Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is your appraisal of Netflixs operating and financial performance based on the data in case Exhibits 1, 2, 5, 6, and 7? What positives

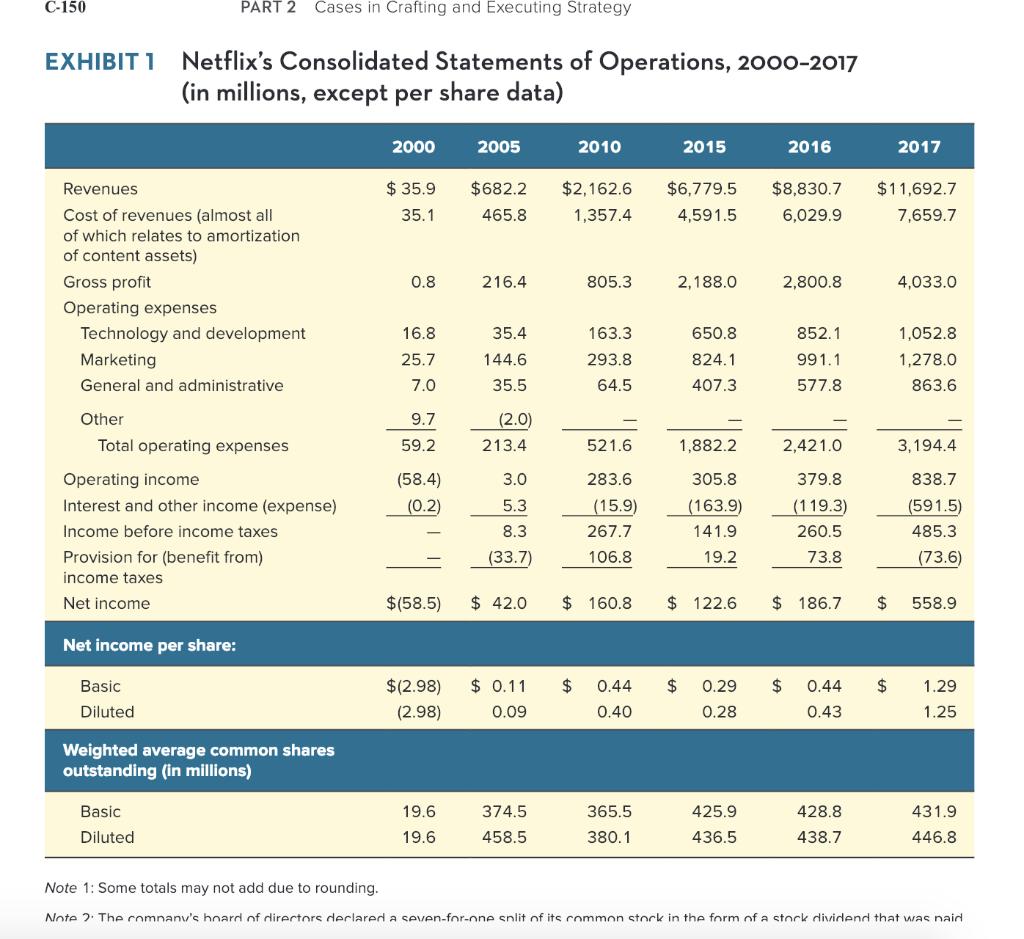

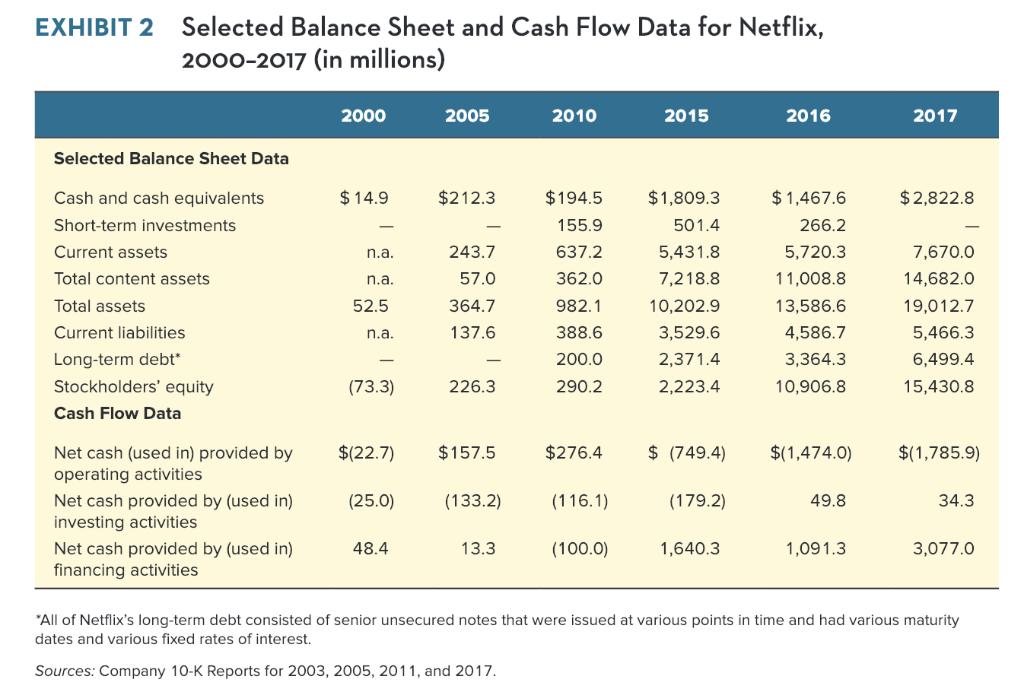

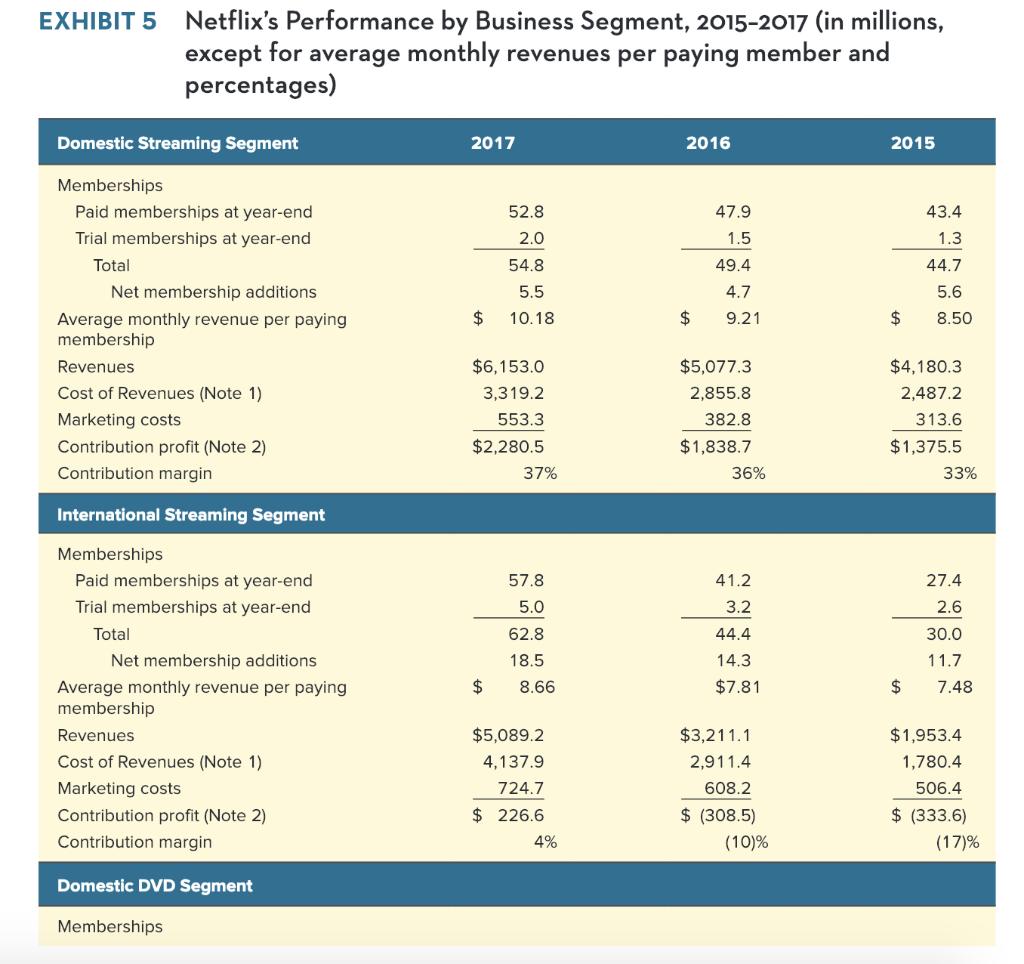

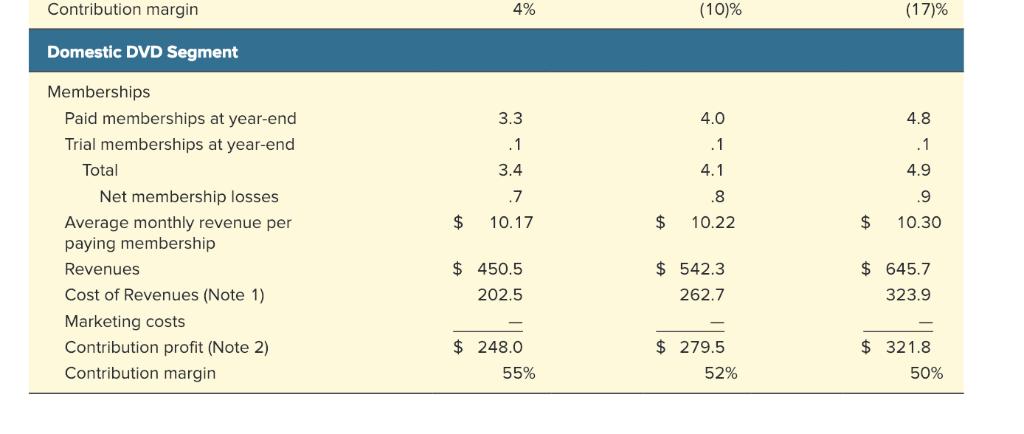

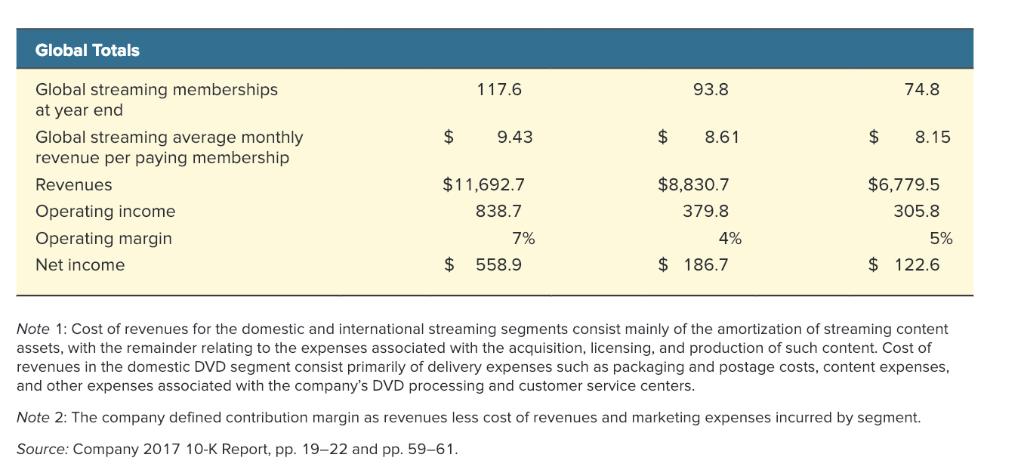

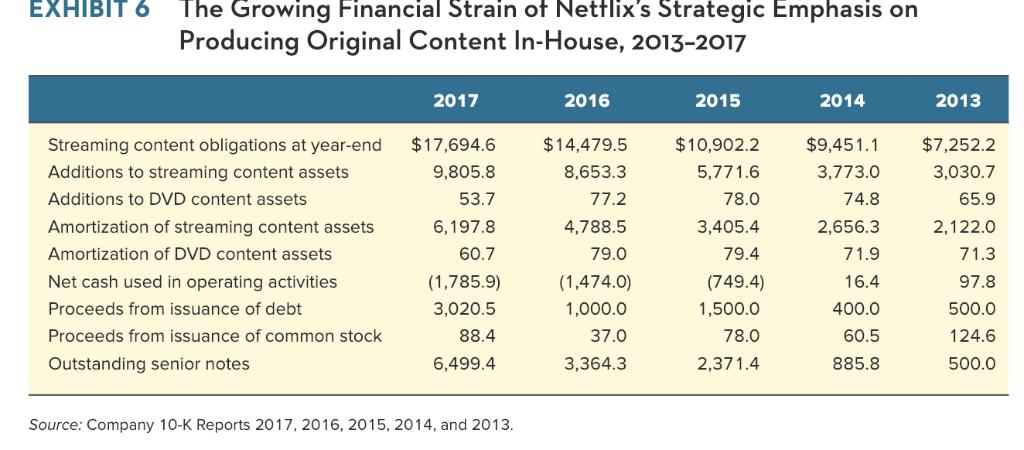

What is your appraisal of Netflix’s operating and financial performance based on the data in case Exhibits 1, 2, 5, 6, and 7? What positives and negatives do you see in Netflix’s performance? Use the financial ratios in Table 4.1 of Chapter 4 as a guide in doing the calculations needed to arrive at an analysis-based answer to your assessment of Netflix’s recent financial performance.

C-150 PART 2 Cases in Crafting and Executing Strategy Netflix's Consolidated Statements of Operations, 2000-2017 (in millions, except per share data) EXHIBIT 1 2000 2005 2010 2015 2016 2017 Revenues $ 35.9 $682.2 $2,162.6 $6,779.5 $8,830.7 $11,692.7 Cost of revenues (almost all 35.1 465.8 1,357.4 4,591.5 6,029.9 7,659.7 of which relates to amortization of content assets) Gross profit 0.8 216.4 805.3 2,188.0 2,800.8 4,033.0 Operating expenses Technology and development 16.8 35.4 163.3 650.8 852.1 1,052.8 Marketing 25.7 144.6 293.8 824.1 991.1 1,278.0 General and administrative 7.0 35.5 64.5 407.3 577.8 863.6 Other 9.7 (2.0) Total operating expenses 59.2 213.4 521.6 1,882.2 2,421.0 3,194.4 Operating income (58.4) 3.0 283.6 305.8 379.8 838.7 Interest and other income (expense) (0.2) 5.3 (15.9) (163.9) (119.3) (591.5) Income before income taxes 8.3 267.7 141.9 260.5 485.3 Provision for (benefit from) (33.7) 106.8 19.2 73.8 (73.6) income taxes Net income $(58.5) $ 42.0 $ 160.8 $ 122.6 $ 186.7 24 558.9 Net income per share: Basic $(2.98) $ 0.11 2$ 0.44 2$ 0.29 24 0.44 24 1.29 Diluted (2.98) 0.09 0.40 0.28 0.43 1.25 Weighted average common shares outstanding (in millions) Basic 19.6 374.5 365.5 425.9 428.8 431.9 Diluted 19.6 458.5 380.1 436.5 438.7 446.8 Note 1: Some totals may not add due to rounding. Note 2: The company's hoard of directors declared a seven-for-one snlit of its common stock in the form of a stock dividdend that was naid

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started