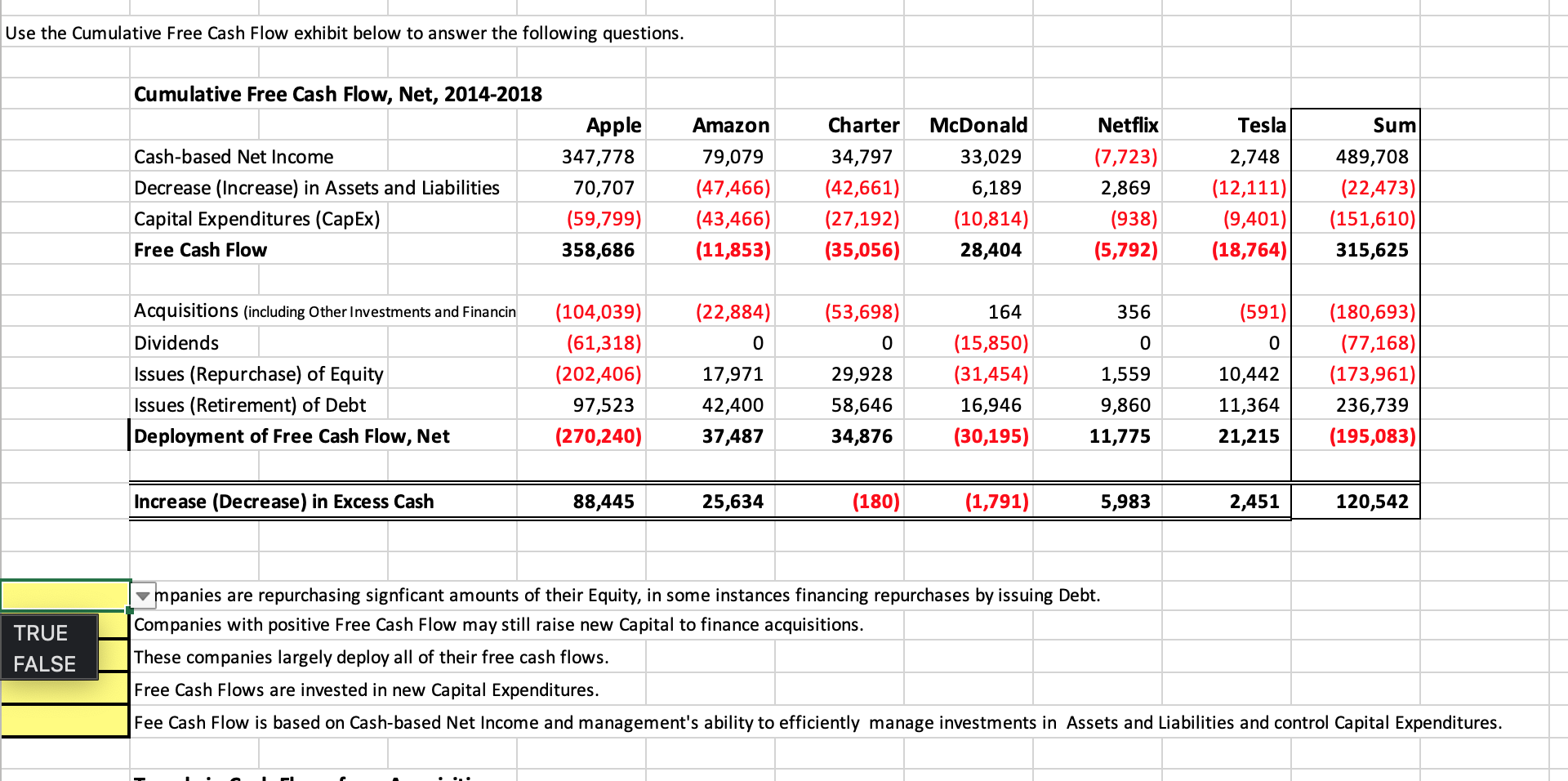

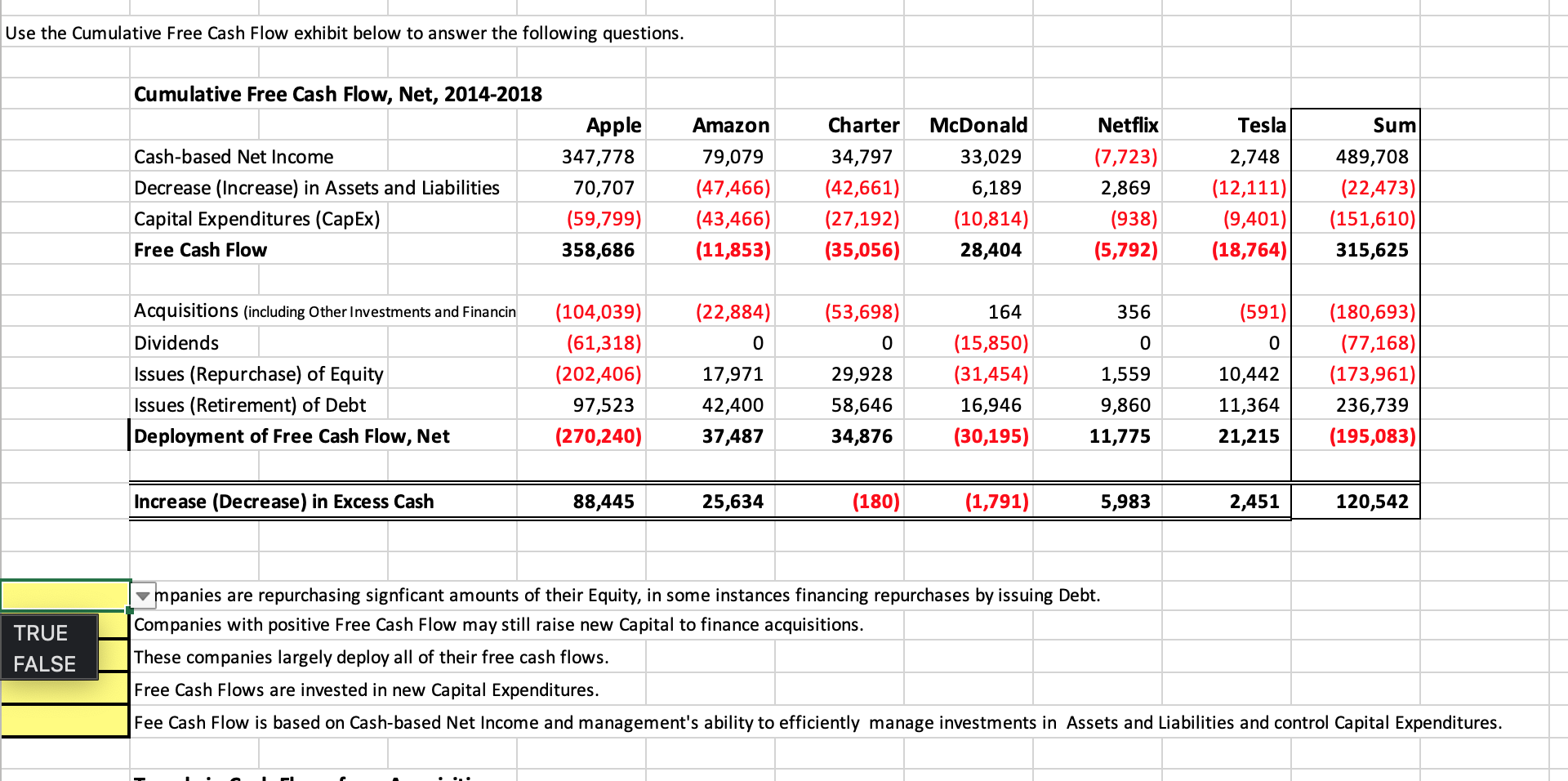

Use the Cumulative Free Cash Flow exhibit below to answer the following questions. Cumulative Free Cash Flow, Net, 2014-2018 Amazon Cash-based Net Income Decrease (Increase) in Assets and Liabilities Capital Expenditures (CapEx) Free Cash Flow Apple 347,778 70,707 (59,799) 358,686 79,079 (47,466) (43,466) (11,853) Charter McDonald 34,797 33,029 (42,661) 6,189 (27,192) (10,814) (35,056) 28,404 Netflix (7,723) 2,869 (938) (5,792) Tesla 2,748 (12,111) (9,401) (18,764) Sum 489,708 (22,473) (151,610) 315,625 Acquisitions (including Other Investments and Financin (22,884) (53,698) 164 356 (591) 0 0 0 (104,039) (61,318) (202,406) 97,523 (270,240) Dividends Issues (Repurchase) of Equity Issues (Retirement) of Debt Deployment of Free Cash Flow, Net 10,442 17,971 42,400 37,487 29,928 58,646 34,876 (15,850) (31,454) 16,946 (30,195) 1,559 9,860 (180,693) (77,168) (173,961) 236,739 (195,083) 11,364 11,775 21,215 Increase (Decrease) in Excess Cash 88,445 25,634 (180) (1,791) 5,983 2,451 120,542 TRUE FALSE 1 - mpanies are repurchasing signficant amounts of their Equity, in some instances financing repurchases by issuing Debt. Companies with positive Free Cash Flow may still raise new Capital to finance acquisitions. These companies largely deploy all of their free cash flows. Free Cash Flows are invested in new Capital Expenditures. Fee Cash Flow is based on Cash-based Net Income and management's ability to efficiently manage investments in Assets and Liabilities and control Capital Expenditures. Use the Cumulative Free Cash Flow exhibit below to answer the following questions. Cumulative Free Cash Flow, Net, 2014-2018 Amazon Cash-based Net Income Decrease (Increase) in Assets and Liabilities Capital Expenditures (CapEx) Free Cash Flow Apple 347,778 70,707 (59,799) 358,686 79,079 (47,466) (43,466) (11,853) Charter McDonald 34,797 33,029 (42,661) 6,189 (27,192) (10,814) (35,056) 28,404 Netflix (7,723) 2,869 (938) (5,792) Tesla 2,748 (12,111) (9,401) (18,764) Sum 489,708 (22,473) (151,610) 315,625 Acquisitions (including Other Investments and Financin (22,884) (53,698) 164 356 (591) 0 0 0 (104,039) (61,318) (202,406) 97,523 (270,240) Dividends Issues (Repurchase) of Equity Issues (Retirement) of Debt Deployment of Free Cash Flow, Net 10,442 17,971 42,400 37,487 29,928 58,646 34,876 (15,850) (31,454) 16,946 (30,195) 1,559 9,860 (180,693) (77,168) (173,961) 236,739 (195,083) 11,364 11,775 21,215 Increase (Decrease) in Excess Cash 88,445 25,634 (180) (1,791) 5,983 2,451 120,542 TRUE FALSE 1 - mpanies are repurchasing signficant amounts of their Equity, in some instances financing repurchases by issuing Debt. Companies with positive Free Cash Flow may still raise new Capital to finance acquisitions. These companies largely deploy all of their free cash flows. Free Cash Flows are invested in new Capital Expenditures. Fee Cash Flow is based on Cash-based Net Income and management's ability to efficiently manage investments in Assets and Liabilities and control Capital Expenditures