Question

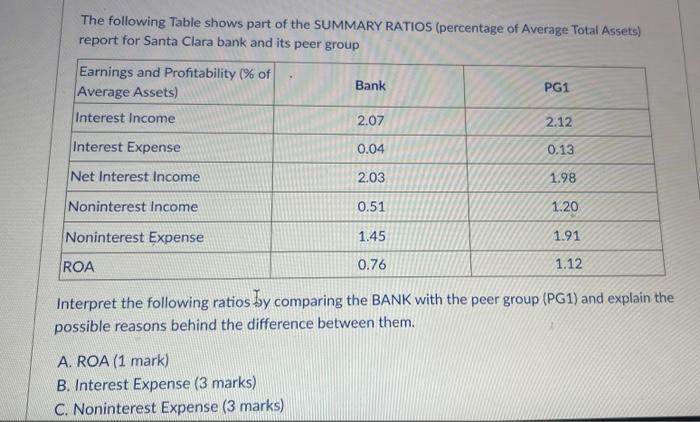

The following Table shows part of the SUMMARY RATIOS (percentage of Average Total Assets) report for Santa Clara bank and its peer group Earnings

The following Table shows part of the SUMMARY RATIOS (percentage of Average Total Assets) report for Santa Clara bank and its peer group Earnings and Profitability (% of Average Assets) Interest Income Interest Expense Net Interest Income Noninterest Income Noninterest Expense Bank A. ROA (1 mark) B. Interest Expense (3 marks) C. Noninterest Expense (3 marks) 2.07 0.04 2.03 0.51 1.45 0.76 PG1 2.12 0.13 1.98 1.20 1.91 1.12 ROA Interpret the following ratios by comparing the BANK with the peer group (PG1) and explain the possible reasons behind the difference between them.

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Return of assets of the bank is 076 and the Peer group is 112 it is seen that the banks return on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Statistics For Business And Economics

Authors: David Anderson, Thomas Williams, Dennis Sweeney, Jeffrey Cam

7th Edition

1305081595, 978-1305081598

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App