Answered step by step

Verified Expert Solution

Question

1 Approved Answer

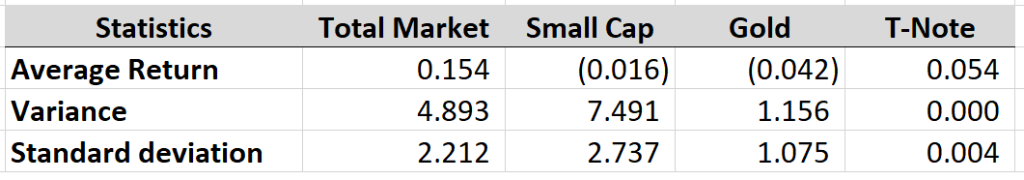

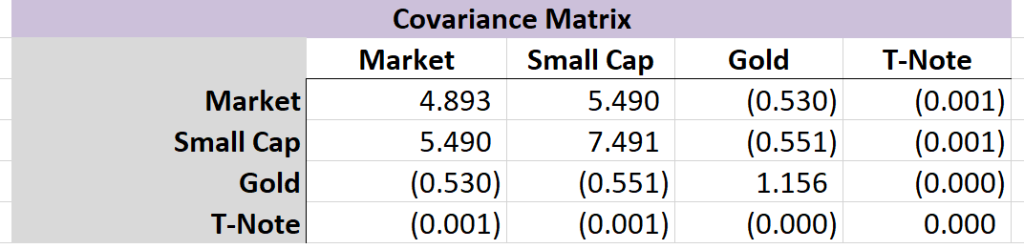

Use the data (the returns, variances, and covariances) calculated above and the formulas for portfolio return and variance to answer the following questions. 1. What

Use the data (the returns, variances, and covariances) calculated above and the formulas for portfolio return and variance to answer the following questions.

1. What is the expected weekly return on a portfolio comprised of 45% of the Market and 55% of the Gold Index?

2. What is the standard deviation of this portfolio?

3. Over the past year, portfolio weights of 45/55 (market/gold) produced a lower risk portfolio than portfolio weights of 55/45. Why?

T-Note Statistics Average Return Variance Standard deviation 0.054 Total Market 0.154 4.893 2.212 Small Cap (0.016) 7.491 2.737 Gold (0.042) 1.156 0.000 1.075 0.004 Market Small Cap Gold T-Note Covariance Matrix Market Small Cap 4.893 5.490 5.490 7.491 (0.530) (0.551) (0.001) (0.001) Gold (0.530) (0.551) 1.156 (0.000) T-Note (0.001) (0.001) (0.000) 0.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started