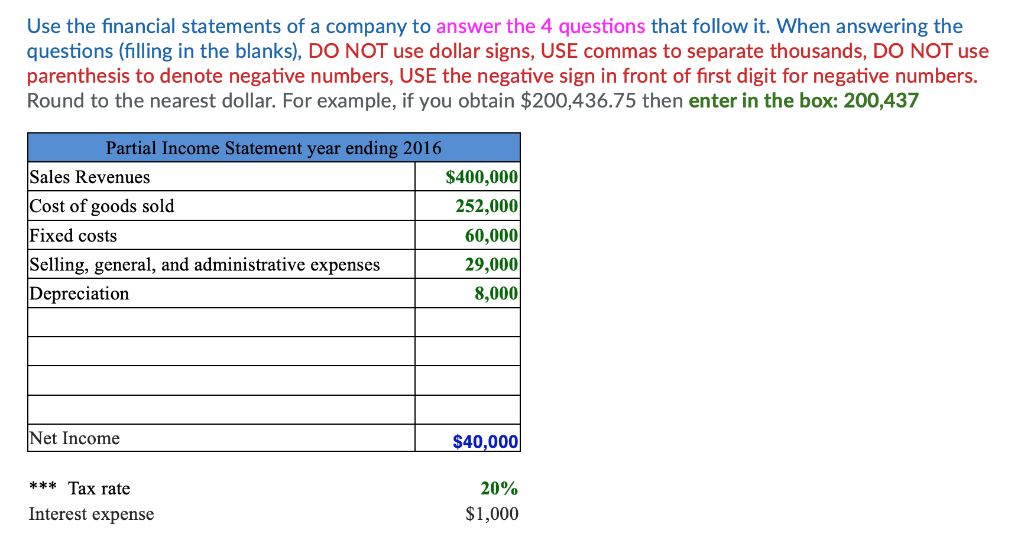

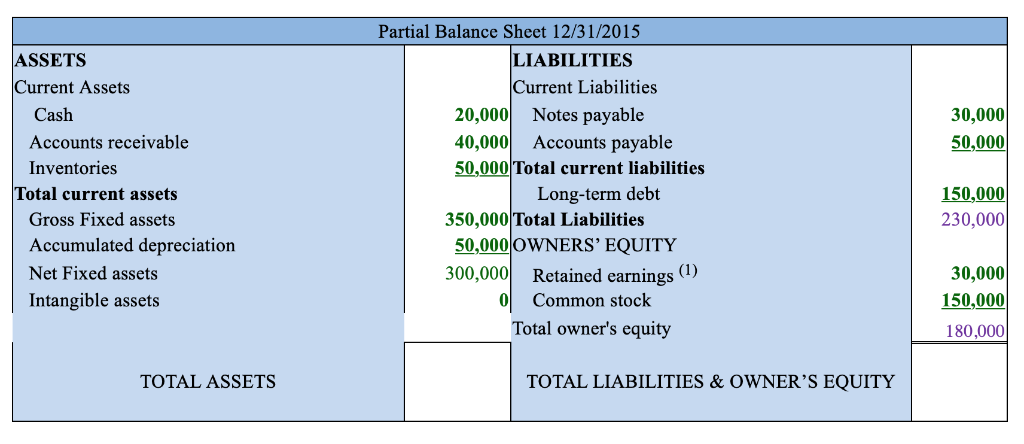

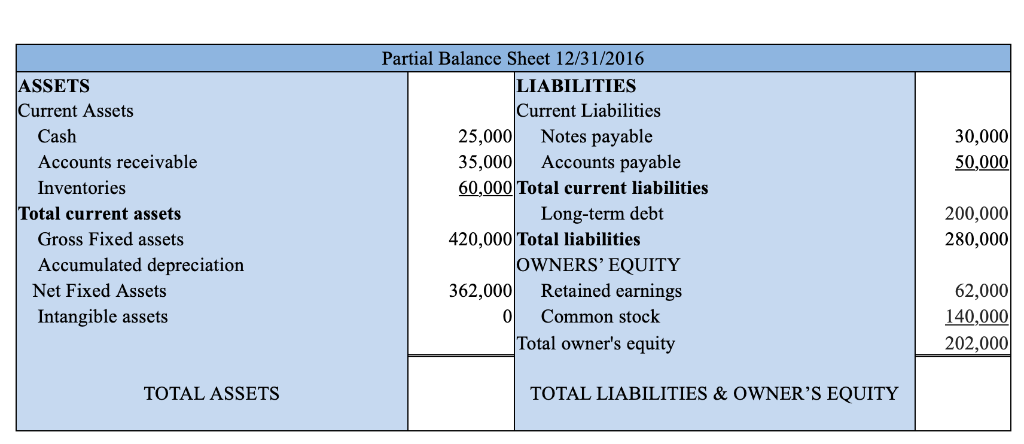

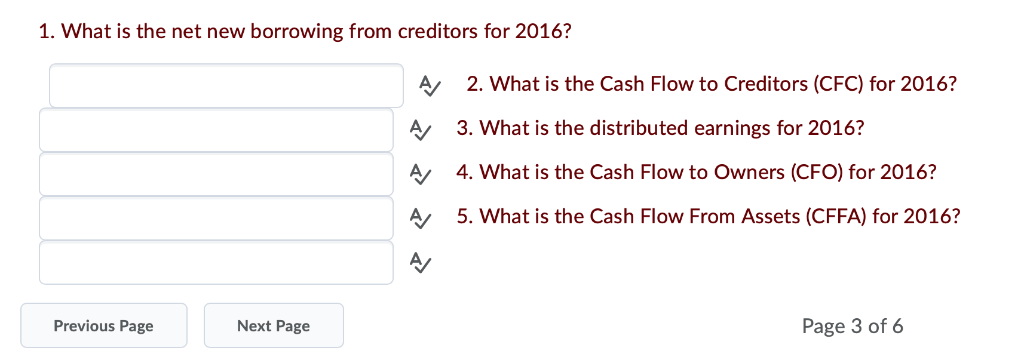

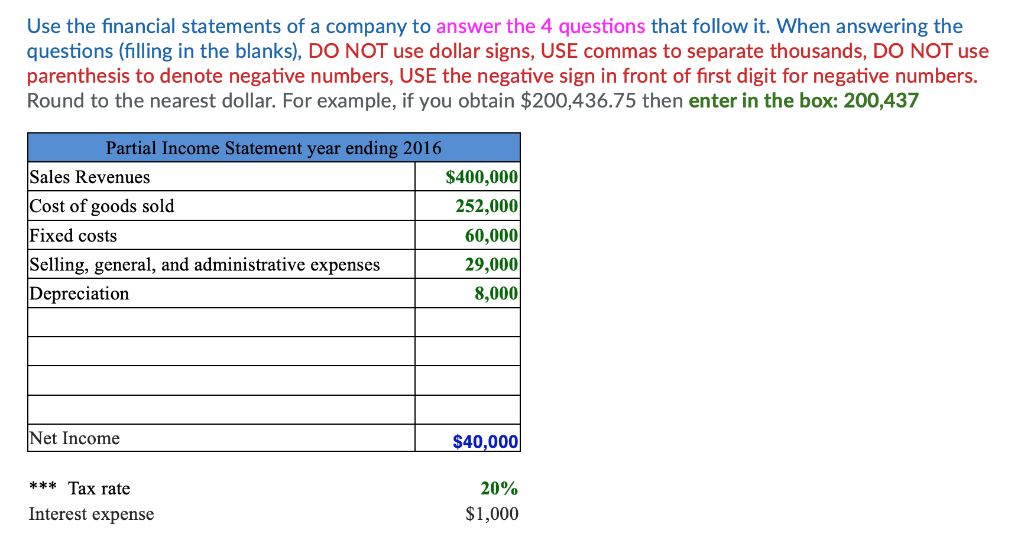

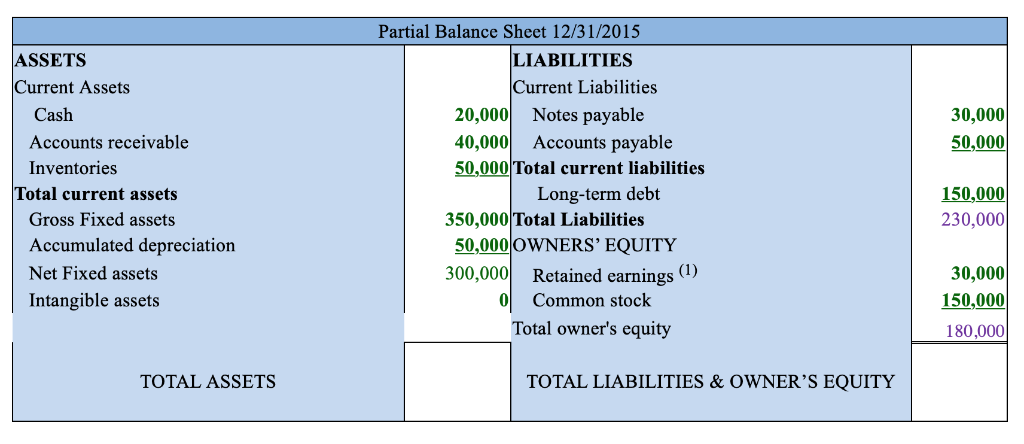

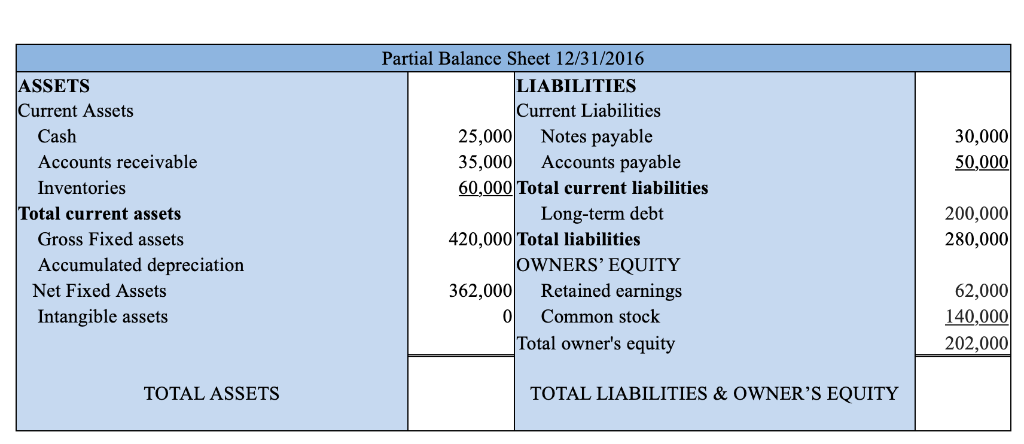

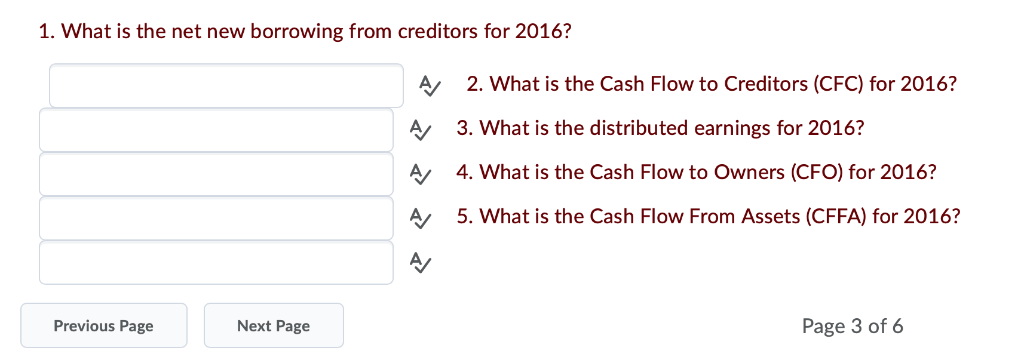

Use the financial statements of a company to answer the 4 questions that follow it. When answering the questions (filling in the blanks), DO NOT use dollar signs, USE commas to separate thousands, DO NOT use parenthesis to denote negative numbers, USE the negative sign in front of first digit for negative numbers. Round to the nearest dollar. For example, if you obtain $200,436.75 then enter in the box: 200,437 Partial Income Statement year ending 2016 Sales Revenues $400,000 Cost of goods sold 252,000 Fixed costs 60,000 Selling, general, and administrative expenses 29,000 |Depreciation 8,000 Net Income $40,000 *Tax rate 20% $1,000 Interest expense Partial Balance Sheet 12/31/2015 ASSETS LIABILITIES Current Assets Current Liabilities 20,000 40,000 50,000 Total current liabilities Notes payable 30,000 50,000 Cash Accounts receivable Accounts payable Inventories 150,000 230,000 Total current assets Long-term debt 350,000 Total Liabilities 50,000 OWNERS' EQUITY 300,000 Gross Fixed assets Accumulated depreciation (1) 30,000 150,000 Net Fixed assets Retained earnings Intangible assets Common stock Total owner's equity 180,000 TOTAL ASSETS TOTAL LIABILITIES & OWNER'S EQUITY Partial Balance Sheet 12/31/2016 LIABILITIES ASSETS Current Assets Current Liabilities 30,000 50,000 25,000 35,000 60,000 Total current liabilities Notes payable Cash Accounts payable Accounts receivable Inventories Long-term debt 420,000 Total liabilities OWNERS' EQUITY Retained earnings Total current assets 200,000 280,000 Gross Fixed assets Accumulated depreciation 62,000 140,000 Net Fixed Assets 362,000 Common stock Intangible assets 0 Total owner's equity 202,000 TOTAL ASSETS TOTAL LIABILITIES & OWNER'S EQUITY 1. What is the net new borrowing from creditors for 2016? 2. What is the Cash Flow to Creditors (CFC) for 2016? AV 3. What is the distributed earnings for 2016? AV 4. What is the Cash Flow to Owners (CFO) for 2016? 5. What is the Cash Flow From Assets (CFFA) for 2016? AV Page 3 of 6 Previous Page Next Page Use the financial statements of a company to answer the 4 questions that follow it. When answering the questions (filling in the blanks), DO NOT use dollar signs, USE commas to separate thousands, DO NOT use parenthesis to denote negative numbers, USE the negative sign in front of first digit for negative numbers. Round to the nearest dollar. For example, if you obtain $200,436.75 then enter in the box: 200,437 Partial Income Statement year ending 2016 Sales Revenues $400,000 Cost of goods sold 252,000 Fixed costs 60,000 Selling, general, and administrative expenses 29,000 |Depreciation 8,000 Net Income $40,000 *Tax rate 20% $1,000 Interest expense Partial Balance Sheet 12/31/2015 ASSETS LIABILITIES Current Assets Current Liabilities 20,000 40,000 50,000 Total current liabilities Notes payable 30,000 50,000 Cash Accounts receivable Accounts payable Inventories 150,000 230,000 Total current assets Long-term debt 350,000 Total Liabilities 50,000 OWNERS' EQUITY 300,000 Gross Fixed assets Accumulated depreciation (1) 30,000 150,000 Net Fixed assets Retained earnings Intangible assets Common stock Total owner's equity 180,000 TOTAL ASSETS TOTAL LIABILITIES & OWNER'S EQUITY Partial Balance Sheet 12/31/2016 LIABILITIES ASSETS Current Assets Current Liabilities 30,000 50,000 25,000 35,000 60,000 Total current liabilities Notes payable Cash Accounts payable Accounts receivable Inventories Long-term debt 420,000 Total liabilities OWNERS' EQUITY Retained earnings Total current assets 200,000 280,000 Gross Fixed assets Accumulated depreciation 62,000 140,000 Net Fixed Assets 362,000 Common stock Intangible assets 0 Total owner's equity 202,000 TOTAL ASSETS TOTAL LIABILITIES & OWNER'S EQUITY 1. What is the net new borrowing from creditors for 2016? 2. What is the Cash Flow to Creditors (CFC) for 2016? AV 3. What is the distributed earnings for 2016? AV 4. What is the Cash Flow to Owners (CFO) for 2016? 5. What is the Cash Flow From Assets (CFFA) for 2016? AV Page 3 of 6 Previous Page Next Page