Question

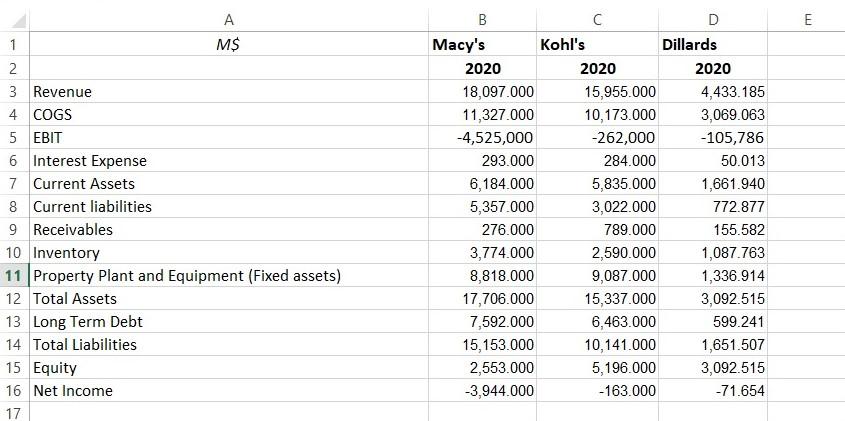

Use the Excel file that has financial data for three department stores to complete this assignment. Write a report where you assess the three companies

Use the Excel file that has financial data for three department stores to complete this assignment.

Write a report where you assess the three companies and determine which the best is managed of the three. You must use at least two profitability ratios, two asset management ratios and two other ratios of your choice. You must show the values for each ratio for each firm. You must explain what information the ratio provides and why management cares about this.

You must create a ratio that is new, that is not something that we discussed in class. It must be relevant to all three companies, and it must provide management with additional information about how well their company is being run. You must state the numerator and denominator and explain what information the ratio provides.

The report must be a written not a bulleted list. There should be an opening paragraph explaining what you are doing. Then each ratio should have its own paragraph where you discuss the values for the three firms as well as explain the results. There should be a concluding paragraph summing up your assessment. You must discuss the results and show me that you understand them.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started