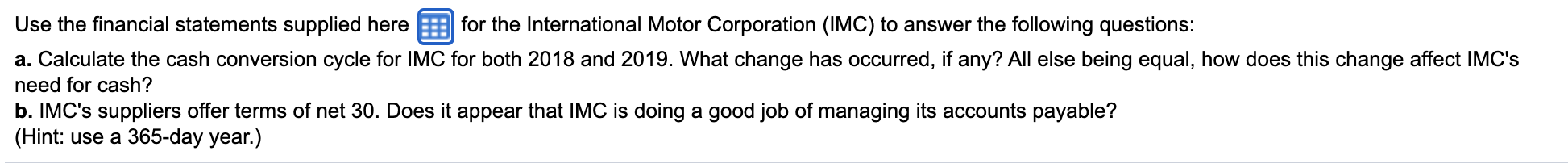

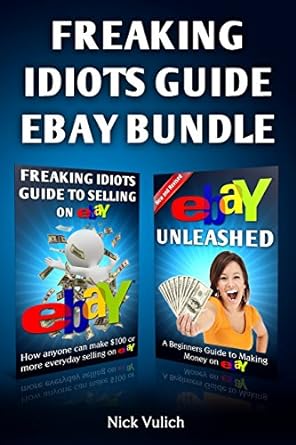

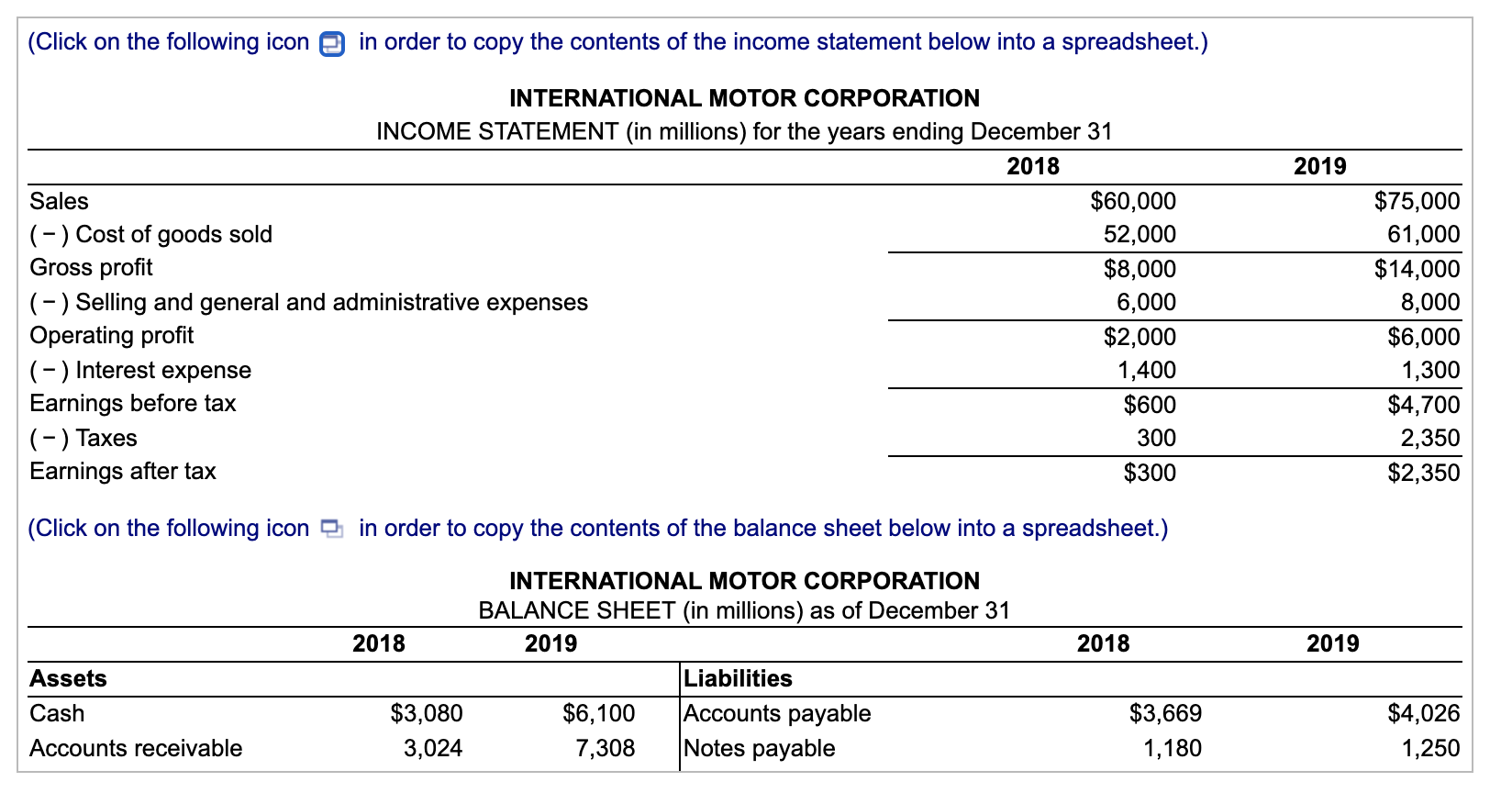

Use the financial statements supplied here for the International Motor Corporation (IMC) to answer the following questions: a. Calculate the cash conversion cycle for IMC for both 2018 and 2019. What change has occurred, if any? All else being equal, how does this change affect IMC's need for cash? b. IMC's suppliers offer terms of net 30. Does it appear that IMC is doing a good job of managing its accounts payable? (Hint: use a 365-day year.) (Click on the following icon in order to copy the contents of the income statement below into a spreadsheet.) 2019 INTERNATIONAL MOTOR CORPORATION INCOME STATEMENT (in millions) for the years ending December 31 2018 Sales $60,000 (-) Cost of goods sold 52,000 Gross profit $8,000 (-) Selling and general and administrative expenses 6,000 Operating profit $2,000 ( - ) Interest expense 1,400 Earnings before tax $600 (-) Taxes 300 Earnings after tax $300 $75,000 61,000 $14,000 8,000 $6,000 1,300 $4,700 2,350 $2,350 (Click on the following icon in order to copy the contents of the balance sheet below into a spreadsheet.) 2018 2018 2019 INTERNATIONAL MOTOR CORPORATION BALANCE SHEET (in millions) as of December 31 2019 Liabilities $6,100 Accounts payable 7,308 Notes payable Assets Cash $3,080 3,024 $3,669 1,180 $4,026 1,250 Accounts receivable Use the financial statements supplied here for the International Motor Corporation (IMC) to answer the following questions: a. Calculate the cash conversion cycle for IMC for both 2018 and 2019. What change has occurred, if any? All else being equal, how does this change affect IMC's need for cash? b. IMC's suppliers offer terms of net 30. Does it appear that IMC is doing a good job of managing its accounts payable? (Hint: use a 365-day year.) (Click on the following icon in order to copy the contents of the income statement below into a spreadsheet.) 2019 INTERNATIONAL MOTOR CORPORATION INCOME STATEMENT (in millions) for the years ending December 31 2018 Sales $60,000 (-) Cost of goods sold 52,000 Gross profit $8,000 (-) Selling and general and administrative expenses 6,000 Operating profit $2,000 ( - ) Interest expense 1,400 Earnings before tax $600 (-) Taxes 300 Earnings after tax $300 $75,000 61,000 $14,000 8,000 $6,000 1,300 $4,700 2,350 $2,350 (Click on the following icon in order to copy the contents of the balance sheet below into a spreadsheet.) 2018 2018 2019 INTERNATIONAL MOTOR CORPORATION BALANCE SHEET (in millions) as of December 31 2019 Liabilities $6,100 Accounts payable 7,308 Notes payable Assets Cash $3,080 3,024 $3,669 1,180 $4,026 1,250 Accounts receivable