Question

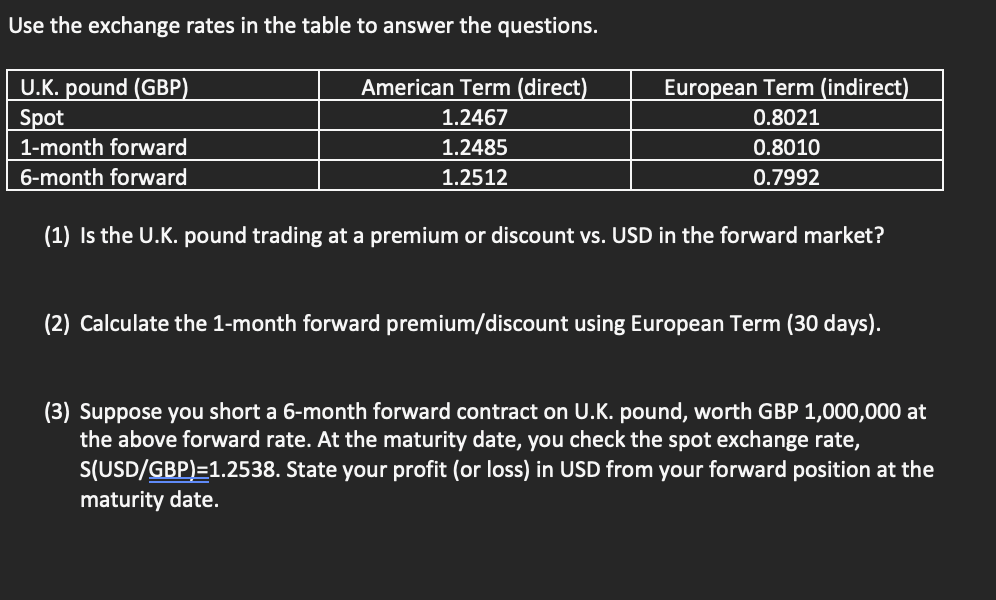

Use the exchange rates in the table to answer the questions. U.K. pound (GBP) Spot 1-month forward 6-month forward American Term (direct) European Term

Use the exchange rates in the table to answer the questions. U.K. pound (GBP) Spot 1-month forward 6-month forward American Term (direct) European Term (indirect) 1.2467 0.8021 1.2485 0.8010 1.2512 0.7992 (1) Is the U.K. pound trading at a premium or discount vs. USD in the forward market? (2) Calculate the 1-month forward premium/discount using European Term (30 days). (3) Suppose you short a 6-month forward contract on U.K. pound, worth GBP 1,000,000 at the above forward rate. At the maturity date, you check the spot exchange rate, S(USD/GBP)=1.2538. State your profit (or loss) in USD from your forward position at the maturity date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Business Mathematics In Canada

Authors: F. Ernest Jerome, Jackie Shemko

3rd Edition

1259370151, 978-1259370151

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App