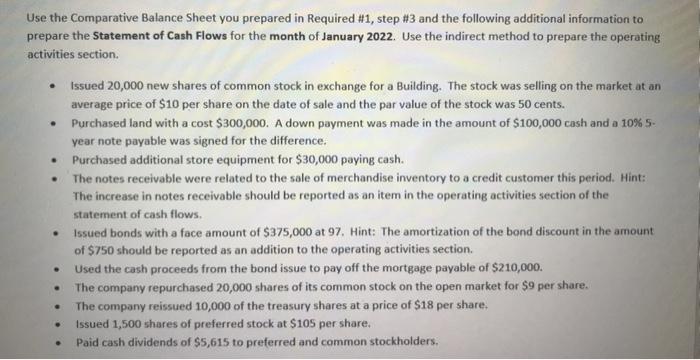

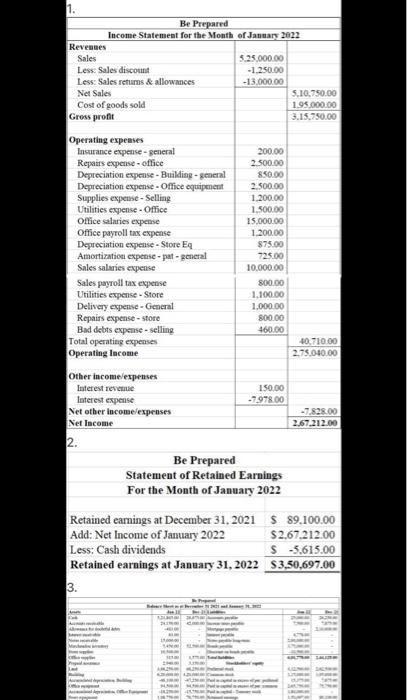

Use the Comparative Balance Sheet you prepared in Required #1, step #3 and the following additional information to prepare the Statement of Cash Flows for the month of January 2022. Use the indirect method to prepare the operating activities section. Issued 20,000 new shares of common stock in exchange for a Building. The stock was selling on the market at an average price of $10 per share on the date of sale and the par value of the stock was 50 cents. Purchased land with a cost $300,000. A down payment was made in the amount of $100,000 cash and a 10%5. year note payable was signed for the difference. Purchased additional store equipment for $30,000 paying cash. The notes receivable were related to the sale of merchandise inventory to a credit customer this period. Hint: The increase in notes receivable should be reported as an item in the operating activities section of the statement of cash flows. Issued bonds with a foce amount of $375,000 at 97. Hint: The amortization of the bond discount in the amount of $750 should be reported as an addition to the operating activities section. Used the cash proceeds from the bond issue to pay off the mortgage payable of $210,000. The company repurchased 20,000 shares of its common stock on the open market for $9 per share. The company reissued 10,000 of the treasury shares at a price of $18 per share. Issued 1,500 shares of preferred stock at $105 per share. Paid cash dividends of $5,615 to preferred and common stockholders. . . 1. Be Prepared Income Statement for the Month of January 2023 Revesses Sales 5.25.000.00 Less: Sales discount -1.250.00 Less: Sales returns & allowances -13.000.00 Net Sales 5.10.750.00 Cost of goods sold 1.95000.00 Gross profit 3.15.750.00 Operating expenses Insurance expense - general Repaits expense-office Depreciation expense - Building - general Depreciation expense - Office equipment Supplies expense - Selling Utilities expense - Office Office salaries expense Office payroll tax expense Depreciation expense - Store Eq Amortization expense pat general Sales salaries expense Sales payroll tax expense Utilities expense Store Delivery expense - General Repairs expense - store Bad debts expense - selling Total operating expenses Operating Income 200.00 2.500.00 850.00 2.500.00 1.200.00 1.500.00 15.000.00 1.200.00 $75.00 725.00 10.000.00 800.00 1.100.00 1,000.00 800.00 460.00 10.710.00 2.75.040.00 -7.828.00 2.67.212.00 Other Income/expenses Interest revenue 150.00 Interest expense -7.978.00 Net other income/expenses Net Income 2. Be Prepared Statement of Retained Earnings For the Month of January 2022 Retained earnings at December 31, 2021 $ 89.100.00 Add: Net Income of January 2022 $2.67.212.00 Less: Cash dividends S -5.615.00 Retained earnings at January 31, 2022 S3,50,697.00 3