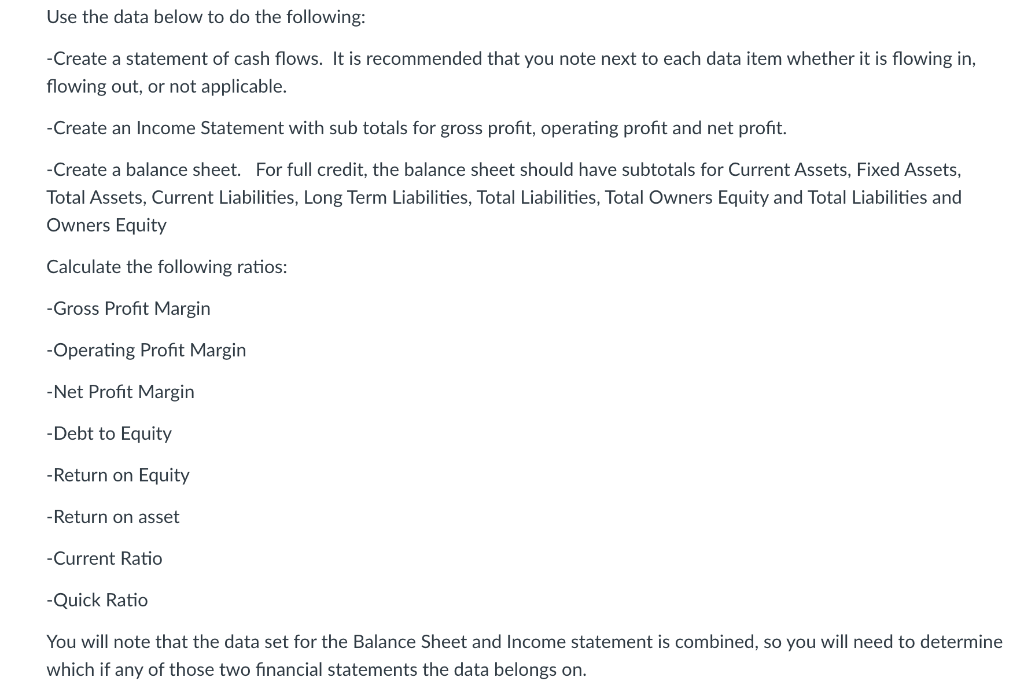

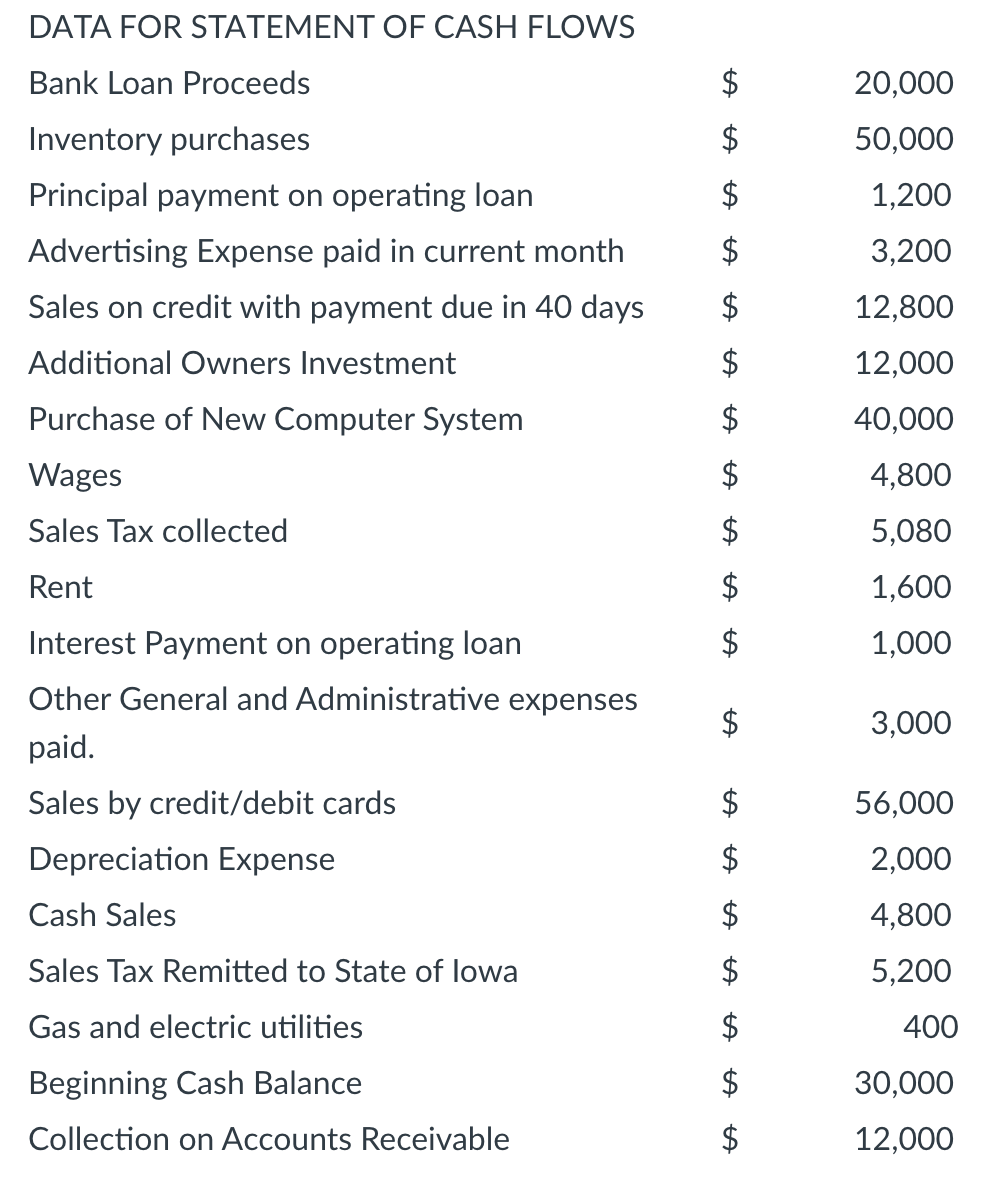

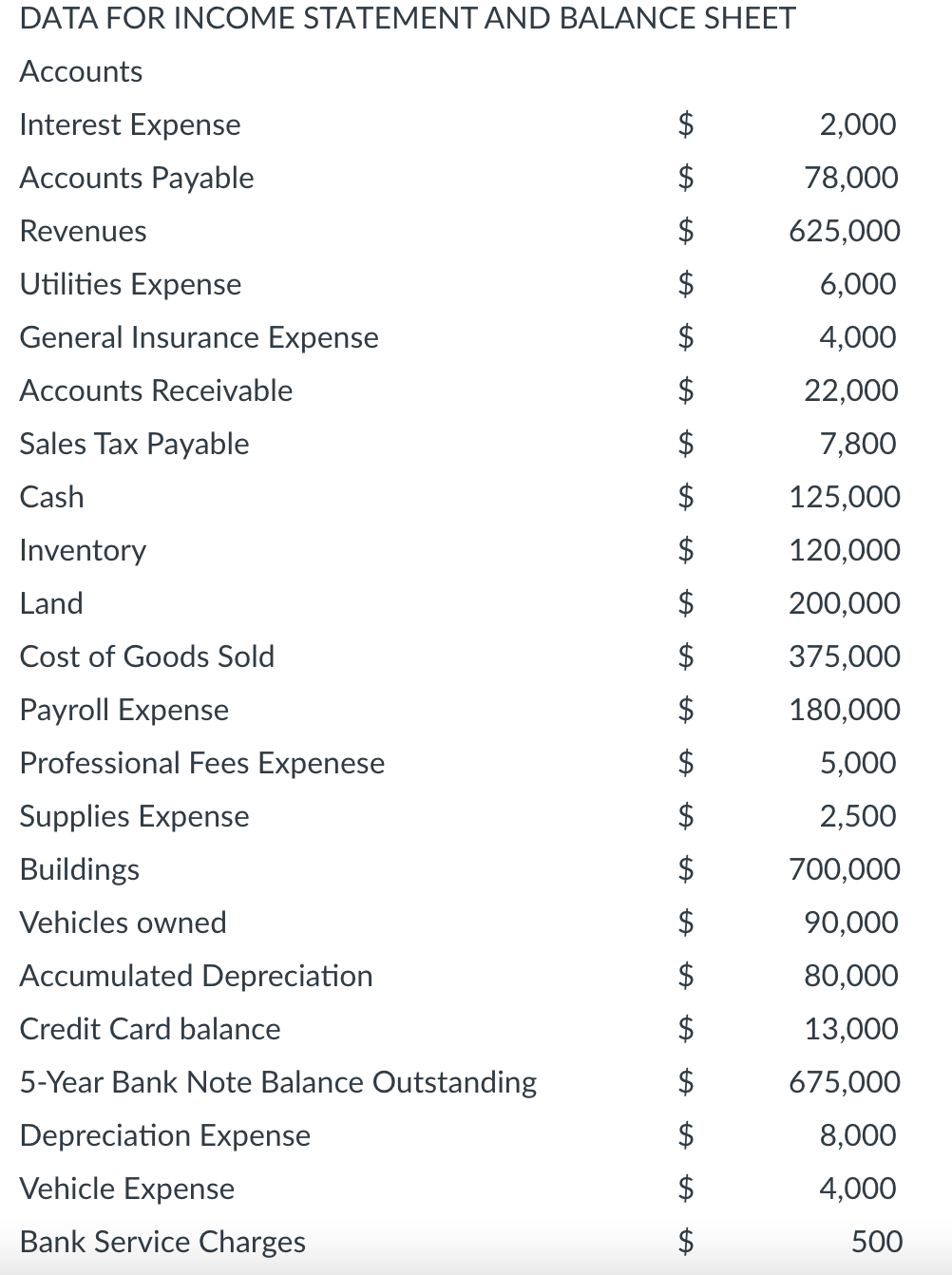

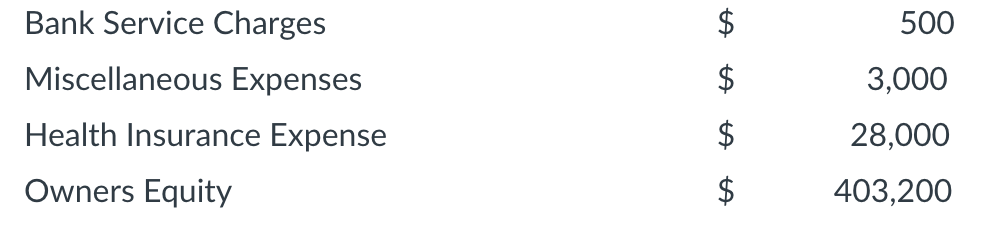

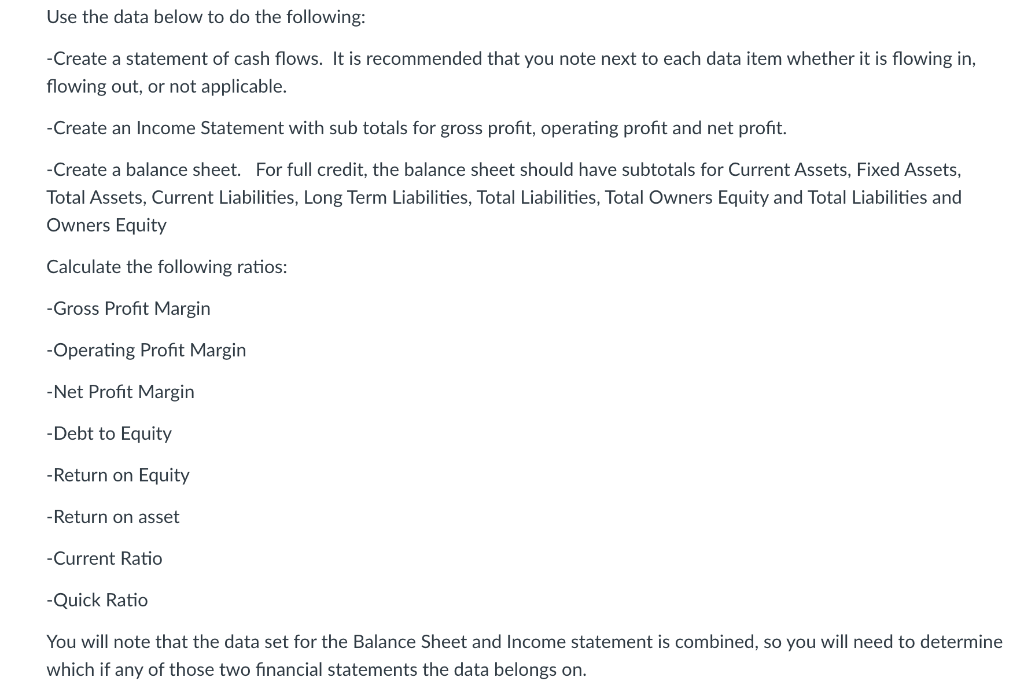

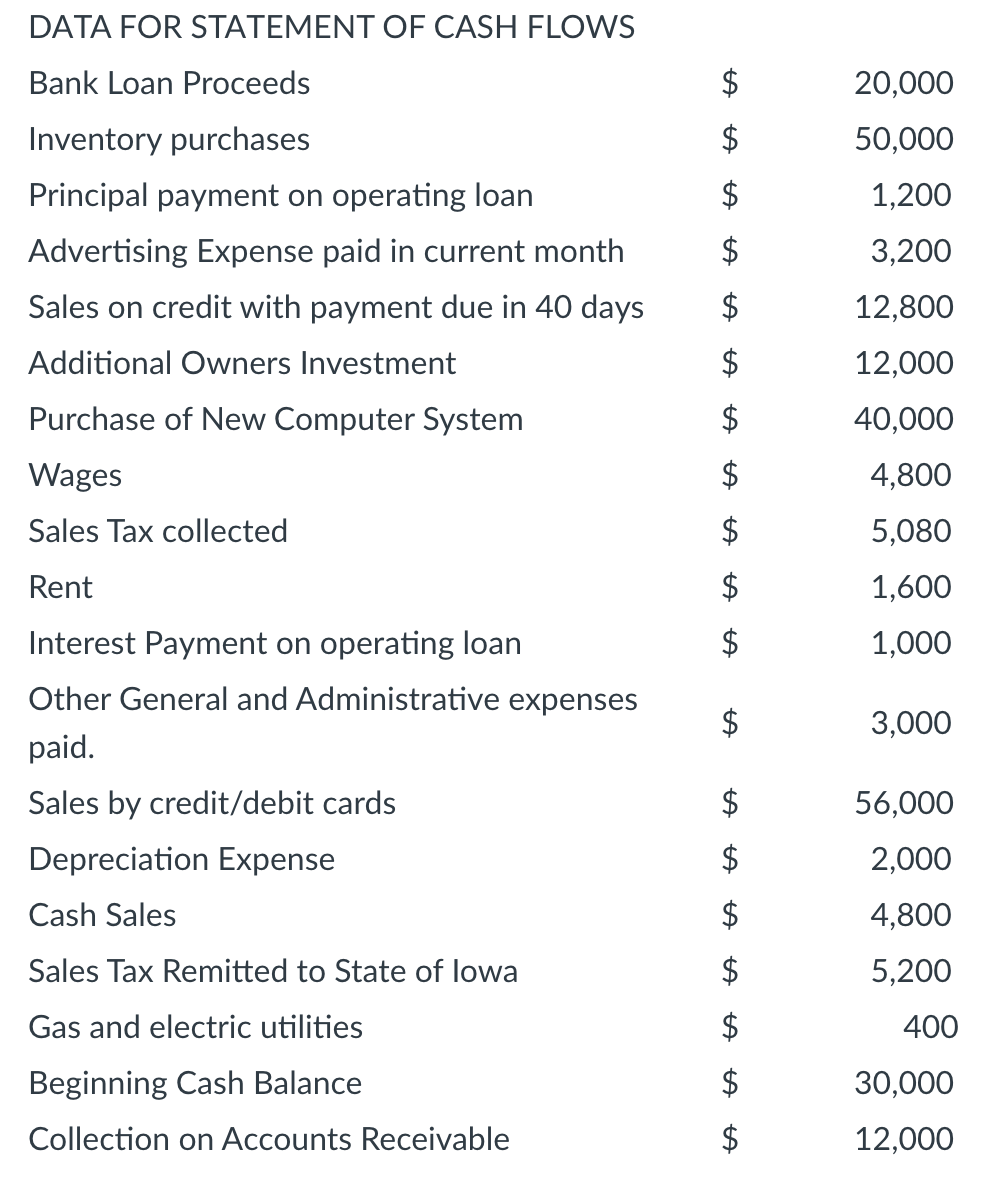

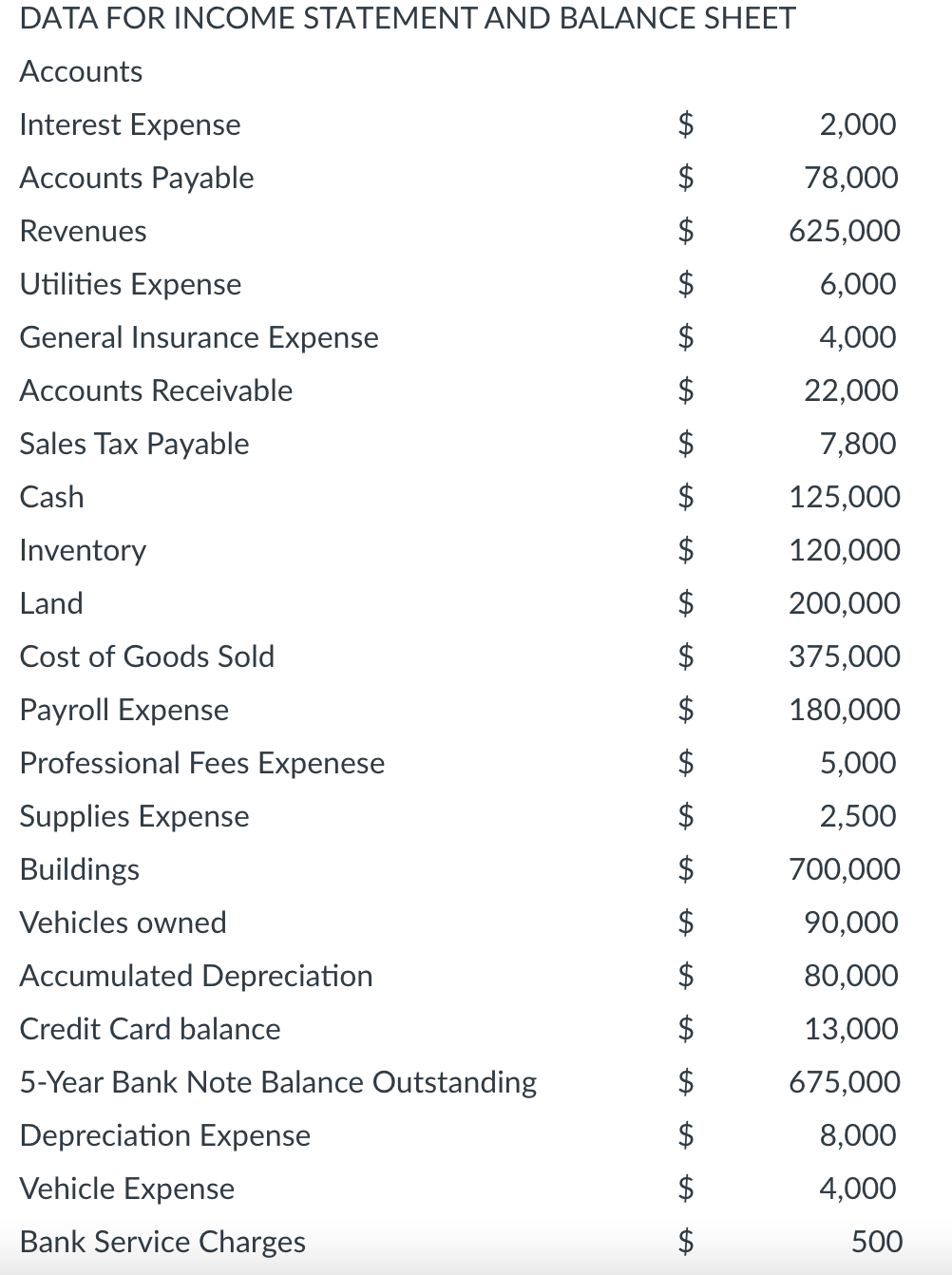

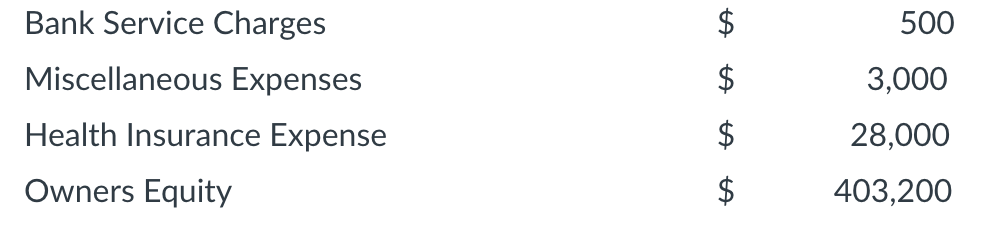

Use the data below to do the following: -Create a statement of cash flows. It is recommended that you note next to each data item whether it is flowing in, flowing out, or not applicable. -Create an Income Statement with sub totals for gross profit, operating profit and net profit. -Create a balance sheet. For full credit, the balance sheet should have subtotals for Current Assets, Fixed Assets, Total Assets, Current Liabilities, Long Term Liabilities, Total Liabilities, Total Owners Equity and Total Liabilities and Owners Equity Calculate the following ratios: -Gross Profit Margin -Operating Profit Margin -Net Profit Margin -Debt to Equity - Return on Equity - Return on asset -Current Ratio -Quick Ratio You will note that the data set for the Balance Sheet and Income statement is combined, so you will need to determine which if any of those two financial statements the data belongs on. DATA FOR STATEMENT OF CASH FLOWS Bank Loan Proceeds $ 20,000 ta 50,000 1,200 Inventory purchases Principal payment on operating loan Advertising Expense paid in current month Sales on credit with payment due in 40 days Additional Owners Investment 3,200 $ 12,800 12,000 Purchase of New Computer System $ 40,000 Wages $ ta Sales Tax collected $ 4,800 5,080 1,600 1,000 Rent $ ta ta ta 3,000 Interest Payment on operating loan Other General and Administrative expenses paid. Sales by credit/debit cards Depreciation Expense Cash Sales $ ta 56,000 2,000 $ ta $ 4,800 Sales Tax Remitted to State of lowa $ 5,200 Gas and electric utilities $ ta 400 Beginning Cash Balance $ 30,000 Collection on Accounts Receivable 12,000 DATA FOR INCOME STATEMENT AND BALANCE SHEET Accounts to 2,000 Interest Expense Accounts Payable ta 78,000 625,000 Revenues $ 6,000 Utilities Expense General Insurance Expense to 4,000 Accounts Receivable $ 22,000 Sales Tax Payable $ Cash $ ta $ Inventory Land 7,800 125,000 120,000 200,000 375,000 180,000 $ Cost of Goods Sold $ $ $ to 5,000 Payroll Expense Professional Fees Expenese Supplies Expense Buildings Vehicles owned $ to 2,500 700,000 A A 90,000 80,000 Accumulated Depreciation ta Credit Card balance to 13,000 675,000 ta 8,000 5-Year Bank Note Balance Outstanding Depreciation Expense Vehicle Expense Bank Service Charges 4,000 ta 500 ta 500 ta Bank Service Charges Miscellaneous Expenses Health Insurance Expense Owners Equity ta 3,000 28,000 403,200 $ Use the data below to do the following: -Create a statement of cash flows. It is recommended that you note next to each data item whether it is flowing in, flowing out, or not applicable. -Create an Income Statement with sub totals for gross profit, operating profit and net profit. -Create a balance sheet. For full credit, the balance sheet should have subtotals for Current Assets, Fixed Assets, Total Assets, Current Liabilities, Long Term Liabilities, Total Liabilities, Total Owners Equity and Total Liabilities and Owners Equity Calculate the following ratios: -Gross Profit Margin -Operating Profit Margin -Net Profit Margin -Debt to Equity - Return on Equity - Return on asset -Current Ratio -Quick Ratio You will note that the data set for the Balance Sheet and Income statement is combined, so you will need to determine which if any of those two financial statements the data belongs on. DATA FOR STATEMENT OF CASH FLOWS Bank Loan Proceeds $ 20,000 ta 50,000 1,200 Inventory purchases Principal payment on operating loan Advertising Expense paid in current month Sales on credit with payment due in 40 days Additional Owners Investment 3,200 $ 12,800 12,000 Purchase of New Computer System $ 40,000 Wages $ ta Sales Tax collected $ 4,800 5,080 1,600 1,000 Rent $ ta ta ta 3,000 Interest Payment on operating loan Other General and Administrative expenses paid. Sales by credit/debit cards Depreciation Expense Cash Sales $ ta 56,000 2,000 $ ta $ 4,800 Sales Tax Remitted to State of lowa $ 5,200 Gas and electric utilities $ ta 400 Beginning Cash Balance $ 30,000 Collection on Accounts Receivable 12,000 DATA FOR INCOME STATEMENT AND BALANCE SHEET Accounts to 2,000 Interest Expense Accounts Payable ta 78,000 625,000 Revenues $ 6,000 Utilities Expense General Insurance Expense to 4,000 Accounts Receivable $ 22,000 Sales Tax Payable $ Cash $ ta $ Inventory Land 7,800 125,000 120,000 200,000 375,000 180,000 $ Cost of Goods Sold $ $ $ to 5,000 Payroll Expense Professional Fees Expenese Supplies Expense Buildings Vehicles owned $ to 2,500 700,000 A A 90,000 80,000 Accumulated Depreciation ta Credit Card balance to 13,000 675,000 ta 8,000 5-Year Bank Note Balance Outstanding Depreciation Expense Vehicle Expense Bank Service Charges 4,000 ta 500 ta 500 ta Bank Service Charges Miscellaneous Expenses Health Insurance Expense Owners Equity ta 3,000 28,000 403,200 $