 1) 2% 2% 267,441 3,609,025 108,265 263,121 4.247.852 2.701,282 4,338,589 1.200,428 28,760 12,516,911 - - 187,915 3,258,785 11,050 220.021 3,677,771 2.434.456 4,338,589 1,200,659 20,823 11,672,298 29% 1% 2% 34% 22% 35% 10% 0% 100% 10% 0% 100% ASSETS Current assets: Cash and cash equivalents Merchandise inventories Income taxes receivable Prepaid expenses and other current assets Total current assets Net property and equipment Goodwill Other intangible assets, net Other assets, net Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term obligations Accounts payable Accrued expenses and other Income taxes payable Total current liabilities Long-term obligations Deferred income taxes Other liabilities Commitments and contingencies Shareholders' equity: Preferred stock Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity - - - - - - - - - - - - - - 4% 13% 401,345 2,009,771 549,658 4.104 2.964,878 2,604,613 515,702 305,944 500,950 1,557,596 500.866 63,393 2,622,805 2,710,576 652,841 279,782 3% 16% 4% 0% 24% 21% - - 17% 235,141 3,196,462 2,698,352 -4,181 6,125,774 12,516,911 240,811 3,154,606 2,015,867 -4,990 5,406,294 11672290 2% 26% 22% 0% 49% 100% 46% 100% Competitor Balance Sheet from EDGAR DOLLAR TREE, INC. CONSOLIDATED BALANCE SHEETS January 28, 2018 January 30, 2017 (in millions, except share and per share data) ASSETS Current assets: Cash and cash equivalents 866.4 S 736.1 Short-term investments Merchandise inventories, net 2,865.80 2,885.50 Other current assets 201.8 310.3 Total current assets 3,938.00 3,935.90 Property, plant and equipment, net of accumulated depreciation of $2,694.5 and $2,172.0, respectively 3,115.80 3,125.50 Assets available for sale 12.1 Goodwill 5,023.50 5,021.70 Favorable lease rights, net 468.6 569.4 Tradename intangible asset 3,100.00 3,100.00 Other intangible assets, net 5.1 5.8 Other assets 41.6 130.8 Total assets 15,701.60 15,901.20 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt 152.1 108 Accounts payable 1,119.60 1,251.90 Other current liabilities 744.2 722.6 Income taxes payable 90 12.9 Total current liabilities 2,105.90 2,095.40 Long-term debt, net, excluding current portion 6,169.70 7,238.40 Unfavorable lease rights, net 124 149.3 Deferred tax liabilities, net 1,458.90 1,586.60 Income taxes payable, long-term 71.2 71.4 Other liabilities 382.4 353.2 Total liabilities 10,312.10 11,494.30 Commitments and contingencies Shareholders' equity: Common stock, par value $0.01; 600,000,000 shares authorized, 236,136,439 and 234,968,078 shares issued and outstanding at January 28, 2017 and January 30, 2016, respectively Additional paid-in capital 2,472.10 2,391.20 Accumulated other comprehensive loss (37.6) (43.1 Retained earnings 2,952.60 2,056.40 Total shareholders' equity 5,389.50 4,406.90