Answered step by step

Verified Expert Solution

Question

1 Approved Answer

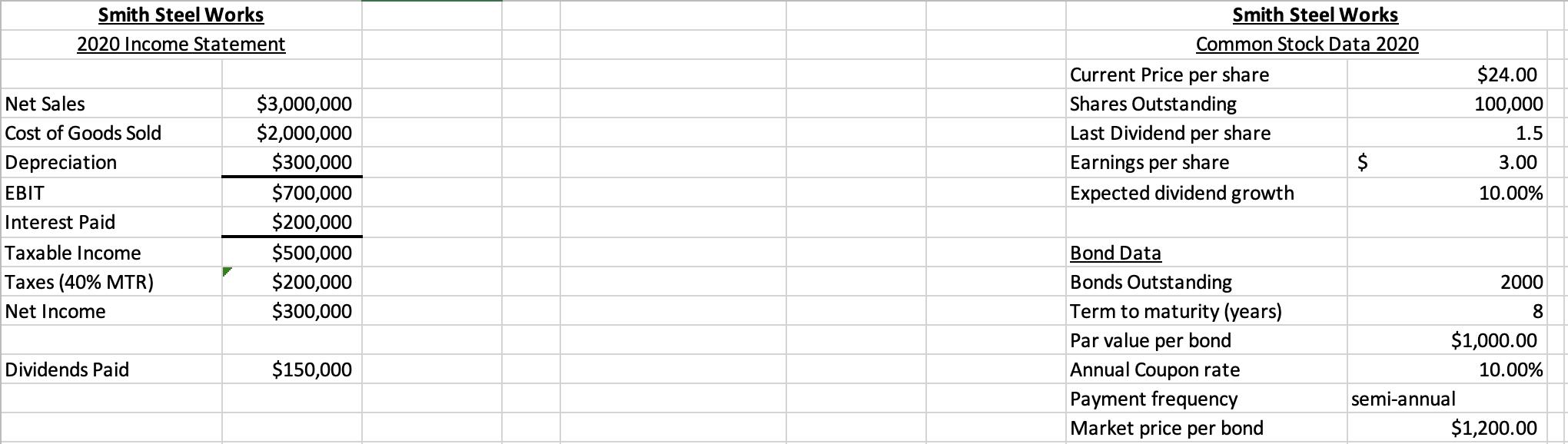

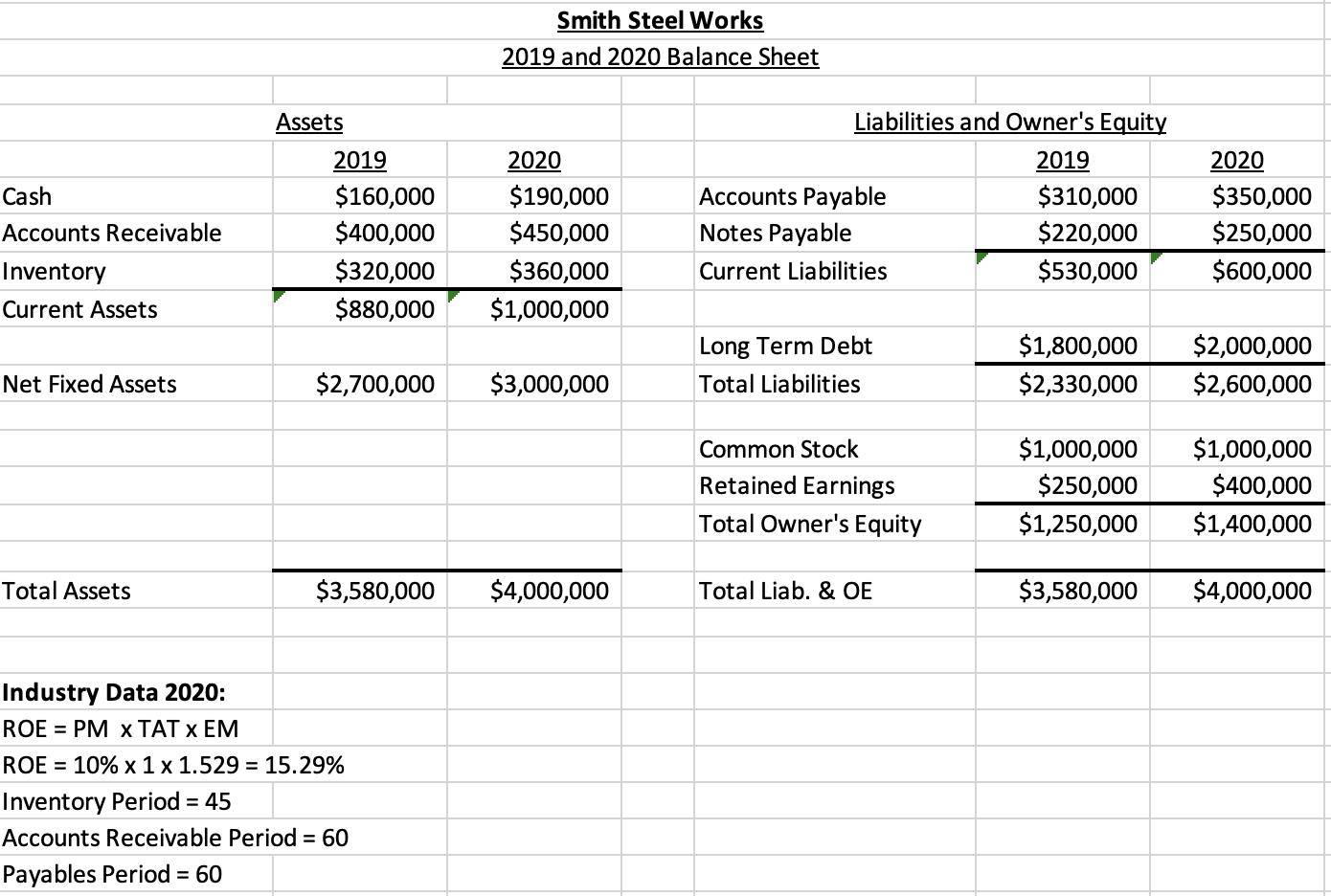

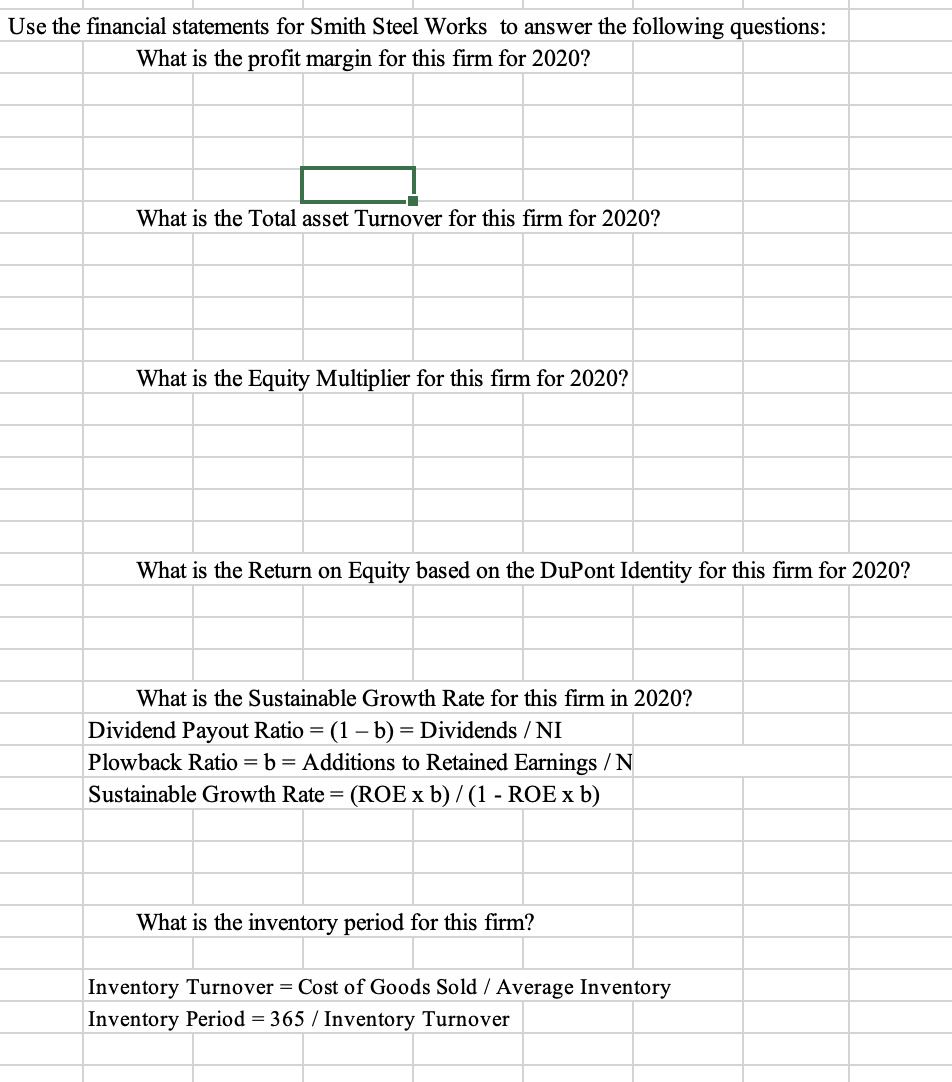

Use the financial statements for Smith Steel Works to answer the following questions: USE GIVEN INFORMATION TO ANSWER QUESTIONS BELOW: Smith Steel WWorks Smith Steel

Use the financial statements for Smith Steel Works to answer the following questions:

USE GIVEN INFORMATION TO ANSWER QUESTIONS BELOW:

Smith Steel WWorks Smith Steel Works 2020 Income Statement Common Stock Data 2020 Current Price per share $24.00 Shares Outstanding $3,000,000 $2,000,000 Net Sales 100,000 Cost of Goods Sold Last Dividend per share 1.5 $300,000 $700,000 $200,000 Depreciation Earnings per share $ 3.00 EBIT Expected dividend growth 10.00% Interest Paid Taxable Income $500,000 Bond Data Taxes (40% MTR) $200,000 Bonds Outstanding 2000 Net Income $300,000 Term to maturity (years) 8 $1,000.00 Par value per bond Annual Coupon rate Dividends Paid $150,000 10.00% Payment frequency semi-annual Market price per bond $1,200.00

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6362e4b83c8de_237359.pdf

180 KBs PDF File

6362e4b83c8de_237359.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started