Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following as inputs into the Cash Budget Capital Budget: Equipment costing $328,498 will be purchased at the end of Q2, paid in cash.

Use the following as inputs into the Cash Budget

| Capital Budget: | |||||

| Equipment costing $328,498 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. | |||||

| Other cash items: | |||||

| The beginning cash balance is $5,909. Interest expense for each quarter is paid 100% in the quarter incurred from your budgeted income statement by quarter. | |||||

| All components of cash COGS (DM, DL) are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter based on the amounts in your budgeted income statement. | |||||

| Fixed Overhead, Variable Overhead and Fixed and Variable SG&A are paid 100% in the quarter incurred based on the budgeted income statement. Depreciation must be subtracted from the FOH to derive cash COGS. | |||||

| All Fixed Assets are depreciated over 10 years (40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Use the Fixed Asset value of 2,400,000 to calculate. | |||||

| Sales are collected 50% in the quarter of sale and the balance in the following quarter. | |||||

| Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement by quarter. | |||||

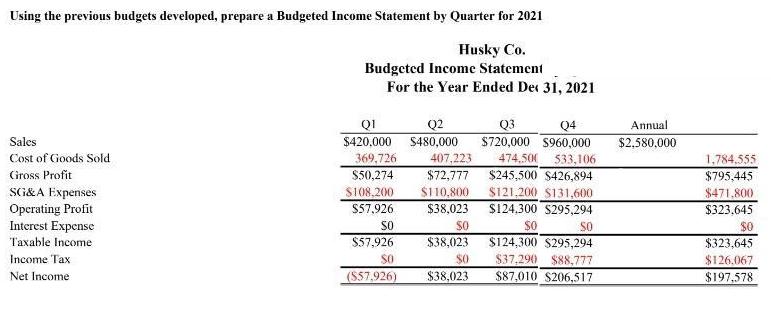

Using the previous budgets developed, prepare a Budgeted Income Statement by Quarter for 2021 Husky Co. Budgeted Income Statement Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable Income Income Tax Net Income For the Year Ended Dec 31, 2021 Q1 $420.000 369,726 $50,274 $108,200 $57,926 SO $57,926 SO (S$7,926) Q2 $480,000 Q3 Q4 $720,000 $960,000 407,223 474.500 533,106 $72,777 $245,500 $426,894 $110,800 $38,023 SO $38,023 $0 $38,023 $121,200 $131,600 $124,300 $295,294 $0 $124,300 $295,294 SO $37,290 $88,777 $87,010 $206,517 Annual $2,580,000 1,784,555 $795,445 $471,800 $323,645 $0 $323,645 $126.067 $197,578

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Beginning Cash Balance 5909 Cash Receipts Sales 1950000 Total Cash Receipts 1950000 Cash Payments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started