Answered step by step

Verified Expert Solution

Question

1 Approved Answer

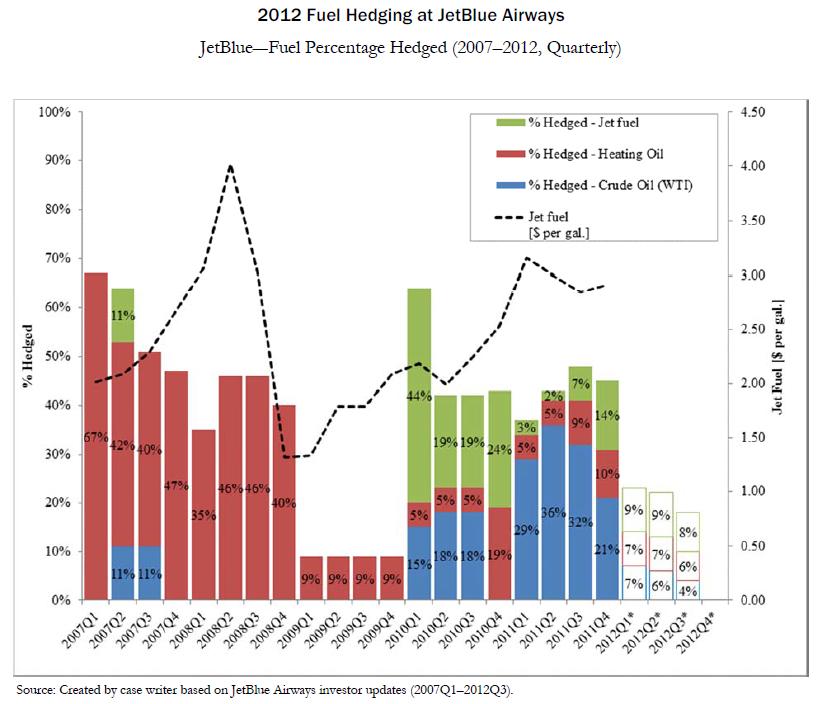

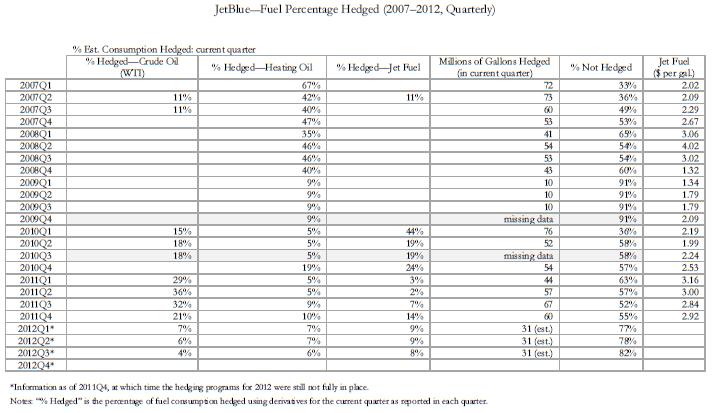

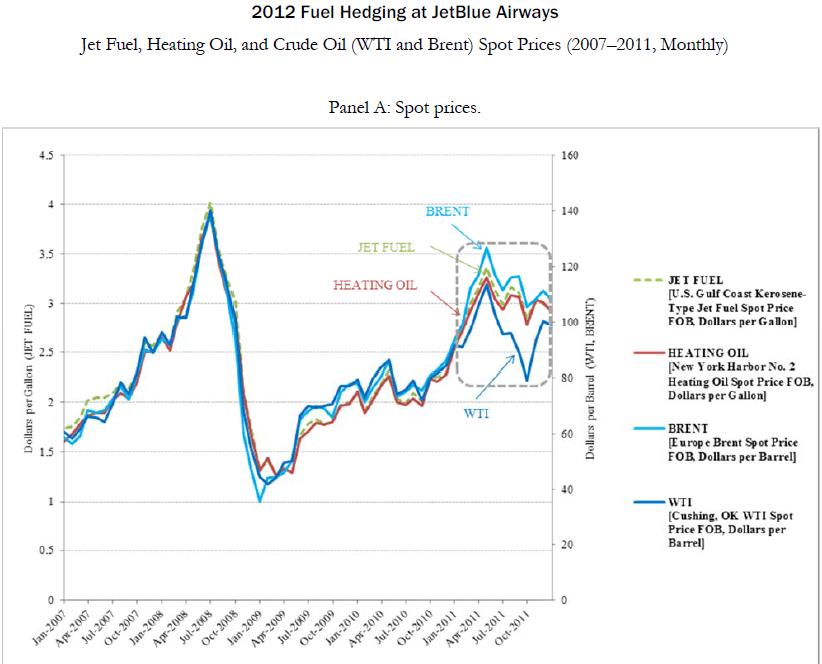

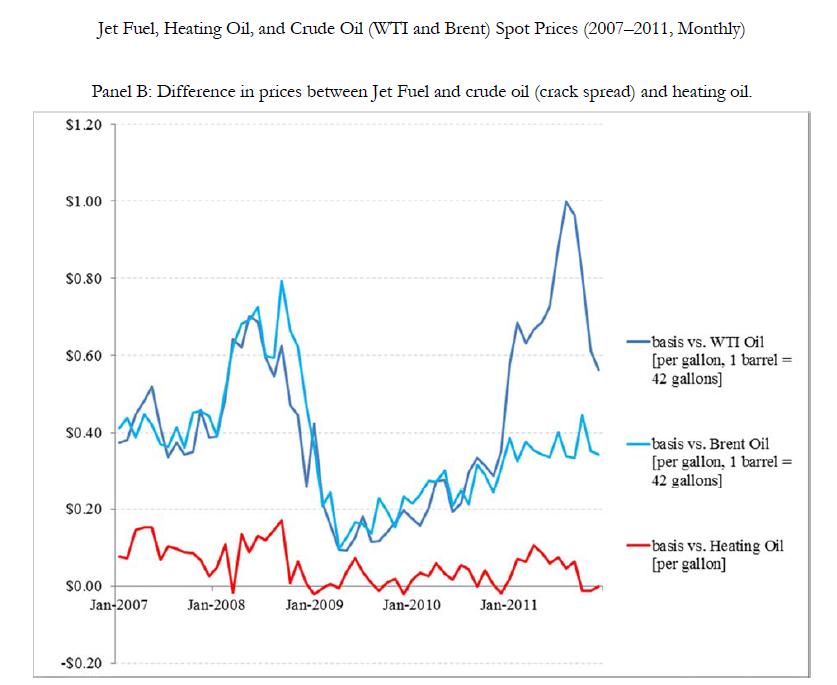

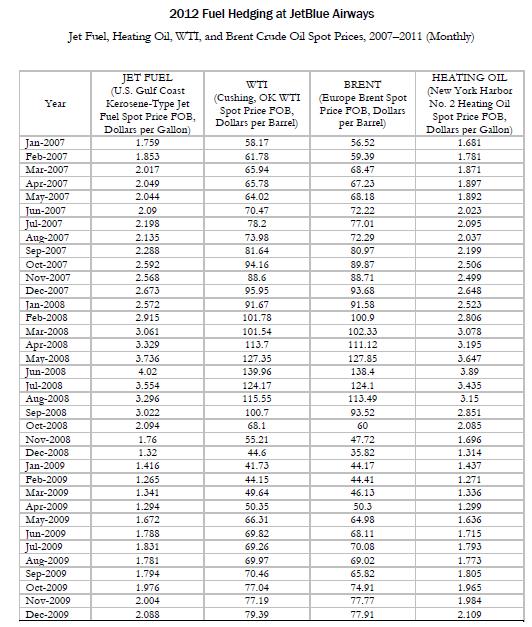

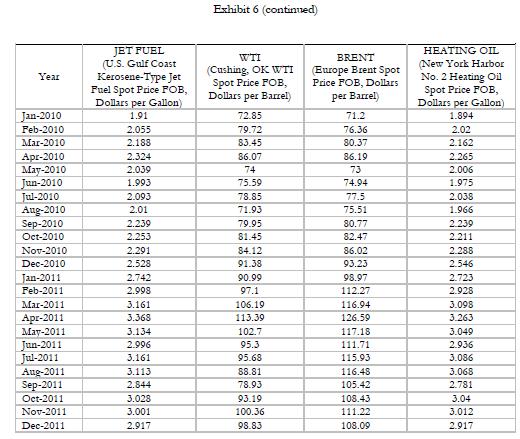

Use the data below on WTI, Brent, heating oil and RBOB gasoline in any combination and back-test them against jet fuel to determine the best

- Use the data below on WTI, Brent, heating oil and RBOB gasoline in any combination and back-test them against jet fuel to determine the best correlation. Will have to try a multiple regression to see if using two variables or more make it more efficient. Basis risk and the weights of each variable will come into play here.

For example:

Determine the correlation between the following:

1. WTI vs Jet fuel

2. Brent vs Jet fuel

3. Heating oil vs Jet fuel

4. RBOB Gasoline vs Jet fuel (briefly)

And then back-test them to find the best correlation.

% Hedged 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 67% 2007Q1 11% 42% 40% 11% 11% 2007Q2 2007Q3 47% 2012 Fuel Hedging at JetBlue Airways JetBlue-Fuel Percentage Hedged (2007-2012, Quarterly) 2007Q4 35% 2008Q1 46% 46% 2008Q2 2008Q3 40% 2008Q4 9% 9% 9% 9% 2009Q1 2009Q2 2009Q4 2009Q3 44% 5% 15% 2010Q1 19% 19% 5% 5% 18% 18% 19% 2010Q2 201003 3% 24% 5% 2010Q4 1% Hedged - Jet fuel % Hedged - Heating Oil %Hedged - Crude Oil (WTI) Jet fuel [S per gal.] 29% 2011Q1 Source: Created by case writer based on JetBlue Airways investor updates (2007Q1-2012Q3). 5% 36% 201102 7% 9% 14% 32% 10% 201103 2011Q4 9% 9% 21% 7% 7% 7% 2012Q1* 6% 8% 2012Q2* 6% 4% 2012Q3* 2012Q4* 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 Jet Fuel I$ per gal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the correlations between jet fuel and the other fuelscrudes on a monthly basis from 20072...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started