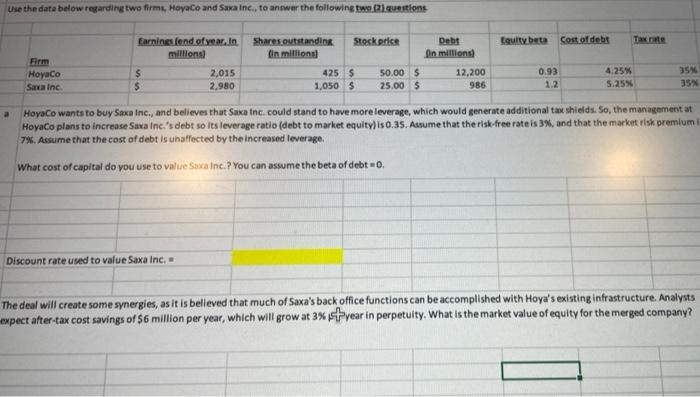

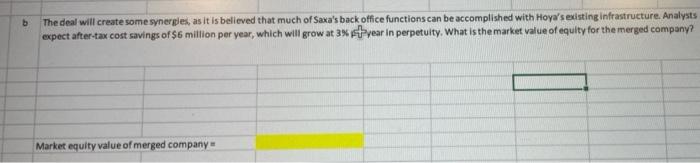

Use the data below regarding two firm. Hoyaco and Sana Inc., to answer the following two questions Stock price Equity beta Cost of debt Taxe Earnings fond of year. In millions Shares outstanding in millions Firm Hoyaco Saxainc Debt in millions 12,200 986 0.93 $ $ 2,015 2,980 425 5 1,050 S 50.00 $ 25.00 5 4.25% 5.25% 35% 35 1.2 a HoyaCo wants to buy Saxa Inc., and believes that Saxa Inc. could stand to have more leverage, which would generate additional tax shields. So, the managementat HoyaCo plans to increase Sava Inc.'s debt so its leverage ratio (debt to market equity) is 0.35. Assume that the risk-free rate is 3%, and that the market risk premium 7%. Assume that the cost of debt is unaffected by the increased leverage What cost of capital do you use to value Suxa Inc.? You can assume the beta of debt-0. Discount rate used to value Saxa Inc, The deal will create some synergies, as it is believed that much of Saxa's back office functions can be accomplished with Hoya's existing infrastructure. Analysts expect after-tax cost savings of $6 million per year, which will grow at 3% Fyear in perpetuity. What is the market value of equity for the merged company? The deal will create some synergies, as it is believed that much of Saxa's back office functions can be accomplished with Hoya's existing infrastructure. Analysts expect after-tax cost savings of $6 million per year, which will grow at 3 year in perpetuity. What is the market value of equity for the merged company? Market equity value of merged company Use the data below regarding two firm. Hoyaco and Sana Inc., to answer the following two questions Stock price Equity beta Cost of debt Taxe Earnings fond of year. In millions Shares outstanding in millions Firm Hoyaco Saxainc Debt in millions 12,200 986 0.93 $ $ 2,015 2,980 425 5 1,050 S 50.00 $ 25.00 5 4.25% 5.25% 35% 35 1.2 a HoyaCo wants to buy Saxa Inc., and believes that Saxa Inc. could stand to have more leverage, which would generate additional tax shields. So, the managementat HoyaCo plans to increase Sava Inc.'s debt so its leverage ratio (debt to market equity) is 0.35. Assume that the risk-free rate is 3%, and that the market risk premium 7%. Assume that the cost of debt is unaffected by the increased leverage What cost of capital do you use to value Suxa Inc.? You can assume the beta of debt-0. Discount rate used to value Saxa Inc, The deal will create some synergies, as it is believed that much of Saxa's back office functions can be accomplished with Hoya's existing infrastructure. Analysts expect after-tax cost savings of $6 million per year, which will grow at 3% Fyear in perpetuity. What is the market value of equity for the merged company? The deal will create some synergies, as it is believed that much of Saxa's back office functions can be accomplished with Hoya's existing infrastructure. Analysts expect after-tax cost savings of $6 million per year, which will grow at 3 year in perpetuity. What is the market value of equity for the merged company? Market equity value of merged company