Answered step by step

Verified Expert Solution

Question

1 Approved Answer

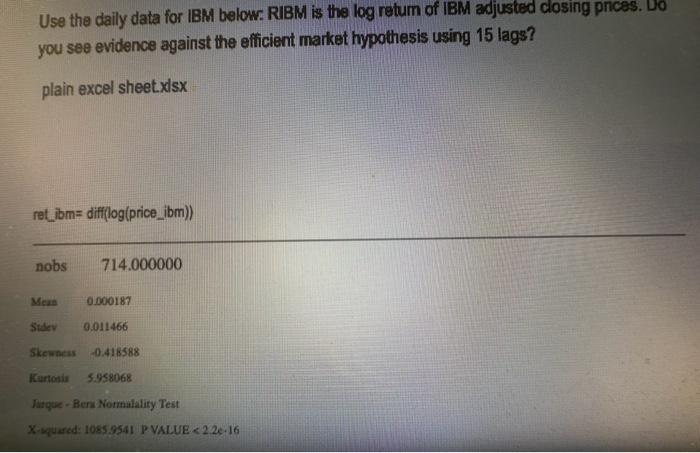

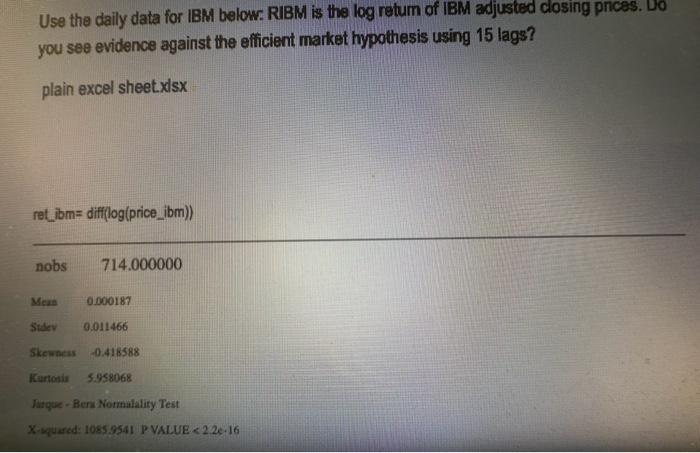

Use the daily data for IBM below. RIBM is the log retum of IBM adjusted closing prices. Lo you see evidence against the efficient market

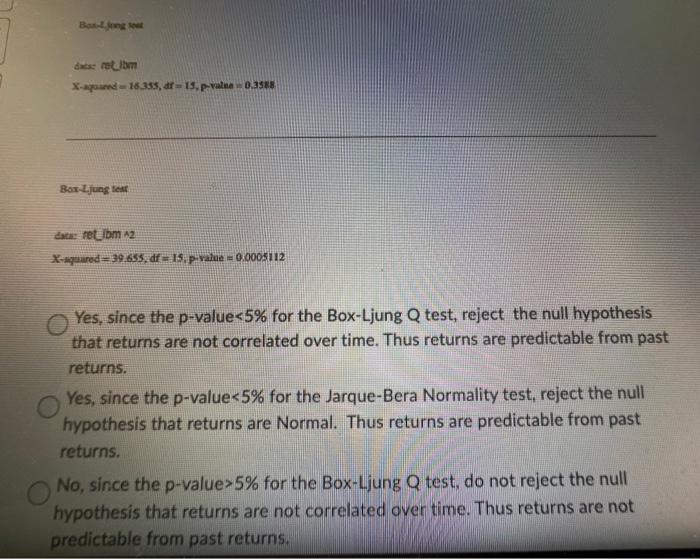

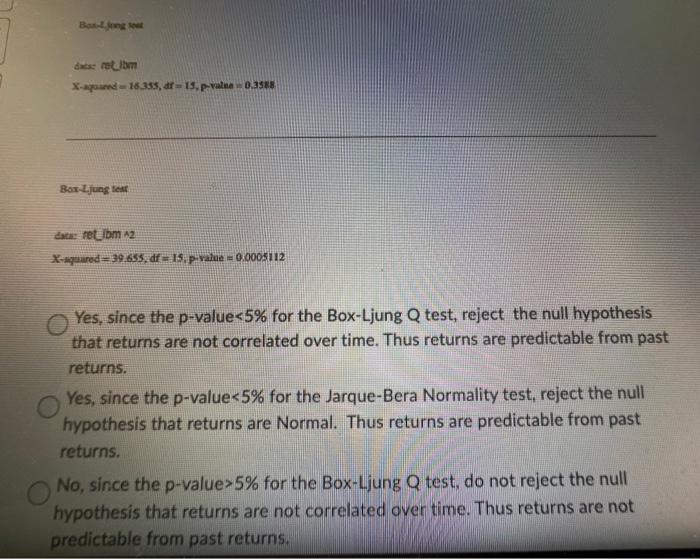

Use the daily data for IBM below. RIBM is the log retum of IBM adjusted closing prices. Lo you see evidence against the efficient market hypothesis using 15 lags? plain excel sheet x ssx ret__bm= difflog(price_ibm)) dacse tek olvert x-apournd =18.355, df =19,p valne w0,3518 Box-t.jung text Late: Fet Ion 12 K-MMured =39.655,df=15, piratue =0.0005112 Yes, since the p-value 5% for the Box-Ljung Q test, reject the null hypothesis that returns are not correlated over time. Thus returns are predictable from past returns. Yes, since the p-value 5% for the BoxLjung,Q test, do not reject the null hypothesis that returns are not correlated over time. Thus returns are not Use the daily data for IBM below. RIBM is the log retum of IBM adjusted closing prices. Lo you see evidence against the efficient market hypothesis using 15 lags? plain excel sheet x ssx ret__bm= difflog(price_ibm)) dacse tek olvert x-apournd =18.355, df =19,p valne w0,3518 Box-t.jung text Late: Fet Ion 12 K-MMured =39.655,df=15, piratue =0.0005112 Yes, since the p-value 5% for the Box-Ljung Q test, reject the null hypothesis that returns are not correlated over time. Thus returns are predictable from past returns. Yes, since the p-value 5% for the BoxLjung,Q test, do not reject the null hypothesis that returns are not correlated over time. Thus returns are not

Use the daily data for IBM below. RIBM is the log retum of IBM adjusted closing prices. Lo you see evidence against the efficient market hypothesis using 15 lags? plain excel sheet x ssx ret__bm= difflog(price_ibm)) dacse tek olvert x-apournd =18.355, df =19,p valne w0,3518 Box-t.jung text Late: Fet Ion 12 K-MMured =39.655,df=15, piratue =0.0005112 Yes, since the p-value 5% for the Box-Ljung Q test, reject the null hypothesis that returns are not correlated over time. Thus returns are predictable from past returns. Yes, since the p-value 5% for the BoxLjung,Q test, do not reject the null hypothesis that returns are not correlated over time. Thus returns are not Use the daily data for IBM below. RIBM is the log retum of IBM adjusted closing prices. Lo you see evidence against the efficient market hypothesis using 15 lags? plain excel sheet x ssx ret__bm= difflog(price_ibm)) dacse tek olvert x-apournd =18.355, df =19,p valne w0,3518 Box-t.jung text Late: Fet Ion 12 K-MMured =39.655,df=15, piratue =0.0005112 Yes, since the p-value 5% for the Box-Ljung Q test, reject the null hypothesis that returns are not correlated over time. Thus returns are predictable from past returns. Yes, since the p-value 5% for the BoxLjung,Q test, do not reject the null hypothesis that returns are not correlated over time. Thus returns are not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started