Answered step by step

Verified Expert Solution

Question

1 Approved Answer

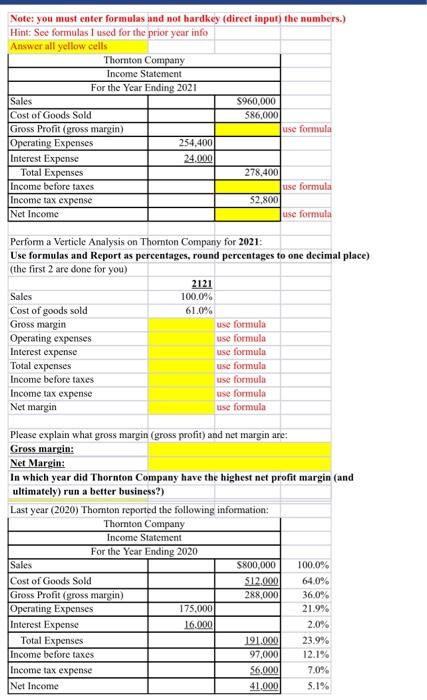

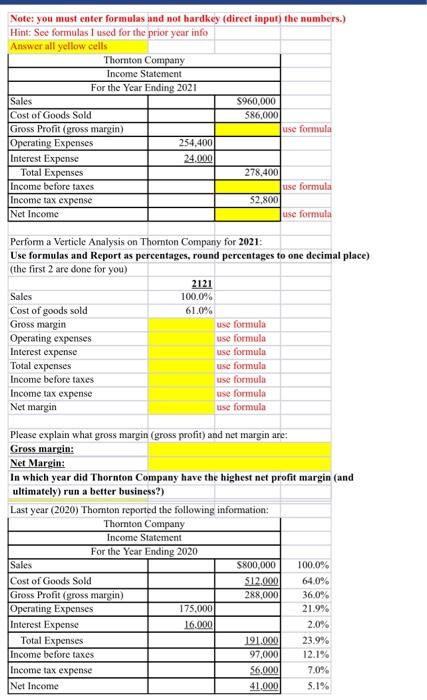

Use the excel file in the link below to complete an Income Statement for Thornton Company as well as perform a Vertical Anlysis. Upload your

Use the excel file in the link below to complete an Income Statement for Thornton Company as well as perform a Vertical Anlysis. Upload your Excel file here. Do NOT just type in your answers. USE EXCEL FORMULAS to calculate the missing amounts highlighted in yellow. You have several questions you also need to answer in the yellow highlighted cells.

Note: you must enter formulas and not hardkey (direct input the numbers.) Hint: See formulas I used for the prior year info Answer all yellow cells Thornton Company Income Statement For the Year Ending 2021 Sales $960,000 Cost of Goods Sold 586,000 Gross Profit (gross margin) use formula Operating Expenses 254,400 Interest Expense 24.000 Total Expenses 278.400 Income before taxes use formula Income tax expense 52,800 Net Income use formula Perform a Verticle Analysis on Thornton Company for 2021: Use formulas and Report as percentages, round percentages to one decimal place) (the first 2 are done for you 2121 Sales 100.0% Cost of goods sold 61.0% Gross margin use formula Operating expenses use formula Interest expense use formula Total expenses use formula Income before taxes use formula Income tax expense use formula Net margin use formula Please explain what gross margin (gross profit) and net margin are: Gross margin: Net Margin: In which year did Thornton Company have the highest net profit margin (and ultimately) run a better business?) Last year (2020) Thornton reported the following information: Thornton Company Income Statement For the Year Ending 2020 Sales $800,000 100.0% Cost of Goods Sold $12.000 64.0% Gross Profit (gross margin) 288,000 36.0% Operating Expenses 175.000 21.9% Interest Expense 16.000 2.0% Total Expenses 191.000 23.9% Income before taxes 97,000 12.1% Income tax expense 56,000 7.0% Net Income 41,000 5.1%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started